TL;DR

- Bernstein projects that companies will invest $330 billion in Bitcoin over the next four years, driven by MicroStrategy’s example.

- Small companies are leading this trend, seeing BTC as an opportunity to grow and hedge against inflation.

- Even giants like Meta and Amazon will face internal votes to decide whether to add Bitcoin to their corporate reserves.

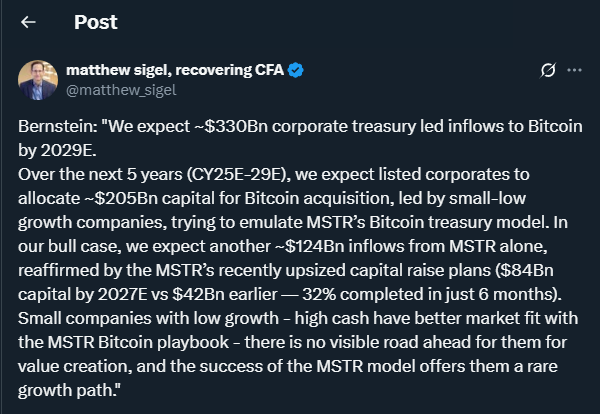

In a new report, investment firm Bernstein forecasts that by 2029 companies will have allocated around $330 billion to buying Bitcoin for their treasuries. This movement would be spearheaded by companies like MicroStrategy, which has pioneered this strategy, and followed by small and mid-sized businesses looking for an innovative path to growth in a context of low expansion rates.

Currently, public companies hold about 720,000 BTC, with MicroStrategy alone controlling more than 555,000. According to Bernstein, the firm could allocate another $124 billion in the coming years, after doubling its capital raise plan from $42 billion to $84 billion through 2027. The enthusiasm on Wall Street about this plan suggests that the Bitcoin bet is no longer seen as a mere experiment but as a serious strategic move. Furthermore, the growing crypto-friendly environment in the United States is helping more companies adopt Bitcoin as a store of value against high inflation and currency depreciation, consolidating its role in global markets. Analysts also highlight the impact of regulatory clarity, which has encouraged institutional players, family offices, and hedge funds to participate.

Small Companies Leading The Bitcoin Standard

The report highlights that small companies, especially those with limited growth but strong cash reserves, see Bitcoin as a rare opportunity to generate value. Firms like Metaplanet, Semler Scientific, and KULR Technologies have already begun adopting this strategy, gradually accumulating BTC as a key part of their balance sheets. Meanwhile, companies like GameStop and Rumble have announced plans to adopt the Bitcoin standard, though they have not yet begun purchasing BTC.

Tech Giants Under Shareholder Pressure

Although major tech companies like Apple, Amazon, Meta, Microsoft, and Nvidia have yet to take the leap, some shareholders are pushing them to allocate part of their cash to Bitcoin. In fact, Meta and Amazon will vote this month on whether to include it in their corporate treasuries.

Although similar proposals recently failed at Microsoft, the very fact these debates are happening reflects how far crypto has advanced in the corporate world. Bitcoin adoption is no longer just a fad: it’s a financial revolution in progress.