TL;DR

- JPMorgan will allow its clients to use crypto ETFs as collateral for loans, starting with BlackRock’s iShares Bitcoin Trust.

- The bank will include crypto holdings in net worth and liquid asset calculations to determine available credit levels.

- This move formalizes what was previously a case-by-case use of crypto ETFs as collateral and sets the stage for adding more products.

JPMorgan announced it will let its trading and wealth management clients use cryptocurrency-linked assets as collateral to access financing.

The program will begin with BlackRock’s iShares Bitcoin Trust and gradually expand to other exchange-traded funds tied to cryptocurrencies. It’s a strategic decision aimed at addressing growing client demand and taking advantage of a more flexible regulatory environment in the United States.

JPMorgan will also factor its wealth management clients’ cryptocurrency holdings into their net worth and liquid asset assessments. This means digital asset positions will receive the same treatment as stocks, cars, or artwork when determining available credit levels. The change will apply across all customer segments, from retail users to high-net-worth individuals.

JPMorgan Expects to Add More Products in the Near Future

Until now, JPMorgan had authorized the use of crypto ETFs as collateral only in isolated situations. With this change, the bank formalizes the option and anticipates adding more products as the rollout progresses. The firm maintains relationships with crypto industry players like Coinbase, although its CEO, Jamie Dimon, has repeatedly voiced skepticism toward Bitcoin. Despite his personal stance, Dimon has made it clear the bank will continue offering services aligned with client demand.

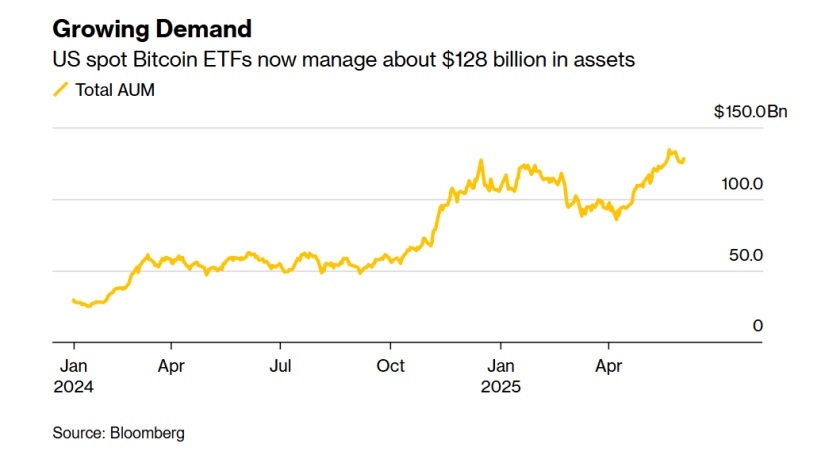

The launch of spot Bitcoin ETFs in January 2024 radically changed the institutional landscape for cryptocurrencies in the U.S. These products now manage $128 billion in assets, making them one of the most successful debuts in U.S. financial market history. At the same time, Bitcoin reached a new all-time high of $111,980 in May 2025.

The current regulatory climate and the growth of institutional crypto products have prompted several banks to rethink their strategies. Morgan Stanley, for instance, is working on integrating cryptocurrency trading into its E*Trade platform