TL;DR

- XRP moved 707 million tokens in 24 hours following the arrival of ETFs, establishing a new liquidity regime across the network and exchanges.

- Volume spikes have become frequent, driven by concentrated high-value movements from institutional arbitrage and professional desks.

- XRP remains in a descending channel, but the lower boundary holds; institutional liquidity and automated flows now dominate, signaling higher volatility and recurring liquidity shocks.

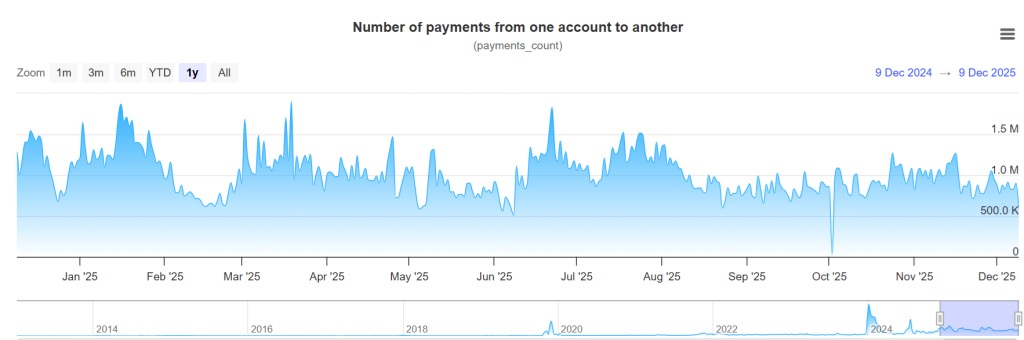

XRP moved 707 million tokens in 24 hours after the introduction of ETFs, creating a new liquidity regime across the network and exchanges. The token processes nearly one million payments daily, showing stable underlying demand despite price weakness.

Volume spikes in transfers have become routine. Dates such as November 14 and late November/early December coincided with notable increases in swap volumes, indicating concentrated activity of high-value movements.

This pattern directly relates to the participation of new institutional actors, ranging from professional desks to automated arbitrage, emerging with ETF trading. Their activity generates abrupt and erratic flows that distort traditional accumulation and distribution metrics, making them no longer reflect solely retail investor behavior.

Technical analysis shows that XRP remains in a descending channel. Selling pressure remains dominant, but the channel’s lower boundary has held, suggesting a weakening of the bearish trend. The RSI stays around 40–50, indicating a balance between overbought and oversold conditions, while overall volume declines, reflecting a market on hold and ready for more pronounced liquidity shocks.

ETFs Reconfigure the XRP Market

ETFs have introduced a new type of liquidity to XRP, where sudden spikes in exchange activity are no longer exceptional but the norm. Arbitrage, fund rebalancing, and custodial movements explain many of these peaks, and investors should interpret them as signals of new market dynamics rather than straightforward accumulation or distribution.

Overall, network data and market metrics show that XRP is transitioning into a regime where institutional liquidity and automated flows shape the daily transaction structure. This combination of factors indicates that the token is entering a phase of higher volatility and frequent liquidity shocks, driven by increased ETF-related volumes.

XRP has entered a new chapter of adoption and market dynamism, where the combined activity of retail investors, companies, and institutions redefines liquidity measurement and market health. Traders must adjust their metrics and expectations to correctly interpret the signals the network is sending in this context of elevated liquidity and programmed volatility