Experts Say Solana (SOL) Staking ETF Will Be Approved This Week!

TL;DR Solana will have its first spot ETF in the U.S. this week, which will include staking services and pay periodic rewards to fund investors. The

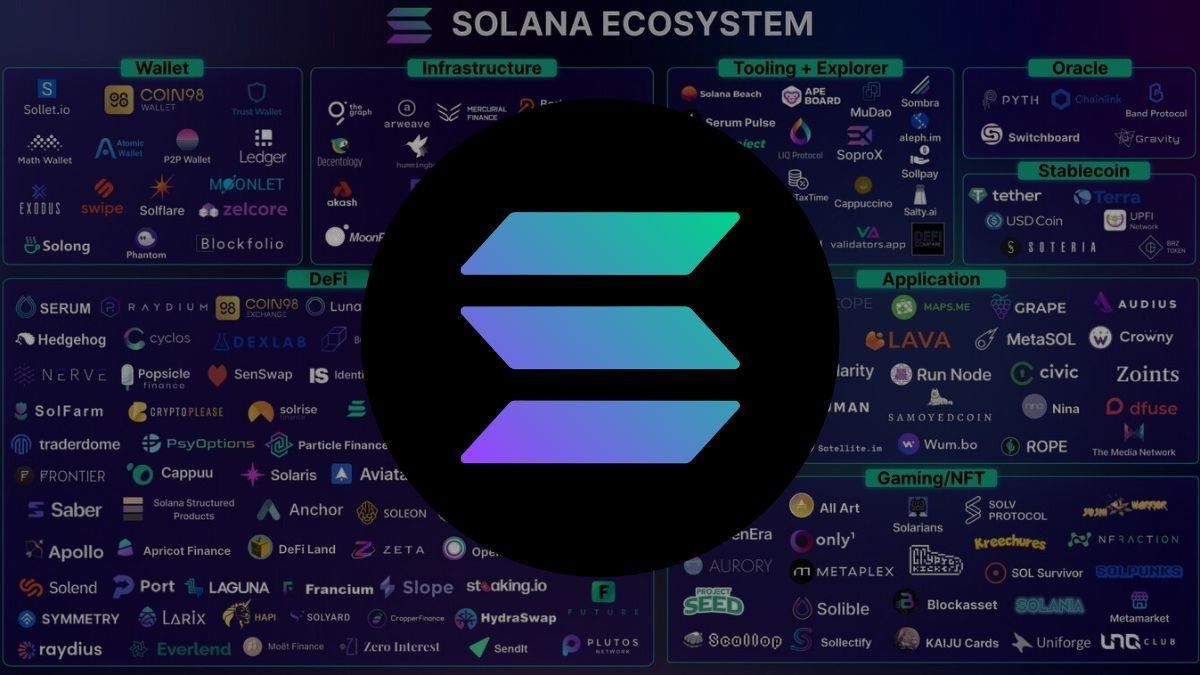

Solana is a layer 1 blockchain platform whose main goal is to compete with Ethereum‘s network. Improving scalability and reducing gas fees.

Solana aims to boost the development of new applications, offering an environment with greater scalability and higher transaction speeds, which would make it a blockchain accessible to everyone.

SOL, the native token of the Solana blockchain, has seen significant growth during 2021, capturing the attention of the entire investment community.

In this section, you will find the latest news about Solana and SOL.

TL;DR Solana will have its first spot ETF in the U.S. this week, which will include staking services and pay periodic rewards to fund investors. The

TL;DR Invesco and Galaxy Digital have jointly filed an application with the SEC to launch a Solana ETF under the ticker QSOL. The fund would track

TL;DR Santiment reports a sharp spike in GitHub commits and repo events across Solana’s core protocol and ecosystem projects, marking a clear developer renaissance. Core protocol

TL;DR The Solana Policy Institute and firms like Phantom, Superstate, and Orca proposed to the SEC the legalization of tokenized securities without intermediaries. They argue that

TL;DR CoinShares submitted an official application to the SEC to launch a Solana spot ETF, triggering a 3.49% price increase in SOL, which is currently trading

TL;DR Invesco and Galaxy Digital registered a trust in Delaware as a preliminary step to filing for SEC approval of a Solana spot ETF. The SEC

TL;DR Pump.fun, one of the most popular platforms for launching memecoins on Solana, plans to raise $1 billion through a token sale, with a projected valuation

TL;DR MetaMask added support for Solana in its browser extension, allowing users to manage Solana assets and dApps from a single interface. Solana’s price jumped 6%

TL;DR Ledger introduced a special edition of its Flex wallet for Solana, featuring support for SPL tokens and network-specific functions. The device includes an exclusive Soulbound

TL;DR Solana Mobile will launch the Seeker phone on August 4 at $500, along with SKR, its new token designed to boost its mobile ecosystem. The

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy