TL;DR

- Movement Labs launched the Developer Mainnet phase, allowing developers to deploy applications on its scalable and flexible blockchain.

- World Liberty Financial acquired $2 million in MOVE tokens, making them its tenth-largest investment, sparking debates about potential insider trading.

- The MOVE token purchase is part of a strategy that includes exchanges of stablecoins and tokens like LINK, ENA, AAVE, and TRX.

World Liberty Financial, the DeFi platform backed by the Trump family, has acquired approximately $2 million worth of MOVE tokens, making this asset its tenth-largest investment.

The purchase has generated some debate about potential insider trading, especially as it was made shortly after Movement Labs, the company behind MOVE, launched a new developer program and a community funding initiative.

The acquisition is part of a series of strategic moves by the World Liberty Financial project, including a mix of stablecoins and native tokens like MOVE. These exchanges are carried out using platforms like CoW Swap, highlighting the project’s close relationship with decentralized technologies. In addition to MOVE, World Liberty has accumulated significant amounts of other cryptocurrencies, such as Chainlink’s LINK, Ethena’s ENA, and Aave’s AAVE, as well as a substantial amount of Tron’s TRX tokens.

World Liberty Financial Investments

World Liberty’s purchases, which include significant amounts of assets, are part of a long-term strategy to consolidate positions in various cryptocurrencies. The platform’s $389 million in cryptocurrencies provides a solid base for future investments, with a particular focus on strategic tokens for the DeFi ecosystem. Additionally, World Liberty’s relationship with Tron and its plans to increase its investment in the network are evidence of the project’s ambition to expand its influence.

Movement Labs Prepares to Open Its Network to the General Public

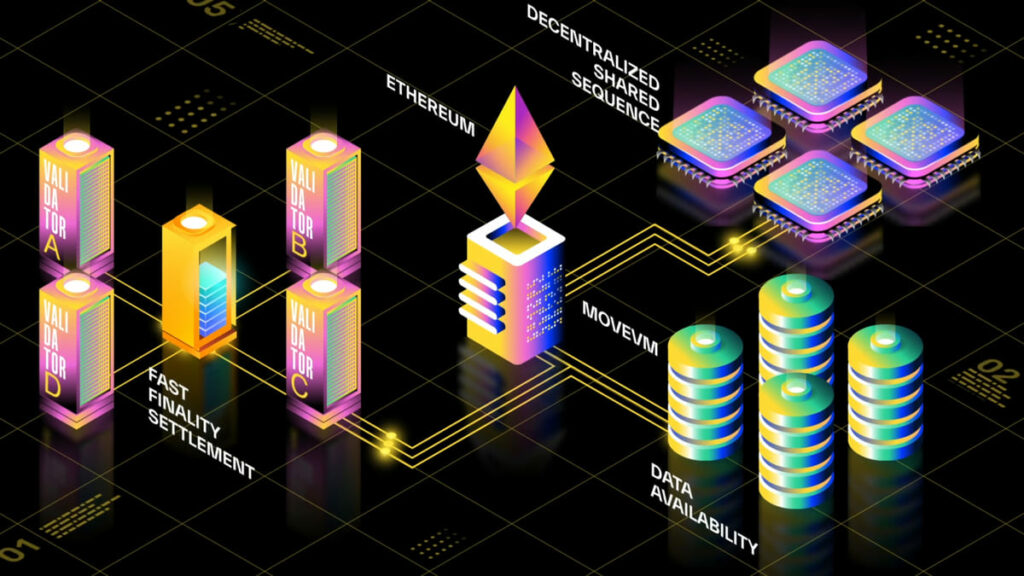

On the other hand, Movement Labs continues to build a scalable and flexible blockchain. This month, it launched the Developer Mainnet phase, a new stage that allows developers to begin deploying applications on the Movement network. This phase is part of a plan that started in December with the introduction of the Mainnet Beta.

The goal is to provide robust infrastructure and technical resources to encourage the creation of decentralized applications (dApps). The Movement network also aims to combine advanced security features with the scalability of Ethereum, leveraging projects like Optimism, Polygon, and Arbitrum.

With the launch of these initiatives and growing interest from major investors, Movement Labs is preparing to open its network to the general public, with the intention of offering permissionless options for app deployment and user onboarding