Blockdata Published a Report About the State of CBDC in 2022

According to the latest report by Blockdata, stakeholders are opposed to CBDC for several reasons.

According to the latest report by Blockdata, stakeholders are opposed to CBDC for several reasons.

The New York Fed has announced that some global banks have partnered to implement a 12-week trial program of CBDC (Central Bank Digital Currency).

Cryptocurrencies were originally created with a clear objective: to serve as an alternative to the traditional financial system and give ordinary people back their financial freedom.

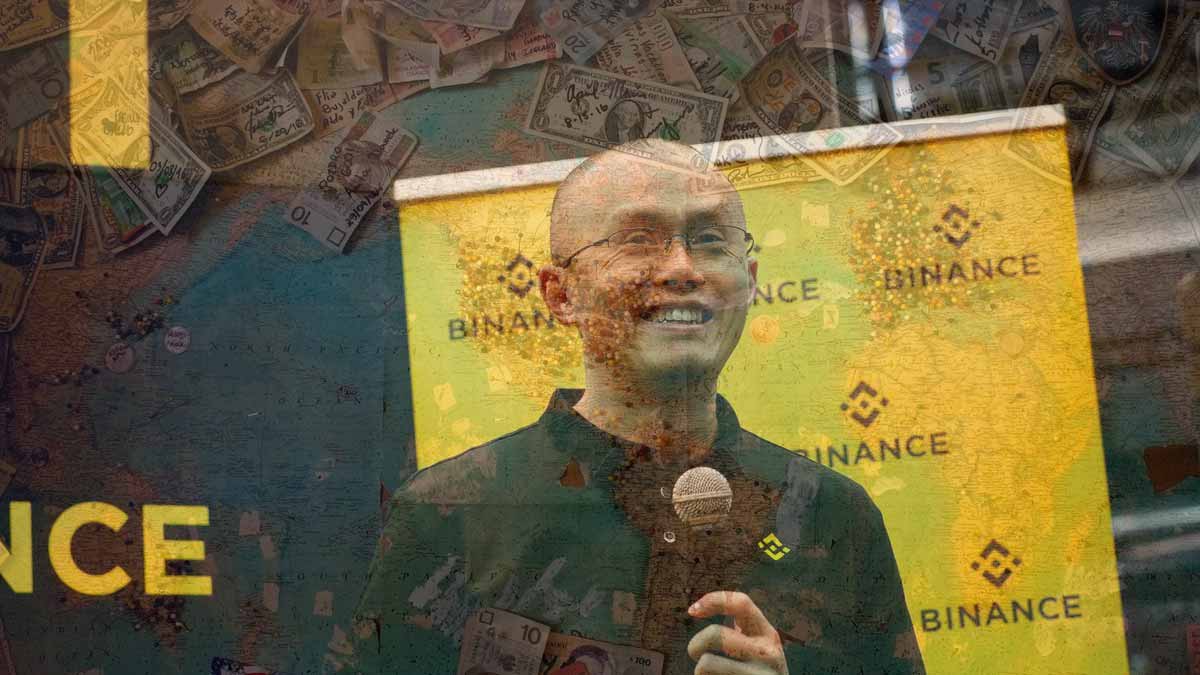

Digital currencies issued by central banks do not pose any threat to crypto, according to Binance CEO Changpeng Zhao.

The Chinese Central Bank Digital Currency (CBDC), e-CNY, has become the largest adopted CBDC in the world surpassing nearly $14 billion, or 100.04 billion yuan transactions

A recent article published by the Bitcoin Think Tank states that Central Bank Digital Currencies pose a serious risk to the future of individual and economic

A senior Russian senator said that after establishing a digital rouble early next year, Russia intends to utilize the currency in mutual settlements with China as it

The Hong Kong Monetary Authority has revealed plans to start the trial of its central bank digital currency in the last quarter of 2022. Its CBDC

The Reserve Bank of Australia (RBA) has just announced that it will launch a one-year research program to evaluate the advantages and disadvantages for a central bank

Thailand is actively pursuing its central bank digital currency project. The Thai Central Bank has recently revealed that it will be testing its digital currency from

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy