DODO DEX is a decentralized finance (DeFi) protocol that works as a low-slippage on-chain liquidity provider built on Ethereum and Binance Smart Chain (BSC) and powered by an innovative market maker algorithm called Proactive Market Maker (PMM).

Before we begin, it is worth mentioning that there are two ways decentralized exchanges operate: order book and automated market maker (AMM). Decentralized exchanges do not require the user to compromise the custody of their assets. To achieve this, the orders are executed using smart contracts.

On the other hand, the off-chain order book DEXs are faster as they use intermediaries known as relayers to manage off-chain orders. But these DEXes suffer from liquidity issues. This is where AMMs play a pivotal role as it incentivizes users to pool their tokens to ensure there will always be liquidity for otherwise illiquid markets. But AMM-based DEXes are not free of problems. The biggest issue they face is impermanent loss.

DODO’s Proactive Market Maker (PMM) algorithm tries to address this impermanent loss issue associated with AMM-based DEXes like Uniswap or SushiSwap. With this innovative market maker, DODO offers better liquidity and price stability than automated market makers (AMM).

So, let’s take a brief look at DODO DEX.

What is DODO DEX?

DODO is a DeFi protocol and low-slip blockchain liquidity provider, which has implemented a novel algorithm known as Proactive Market Maker (PMM). DODO offers a seamless trading experience and lucrative liquidity provision opportunities..

This platform was founded by two Chinese developers Diane Dai and Radar Bear and an anonymous development team. The protocol was launched in August 2020 and has been audited by PeckShield and Trail of Bits. The protocol is governed by an ERC20-based DODO token.

DODO features highly capital-efficient liquidity pools that support single-token provision, reduce impermanent loss, and minimize slippage for traders. The protocol also caters for new crypto projects with a free ICO listing through its Initial DODO Offering (IDO) called Crowdpooling which requires issuers to only deposit their own tokens.

To provide the best trading experience to users, DODO offers SmartTrade, and the PMM algorithm provides superior pricing over that of AMM competitors.

Features of DODO DEX

According to the documentation, DODO V2’s product suite consists of a SmartTrade trading and aggregation service, Crowdpooling/IDO, pools, and mining which includes liquidity mining, trading mining, and combiner harvest mining. The platform supports many wallets applications that include MetaMask, Coinbase, WalletConnect, and Portis.

Apart from standard DEX products, DODO also has some unique features that include DODO Vending Machine, DODO NFT Vault, and DODO Private Pools.

At the heart of the protocol is its PMM algorithm that provides the market-making model. Let’s take a brief look at PMM.

Proactive Market Maker (PMM)

DODO’s Proactive Market Maker (PMM) algorithm is developed entirely in-house by the DODO team iterating on the design of Automated Market Makers (AMMs) to improve capital efficiency, reduce impermanent loss, and minimize slippage for traders.

According to the documentation, PMM is an “elegant, on-chain generalization of orderbook trading”. The PMM pricing mechanism, which mimics human trading, utilizes oracles to gather highly accurate market prices for assets. AMM-based DEXes use a simple fixed curve to determine the current price based on the current amount of each asset held. PMM proactively adjusts parameters such as asset ratio and curve slope in anticipation of market conditions, resulting in DODO pools that are adaptable and flexible for all sorts of use cases.

This enables the protocol to provide enough liquidity close to the market prices to stabilize the portfolios of liquidity providers (LP), lower price slippage, and negate impermanent loss by allowing arbitrage trading as a reward.

SmartTrade: Trading and Aggregation Engine

SmartTrade is a decentralized liquidity aggregation service that routes to and compares various liquidity sources to quote the optimal swap rate between any two tokens. This feature intelligently finds the best order routing from aggregated liquidity sources to give traders the best prices.

Through this routing algorithm, DODO enables trading between two arbitrary tokens on Ethereum and Binance Smart Chain (BSC). On DODO, for the same token asset, there are multiple liquidity pools with different price curves and parameters configured and designed by users to meet their specific market-making needs. DODO SmartTrade ties these pools together and finds the best price amongst them.

DODO also integrates other DeFi protocols to aggregate liquidity that includes 0x and 1inch.

