TL;DR

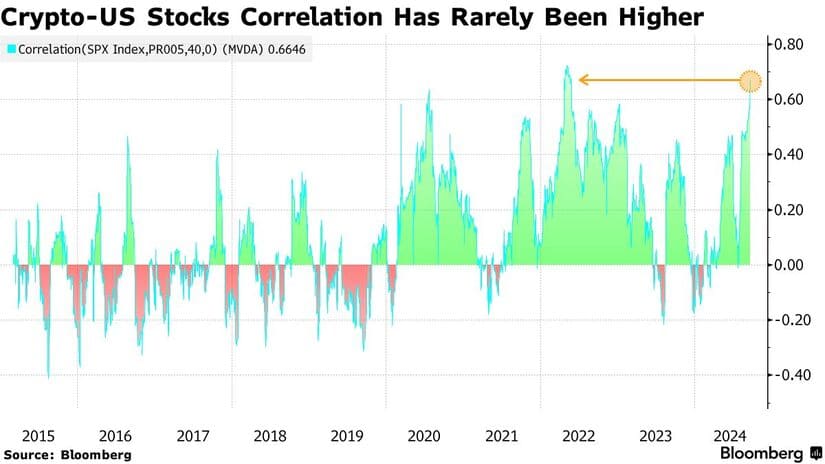

- The correlation between cryptocurrencies and U.S. stocks has reached a coefficient of 0.67, indicating a fundamental relationship between both markets.

- The recent 50 basis point interest rate cut by the Federal Reserve has pushed Bitcoin above $64,000 and has led stocks to new all-time highs.

- Comments from the Fed and key economic data are expected to influence future rate cuts.

The correlation between cryptocurrencies and U.S. stocks has reached striking levels, according to a recent study revealing a coefficient of 0.67.

The increase in the relationship between digital asset markets and the S&P 500 suggests that macroeconomic variables, especially following the recent interest rate reduction by the Federal Reserve, are playing a crucial role in the dynamics of both sectors. The Fed implemented an aggressive 50 basis point cut, contributing to Bitcoin surpassing the $64,000 barrier last week, while stocks reached new historical highs.

Economic data from the United States is now essential for traders, who are looking for signals that could indicate the magnitude and pace of future rate cuts.

It is anticipated that comments from Fed officials will have a significant impact, as their reaction to market conditions is seen as a key factor in the evolution of monetary policies. In this context, the release of the personal consumption expenditures price index will be a fundamental event for the week.

The Influence of Policy on the Crypto Market

The growing correlation between cryptocurrencies and the S&P 500 indicates how recent events in the U.S. economy have affected both assets. Industry specialists anticipate that the positive relationship will persist as the economy seeks a potential soft landing, which could translate into a more favorable environment for liquidity. Such an environment is viewed as conducive to the development of a new bull market for the crypto industry.

Additionally, market optimism is supported by the political backing that cryptocurrencies and artificial intelligence are receiving in the lead-up to the U.S. elections. This is complemented by expectations for additional stimulus in China following the recent reduction in borrowing costs, which reinforces optimism in the markets