The cryptocurrency market recently experienced a significant setback, with Bitcoin leading a notable downturn. After starting the year on a positive note, BTC underwent a dramatic 6% plunge in just one hour, dropping below $42,500. This abrupt turn of events occurred after the leading cryptocurrency surpassed $45,000 the day before, marking its highest point since 2022.

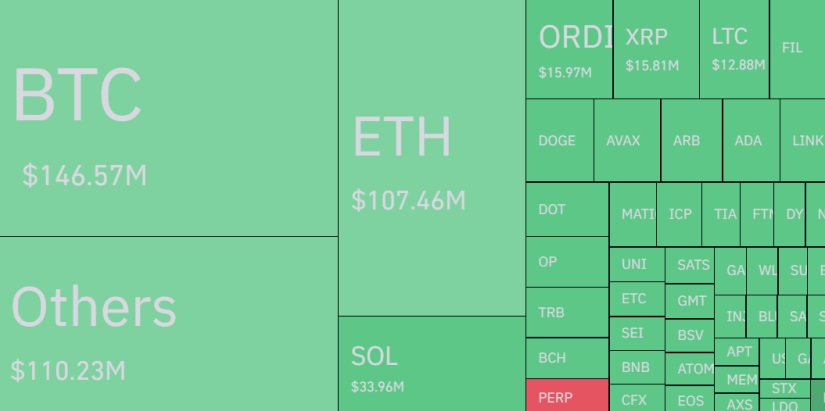

The suffered volatility not only impacted Bitcoin but also extended to the overall market. The swift correction led to liquidations totaling $631 million in the cryptocurrency market, underscoring the magnitude of the fall. This phenomenon, known as a “flash crash,” is indicative of the market’s susceptibility to abrupt changes and the ability of such events to generate significant price movements.

Bitcoin Triggers a Flash Crash and Prompts Strong Liquidations

On the first day of 2024, Bitcoin seemed poised for new highs, reaching $45,800. However, this optimism quickly faded as the cryptocurrency lost over 9%, dropping to the $41,813 mark. This decline also affected other cryptos, with Ethereum correcting over 8.8% and falling below $2,200. Other altcoins like Solana, XRP, Cardano, Avalanche, and Polkadot also experienced declines, some exceeding 15%.

Uncertainty in the crypto market intensified with the imminent decision of the Securities and Exchange Commission (SEC) regarding the approval of spot Bitcoin ETFs. The anticipation surrounding this decision led to various speculations, with some analysts suggesting it could result in a “Sell the News” event. Markus Thielen, an analyst at Matrixport, recently argued, contrary to positive opinions, that the SEC would reject the ETFs.

In this context, the situation of MicroStrategy, the leading institutional holder of Bitcoin, is intriguing. While BTC experienced its fall, MicroStrategy’s stocks increased by 8.48%. This is attributed to Michael Saylor, founder and CEO of MicroStrategy, deciding to sell stock options totaling $216 million. This move aims to increase Saylor’s personal BTC holdings and highlights the complexity of the strategies he adopts.

Dealing with the dynamic and sometimes unpredictable nature of this space is challenging. Attention is now focused on the SEC’s decision and how it might influence the trajectory of cryptocurrencies in the short term. The community and investors will need to monitor the evolution of these events in the coming hours to make informed decisions for the future

![Is Dogecoin [DOGE] Security? Mad Money's Jim Cramer believe so](https://crypto-economy.com//wp-content/uploads/2022/01/Capture-2-300x184.jpg)