DODO Pools

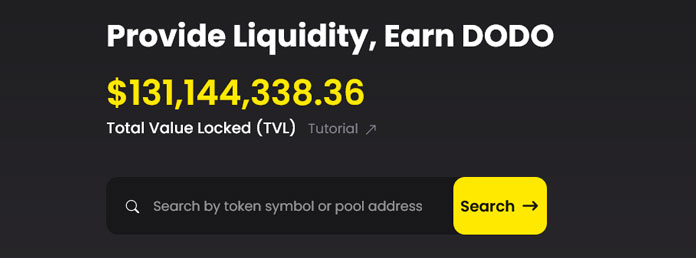

Liquidity pools make decentralized trading possible in the first place. DODO pools give liquidity providers the flexibility to create and manage their own on-chain market-making strategies in a fully permissionless, non-custodial manner.

The best thing is that liquidity providers do not have to provide tokens in pairs to DODO pools. They can deposit any amount of base or quote tokens. According to the team, unlocking a single-token deposit gives LPs the flexibility to choose how they want to market-make.

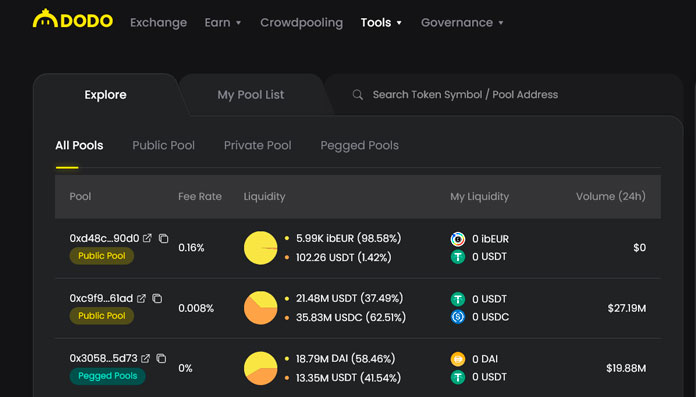

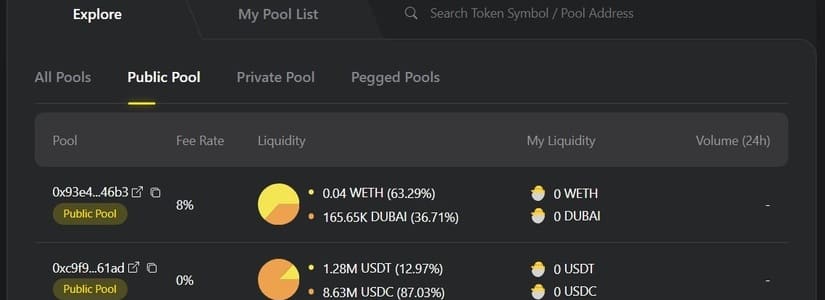

If we look at the DODO app, there are three kinds of pools: public, pegged, and private pools.

Public Pools

Public pools are also called DODO Vending Machine (DVM) on the protocol. DVM allows anyone with a wallet to create a liquidity market using DODO’s PMM technology to create a bonding curve for the provisioned tokens. Pool creators just have to provide the tokens and define the pricing curve desired, and the DODO Vending Machine will create a liquidity market for the asset.

As the name suggests, anyone can add liquidity to these pools and share the trading fees accrued proportionally to their percentage of the pool. The pool parameters cannot be modified after the creation.

DODO Private Pools

Also called DPP, these pools are for professional market makers with special features that cannot be satisfied by the DODO Vending Machine (DVM). In DPP, creators can create pools that only require one token. Only the pool creator can provide liquidity for this pool. Unlike DVM, pool creators can change the pricing curve at any time.

DODO Pegged Pools

According to DODO, these pools are suitable for synthetic assets. These are like public pools where anyone can provide liquidity and the pools parameter the token type, the number of tokens, trading fee rate, initial price, and the slippage coefficient can not be changed after creation.

Crowdpooling

DODO provides the ability to issue new assets at the lowest cost and create highly liquid capital pools through Crowdpooling. On DODO, anyone can create its own token without any coding. The token creator can then distribute its token through DODO Crowdpooling.

