The cryptocurrency market expanded rapidly after the 2017 ICO bubble, from an approximate $566B market capitalization at the end of 2017 to $1.5 trillion in February of 2021. (currently stands at 1.5T) This means that there should be a sound infrastructure to support the ever-increasing trading of cryptocurrencies.

Cryptocurrency exchanges are the first question to this answer. while the majority of cryptocurrency assets are built on the foundations of decentralized architectures, the majority of the trading still takes place on centralized exchanges. On centralized exchanges, users have to custody their assets on the exchange. While these exchanges come with many benefits like speed, their past raises doubt on their reliability. Incidents that happened with centralized exchanges like Coin check, Mt. Gox, BitGrail, NiceHash, Bitfinex, and Youbit force crypto users to think twice before engaging with them.

After the introduction of smart contracts in blockchain with the launch of Ethereum, decentralized exchanges (DEXs) attempted to solve the underlying problems of CEXs by facilitating trades with smart contracts, removing third-party control of trader funds. But that came at the cost of the speed and performance of a blockchain network.

Putting all the trading activities on-chain slow down the network. So, a group of cryptocurrency traders built a solution on the Ethereum blockchain that rests in middle, one that provides speed without compromising the security of DEXs. They named their solution IDEX.

What is IDEX Exchange?

IDEX is an Ethereum-based decentralized exchange (DEX) launched by a group of cryptocurrency traders in 2017. It claims to offer real-time trading of cryptocurrencies with support to limit and market orders, gas-free cancels, and the ability to fill many trades at once.

The 2017 launch was the first IDEX 1.0 version of the exchange. The team launched IDEX 2.0 in late 2019 which is now available to users.

The IDEX 1.0 combined off-chain matching and validation with on-chain settlement. This off-chain trade matching and on-chain settlement architecture offer the speed of centralized while maintaining the security feature of decentralized exchanges. Furthermore, IDEX 1.0 was non-custodial, given the control of funds to traders.

IDEX 2.0 also maintains this same off-chain matching and on-chain settlement but with powerful new features and scaling solutions. Let’s take a look at how does it work?

How Does IDEX Work?

Before the introduction of IDEX, conventional DEXs took the term most literally, building fully on-chain models in which all orders interact directly with each other. This approach achieved decentralization but made trading slow and expensive as each process from placing an order to

modifying or canceling an order incurs a network fee and depends on the time in which a blockchain network confirms a transaction. Below are the features of the IDEX exchange.

Hybrid Design

IDEX exchange uses a hybrid design where trade execution and settlement happen as separate events. On the IDEX platform, transactions execute in real-time but settle minutes later at the speed of the network.

To make this possible, all transactions, such as deposits and trades, are authorized by end-users and their private key. However, IDEX maintains ownership of broadcasting certain authorized transactions to the network.

Workflow

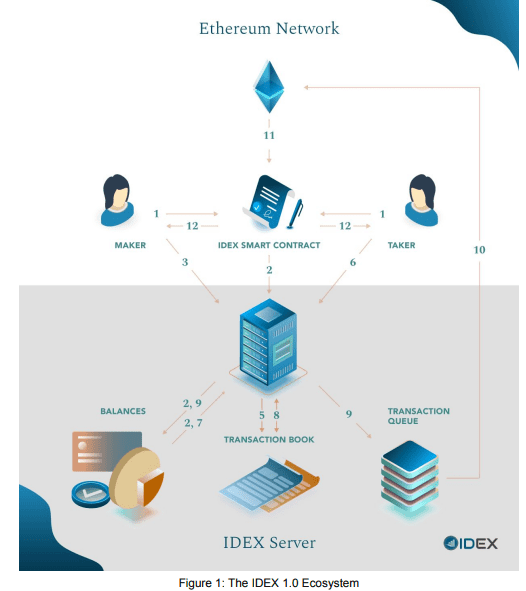

The below diagram describes the working of IDEX.

According to IDEX Whitepaper, trading on IDEX works as follows.

- The maker and taker deposit their tokens into the IDEX contract.

- IDEX smart contracts then update the IDEX database to include the customer addresses and token balances.

- The maker creates and submits a signed order to the IDEX server.

