Latest Ripple [XRP] News

It’s true that incorporating blockchain to processes bring forth transparency, reducing opaqueness. We all know what happens when rogue elements are given a chance in a structure without checks and balances. When third parties can view operations and introduce beneficial oversight not only do ordinary end users get better deals but there is better efficiency and cost savings.

Ripple Inc is proposing three solutions in xRapid, xCurrent and xVia. The second option is popular but is seamless with xRapid, a system where processors as well as banks can use XRP as a medium of exchange. That is, for liquidity purposes. Good news is, xRapid is commercially available and there are no better pointers for prove than surging transaction volumes from three Ripple Inc recommended exchanges in Bitstamp, Coins.ph and Bitso.

Their activity points to increasing use and that could propel transaction volumes between the US—Mexico and US—Philippines remittance corridors. Gradually and despite lack of regulator comment on the status of XRP, it is increasingly becoming clear that Ripple Inc is indeed proposing a system that saves money and is near instantaneous.

For their effort, the World Bank lauds Ripple Inc and other DLT firms saying that their tech is positively impacting people livelihood especially those in developing countries.

“DLT-based cross-border payments potentially offer a promising pathway to dramatic improvements in the lives of millions of people in emerging economies. DLT could improve the traceability of remittances and reduce compliance costs for MTOs and supply chain payments, stimulating economic activity in destination countries.”

XRP/USD Price Analysis

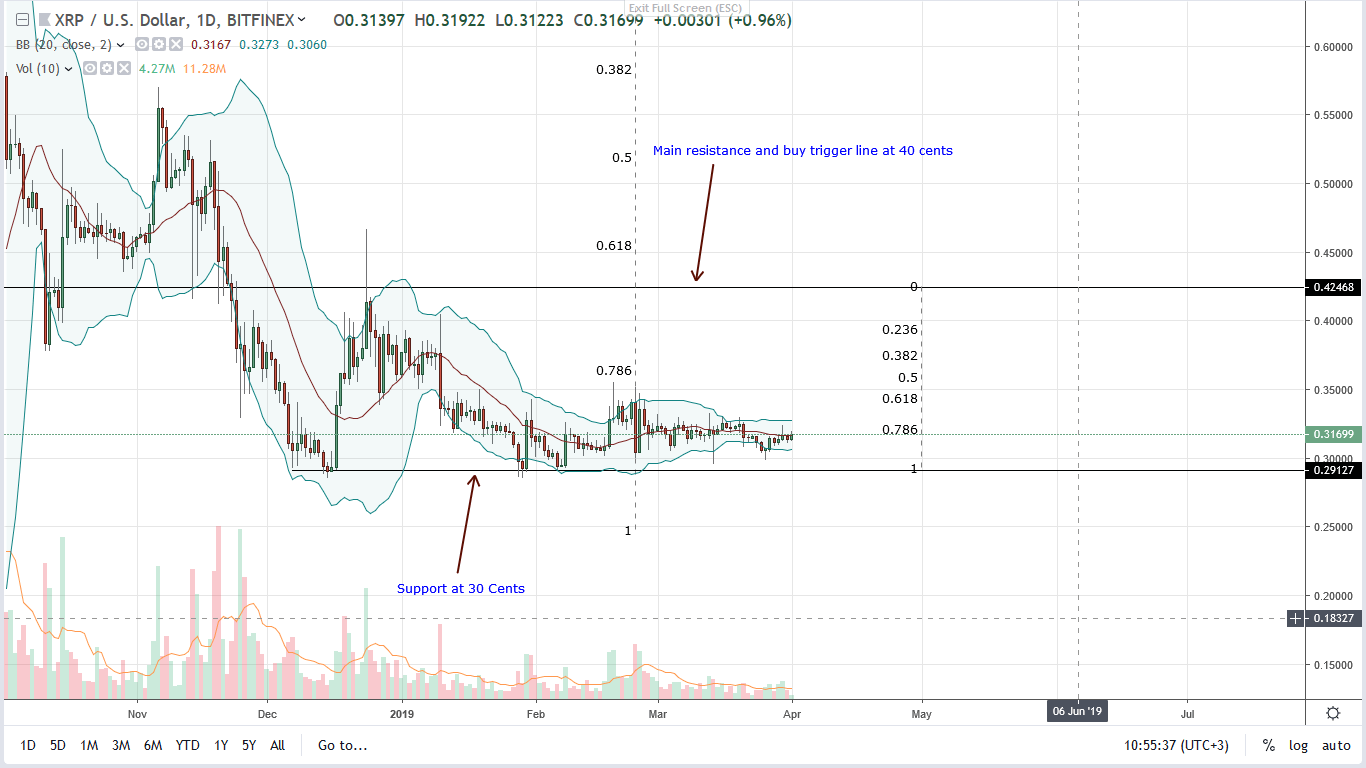

With a market cap of $1,058 million, Ripple [XRP] is up 1.4 percent in the last week and pretty stable in the last day, adding 1.1 percent. All the same, bulls are yet to build on satisfactory momentum and breach the 34 cents mark ushering in a new wave of higher highs towards and above 40 cents.

As a matter of fact, XRP prices are in an energy sapping consolidation within a 4 cents trade range with caps at 30 cents on the lower side and 34 cents on the upper side. As we mentioned in our last XRP/USD trade plan, we shall adopt a neutral but bullish stance expecting breaks above 34 cents as buyers of late Sep 2018 and Jan 2019 to flow in.

Accompanying this close above should be high transaction volumes preferably exceeding 61 million and effectively reversing losses of Feb 24 bear bar.

On the other hand, steep losses below 30 cents or Q1 2019 nullifies our trade plan, opening doors for sellers aiming at sub 20 cents.

All Charts Courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision