TL;DR

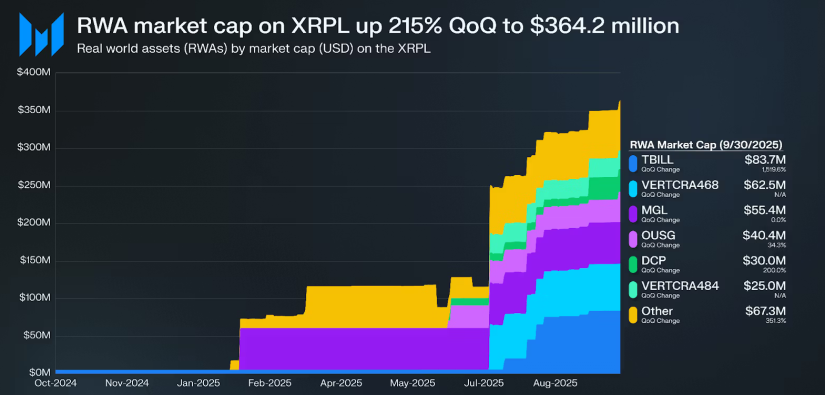

- The XRP Ledger closed Q3 2025 with increasing institutional adoption and $364.2 million in tokenized assets.

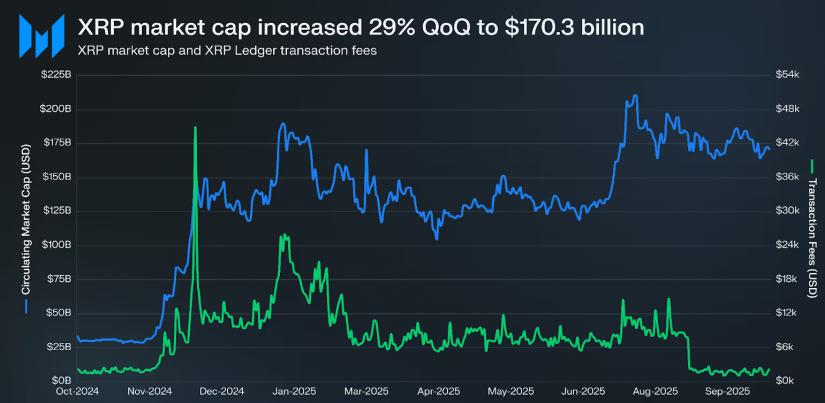

- XRP reached a quarterly high of $2.85 (+27.2% QoQ) and a market capitalization of $170.3 billion (+29% QoQ), outperforming BTC, ETH, and SOL combined.

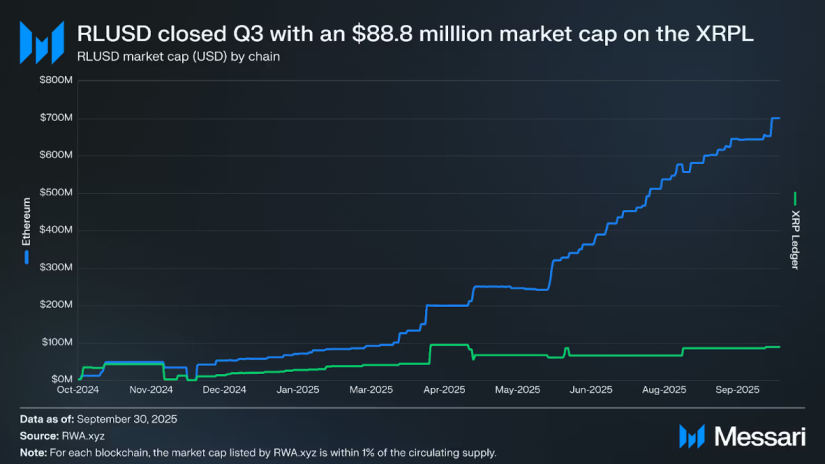

- RLUSD solidified its position as the largest stablecoin on the network with $88.8 million (+34.7% QoQ).

The XRP Ledger (XRPL) closed the third quarter of 2025 with significant progress in institutional adoption, tokenized assets, and regulatory features.

XRP’s price reached a quarterly high of $2.85 (+27.2% QoQ), with a market capitalization of $170.3 billion (+29% QoQ), surpassing the combined growth of BTC, ETH, and SOL, which increased 13.3% QoQ. This performance coincided with listings on the Coinbase Derivatives Exchange and the publication of ETP standards by the SEC, paving the way for a potential U.S. spot ETF for the token.

Paving the Way for an XRP ETF

The real-world asset (RWA) market on the XRPL grew 215% QoQ, reaching $364.2 million. Top assets include the Ondo Short-Term US Government Bond Fund, Guggenheim Digital Commercial Paper, and tokenized real estate from Ctrl Alt, which leverage Ripple’s custody infrastructure.

Stablecoins and wrapped tokens also saw growth. RLUSD, Ripple’s U.S. dollar-backed stablecoin, reached $88.8 million on the XRPL (+34.7% QoQ), becoming the largest stablecoin on the network. USDC launched in June, XSGD and EURØP arrived in preceding months, and BBRL and USDB round out the stablecoin offering. The network also includes Clawback and Deep Freeze features, enabling fund recovery or asset freezing under regulatory mandates.

Expansion to Over 60 Networks

The XRPL continues expanding its ecosystem through sidechains. Its EVM Sidechain connects to over 60 networks, while Coreum provides tokenization of securities and synthetic assets. The Root Network operates an NFT ecosystem with a bidirectional bridge to the Ledger and Ethereum, supporting metaverse applications and decentralized finance.

Activity in fungible tokens and NFTs also increased. The five largest tokens on the XRPL represent 64.6% of the market, led by SOLO and RLUSD. NFTs saw 4.2 million mints in Q3, with a 70% increase in creation transactions.

The XRPL closed Q3 positioned for strong growth in Q4 2025, ready to drive the RWA, stablecoin, and NFT markets while advancing institutional adoption