TL;DR

- U.S. Bitcoin ETFs reported net inflows of $64.91 million on August 22, extending their positive streak to six days.

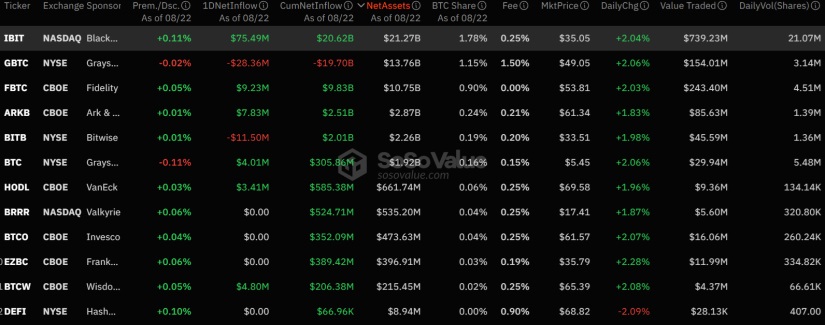

- BlackRock’s ETF, IBIT, led with $75.49 million in net inflows, while Grayscale’s GBTC saw $28.36 million in outflows.

- Ethereum ETFs faced net outflows of $874,610, with only a few funds attracting capital, while the total trading volume decreased significantly.

On Thursday, August 22, 2024, Bitcoin exchange-traded funds (ETFs) in the U.S. reported net inflows of $64.91 million, marking the sixth consecutive day of positive flows. Despite the market’s volatility, a sustained trend of inflows for BTC is developing.

Among Bitcoin ETFs, the standout was BlackRock’s IBIT, which led with $75.49 million in net inflows. Significant inflows were also observed in other funds, including Fidelity’s FBTC with $9.23 million and Ark and 21Shares’ ARKB with $7.83 million. Conversely, Grayscale’s ETF, GBTC, recorded $28.36 million in outflows, and Bitwise’s BITB reported $11.5 million in net outflows.

The total trading volume for the 12 Bitcoin ETFs dropped to $889.67 million, compared to $1.42 billion the previous day. The decrease in volume may reflect market consolidation following several days of intense activity.

In contrast, Ethereum ETFs in the U.S. faced net outflows on Thursday, totaling $874,610 in negative flows, a significant drop from the $17.97 million in outflows reported the day before. The Grayscale Ethereum Trust (ETHE) continued its negative streak with $19.84 million in net outflows, being the only Ethereum ETF to report outflows on the day.

Bitcoin Follows Market Consolidation

However, some Ethereum ETFs managed to attract capital. Fidelity’s FETH recorded $14.33 million, Grayscale’s Ethereum Mini Trust (ETH) saw $3.68 million, and VanEck’s ETHV had $954,100 in inflows. The other five ETH ETFs reported no changes in flows.

The total trading volume for Ethereum ETFs decreased to $93.87 million, down from $201 million the previous day. This decline in volume may indicate similar market consolidation.

According to the latest data from CoinMarketCap, Bitcoin (BTC) is trading at $61,528.83 with a daily increase of 1.8%. On the other hand, Ethereum (ETH) is trading at $2,675.93 after a 2.9% rise in the last session. Meanwhile, the total market capitalization for cryptocurrencies has increased by 2.2%, reaching $2.18 trillion.