- IDEX server then confirms that the maker’s account has sufficient funds and that the signed transaction matches what was submitted to IDEX.

- When confirmed, the order is added to the order book.

- “The taker submits a matching order, signing a transaction with the same price as the target order and an amount less than or equal to it.”

- IDEX confirms that the maker’s account has sufficient funds.

- When confirmed, the trade is marked as matched and the order book is updated.

- IDEX database is updated to reflect new balances and at the same time, signed order is added to the queue to be broadcast to the Ethereum network for processing.

- “The transaction is dispatched to the blockchain by one universal submitting address, using the next nonce to ensure proper ordering by the miners.”

- When the transaction is confirmed by the blockchain network, IDEX smart contract is updated to reflect the trade.

- Maker and taker can now withdraw their funds.

Deposit Contract

IDEX uses a deposit contract that acts like escrow and temporarily locks the funds before allowing the user to authorize a limit or market order. This ensures that funds are available not only at the time of execution but also at the time of settlement eliminating trade failures.

Universal Submitting Address

This is an important function that ensures that only IDEX can submit signed trades to the Ethereum network for settlement and allows the exchange to control the order in which transactions are processed and to settle trades on-chain in the same order they are executed off-chain.

IDEX 2.0

IDEX 2.0 retains the same core design but improves the drawbacks like excessive transaction costs, limited scalability, and limited asset support. IDEX 1.0 only supported Ethereum and ERC-20 tokens. IDEX 2.0 also supports other assets like Bitcoin.

IDEX 2.0 is powered by an innovative Optimized Optimistic Rollup (O2 Rollup) layer-2 scaling solution. O2 Rollup is a novel, open-source layer-2 design for bringing scalable applications to public blockchains.

According to IDEX, O2 Rollup allows for unlimited off-chain scaling with a fixed on-chain settlement cost, removing bottlenecks and costs that have prevented DEX adoption. IDEX 2.0 has been rolled in three phases.

Phase 1

In the first phase, a breakthrough in performance was provided where trades still settled on-chain individually but makers incurred no gas fees, while takers pay a small gas fee per trade. In this phase, new off-chain components were added that generated real production data while still relying on the battle-tested on-chain settlement mechanisms.

Phase 2

In phase 2, the layer-2 system operated alongside the on-chain settlement and the team tested to compare the layer-2 system using this same production data generated in phase, ensuring that the settlement methods produce the same results.

Phase 3

In phase 3, the on-chain settlement was fully transitioned to the layer-2 system, eliminating taker gas costs entirely and setting the stage for unbounded scale.

IDEX 2.0 support batch settlement of trades via Merkle Roots, a data structure that can be used to shrink a data set of arbitrary size into a unique, short set of bytes. IDEX combines the concept of off-chain balances and Merkle root proofs to support the batch settlement of trades and drastically reduce gas costs.

IDEX Token and Staking

IDEX is also the native token of IDEX exchange that is used in staking. IDEX staking enables traders, market makers, and IDEX users to operate part of the IDEX infrastructure and, in the process, contribute to the security and performance of the platform.

On IDEX, staking is a two-tier operation.

Tier 1, Validator Staking: Tier 1 are validator node operators. A validator node (VN) is a staking client run by members of the community that enforces the validity of the layer-2 ledger.

To participate in the validator network, VN operators must deposit IDEX tokens into a staking contract. VN operators review all transactions published to the off-chain ledger, confirming the transactions, and Merkle root for the correctness and calling fraud-proof enforcer functions in the event an issue is identified.

They are rewarded in IDEX tokens through a pool seeded by IDEX. According to the IDEX website, the Validator staking is yet to be live.

Tier 2: Tier 2 are API Node operators that maintain a real-time copy of the IDEX order book and other system data and provide compatible REST API endpoints to the public. They help IDEX reduce transactional costs by offloading popular API operations. Tier 2 nodes receive rewards through an internal audit system.

Tier2 is also replicator staking where users stake IDEX tokens and run a lightweight node. They earn 50% of all IDEX trade fees paid every 2 weeks in ETH and BNB.

Important Links:

- Website: https://idex.io/

- Exchange: https://exchange.idex.io/eth/trading/MITX-ETH

- Whitepaper:

- Twitter: https://twitter.com/idexio