In the past few hours, Bitcoin reaffirmed its bull market status and shook the market, surpassing $41,000 after reaching $40,000 in just a few hours. Currently, its price stands at approximately $41,798, marking a 5.57% increase in the day and over 12.47% in the last week.

This bullish momentum not only impacted Bitcoin but also directly contributed to the increase in the total cryptocurrency market capitalization, now reaching $1.61 trillion. The increase, at 3.6% in the last 24 hours, demonstrates the substantial influence that BTC has on the overall market.

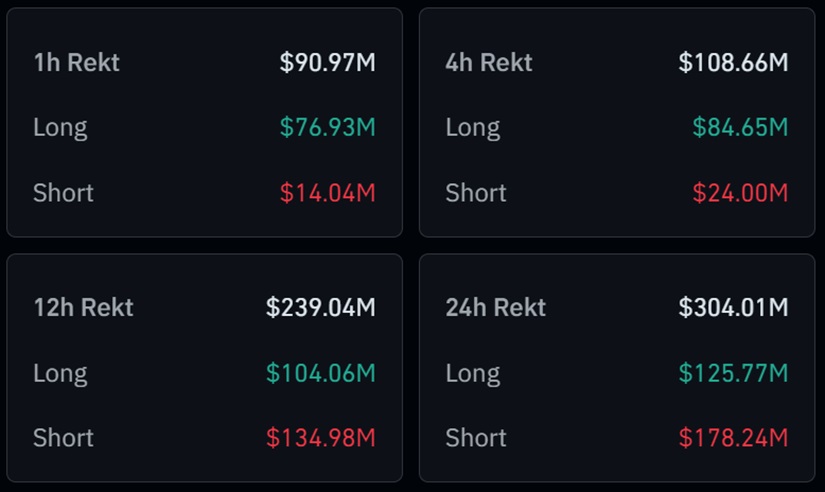

An important data point is the impact on the liquidation of short positions in derivatives, exceeding $178 million in the last 24 hours, according to CoinGlass data. This reflects the bullish pressure in the market, forcing those who bet on the downside to close their positions.

The Market Awaits Bitcoin ETFs in January

Bitcoin’s rise has sparked speculation about the potential approval of a Bitcoin ETF by the U.S. Securities and Exchange Commission (SEC). The recent price surge seems linked to renewed hope regarding the approval of one of the proposals under the regulatory entity’s consideration. Recently, the SEC held meetings with major applicants, including companies like Grayscale and BlackRock, to discuss possible amendments to their ETF applications.

Analysts have identified three key dates in January as opportune moments for the simultaneous approval of multiple Bitcoin ETF applications. The odds, according to Bloomberg Intelligence analysts, point to a 90% chance of the SEC approving a Bitcoin ETF in January. This optimistic outlook has generated enthusiasm among prominent figures in the industry, from Coinbase CEO Brian Armstrong to JP Morgan analysts.

Despite this optimism, uncertainty persists as the SEC could decide to deny one or all pending applications, maintaining its track record of rejecting all Bitcoin ETF applications to date. In summary. Although expectations remain high, we will still have to wait at least a few more weeks.