DODO also attracts new crypto projects with a free listing as an Initial DODO Offering (IDO) on its Crowdpooling feature. The documentation describes Crowdpooling as:

“Crowdpooling is an equal opportunity way to distribute tokens and kick-off liquidity markets. Inspired by the call auction mechanism commonplace in securities markets, Crowdpooling ensures that there is no front-running or bot interference.”

DODO V2 currently supports two types of Crowdpooling (CP): Fixed-Price CP and Variable-Price CP. Then they can set the start and end date.

IDO projects only need to deposit their own tokens to the liquidity pool. A portion of the tokens will be used for crowdfunding and the rest will be used for ask-side liquidity in the pool. Once the Crowdpooling campaign ends, participants can claim the tokens based on their stakes at the pre-defined initial offering price.

After this, new public liquidity pools will be automatically set up with the capital raised and the tokens reserved for ask-side liquidity and trading becomes available for the token.

Mining

DODO platform users can earn DODO token rewards by engaging in liquidity mining, trade mining, and Combiner Harvest mining, which are geared towards liquidity providers, traders, and pool creators respectively.

Traders can mine DODO tokens when they make trades on the DODO exchange. Liquidity providers provide liquidity to DODO pools and receive DODO LP tokens as rewards.

In addition to trade mining and traditional liquidity mining, pool creators and liquidity providers can also get involved by participating in Combiner Harvest mining. The documentation describes this feature as:

“A program aimed at giving platform users exposure to promising projects willing to collaborate with DODO. Under this system, approved projects can create liquidity pools on DODO and those who provide liquidity for these pools will earn DODO reward tokens.”

DODO NFT Vault

According to its website, the DODO NFT Vault is price discovery and liquidity protocol for non-standard assets. This feature allows users to create new or use the existing NFTs and pledge them into the DODO NFT Vault. These NFTs in DODO NFT Vault are divided into many pieces with fungible ERC20 tokens issued to represent them.

Then a liquidity pool powered by DODO’s PMM algorithm is established to trade these tokens. These ERC20 tokens can be traded using DODO’s SmartTrade and liquidity aggregation service at the best price.

This NFT Fractionalization is similar to a public company issuing its shares. In this way, DODO gives rise to a highly active and efficient secondary NFT market. These fungible ERC20 tokens, created by dividing an NFT into pieces, can be traded through cryptocurrency exchanges and used in lending protocols, for derivatives trading, and in many other scenarios.

DODO Token and DODOnomics

The DODO token is the native ERC20 token of the protocol that is used for governance and incentivizing liquidity provisioning. There is a total supply of 1 billion tokens.

With the launch of DODO V2 in January of 2021, the DODO token has been given two new utilities for holders: Crowdpooling and IDO allocations and trading fee discounts on DODO. In V2, a DODO Loyalty program has also been introduced in which users can mint a non-transferable vDODO token.

This vDODO token serves as proof of membership in DODO’s loyalty program. vDODO tokens can be minted at a fixed rate of 1 vDODO = 100 DODO. vDODO token gives some extra privileges to holders like dividends from trading fees, membership rewards, and extra voting power, in addition to the same benefits of holding DODO tokens.

DODO holders can vote in governance but 1 DODO is always equated to 1 vote. They can take part in Crowdpooling and IDO allocation, and get trading fee discounts. While vDODO holders can cast 100 votes by holding 1 vDODO. Apart from Crowdpooling and trading discounts, they also earn a portion of the trading fees accrued on the platform and receive membership rewards in DODO after every block cycle.

DODO Ecosystem Links

- Website: https://dodoex.io/

- DODO App: https://app.dodoex.io/exchange/ETH-USDC?network=mainnet

- DODO Docs: https://docs-next.dodoex.io/en/home/what-is-dodo

- DODO FAQs: https://dodoexhelp.zendesk.com/hc/en-us/sections/900001568323-Frequently-Asked-Questions-FAQ-

- DODO NFT: https://dodonft.io/

- Twitter: https://twitter.com/BreederDodo

- DODO Blog: https://medium.com/dodoex