TL;DR

- Worldcoin faces allegations of price manipulation and insider trading after extending the lockup of its WLD tokens from three to five years.

- The change in the unlock schedule aims to prevent a drop in the token’s price, progressively releasing 80% of the retained tokens until July 2028.

- The price of WLD increased by 49.7% two days after the announcement, generating criticism from industry figures for alleged manipulation and lack of transparency.

The Worldcoin project, known for its eye-scanning identification system, is in the eye of the storm after the organization Tools for Humanity (TFH) decided to extend the lockup schedule for its native tokens. Originally, the WLD tokens were to be unlocked over three years. However, on July 16, TFH announced that the period would be extended to five years. The new schedule would begin on July 24 and conclude in July 2028.

This change means that 80% of the tokens held by investors and team members will be progressively released over the next four years, reducing the number of tokens immediately entering the market. The strategy seems designed to prevent a sudden drop in the token’s price due to a sudden increase in supply.

— DeFi^2 (@DefiSquared) July 17, 2024

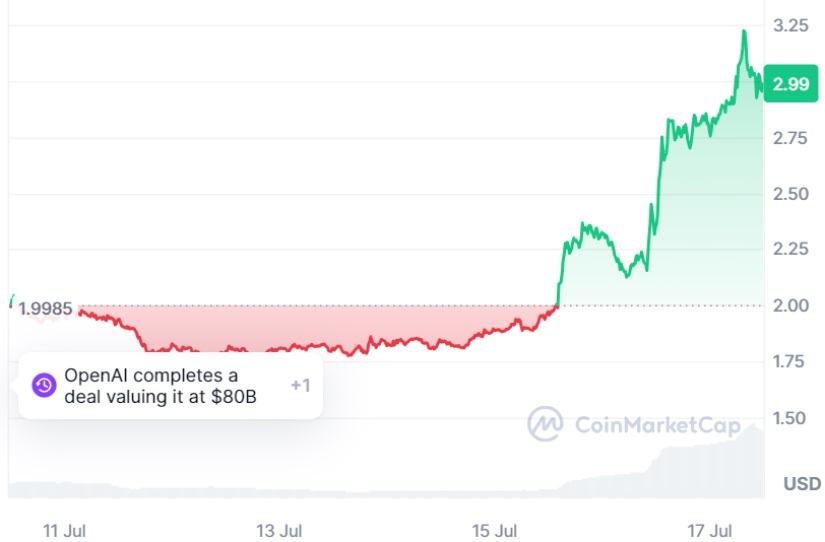

Just one day after the announcement, the price of the WLD token experienced a 49.7% increase, rising from $1.90 on July 15 to $2.96 on July 17, according to CoinMarketCap data. These values have placed Worldcoin among the best-performing tokens in the market, attracting the attention of both investors and critics.

Among the critics of the situation are ZachXBT and the DeFi Squared account on the X platform, who have accused the Worldcoin team of price manipulation and insider trading. DeFi Squared argued that the daily price movements of the token have been deliberately influenced by the team through changes in emissions, market maker contracts, and strategic announcements before unlocks. The account suggested that it is likely, though not proven, that someone from the team used insider information to benefit before the public announcements were made.

Worldcoin: ‘The Biggest Scam of the Bull Market’

For his part, ZachXBT, a well-known crypto investigator, labeled Worldcoin as “the biggest scam of the bull market” and harshly criticized the venture capitalists and team members involved, stating that they should feel ashamed for not having done anything to prevent these practices.

Shame on all of the VCs and team members who are complicit in the biggest scam token of the bull run and did nothing to prevent it.

— ZachXBT (@zachxbt) July 17, 2024

This controversy has highlighted the complexities and challenges in managing crypto projects, where strategic decisions can impact market perception and investor confidence. The evolution of this case should be closely monitored, as well as the price movements of Worldcoin.