TL;DR

- The crypto market faces its largest options expiry of 2025 today, with $17 billion in BTC and ETH contracts expiring.

- Bitcoin leads with $15 billion in open options and a maximum pain level at $102,000, below its current price of $107,500.

- In the last 48 hours alone, $1.4 billion in calls were traded, showing how institutional investors adjusted hedges ahead of expected volatility.

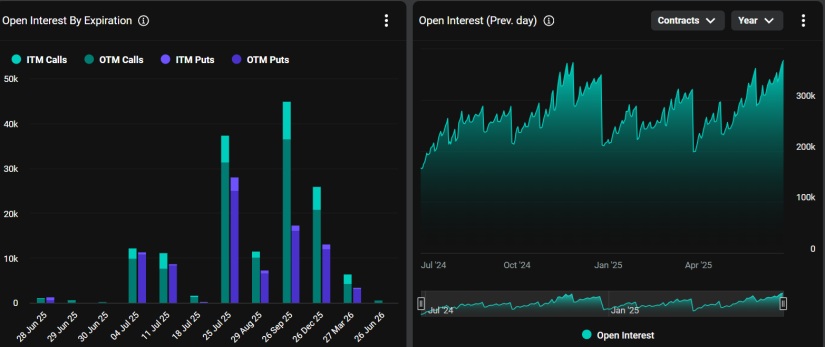

The crypto market will face its biggest options expiry of the year this June 27, with over $17 billion in Bitcoin and Ethereum contracts settling on Deribit.

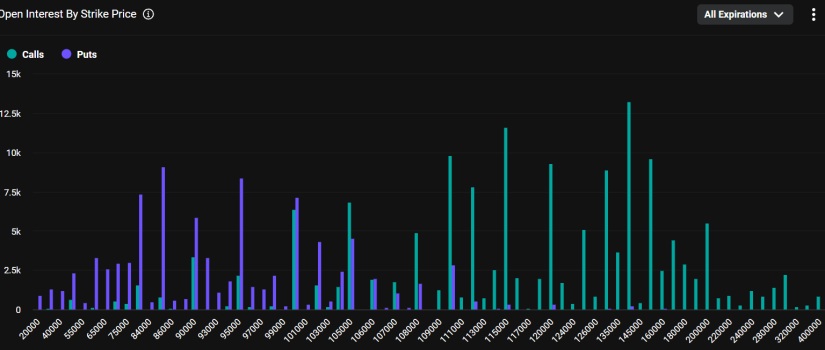

This session concentrates around 30% of total open interest and far exceeds the volumes of previous quarters. Bitcoin leads with $15 billion spread across 139,000 contracts, while Ethereum accounts for $2.3 billion through 939,000 positions.

The figure that worries traders most is the gap between current prices and the “maximum pain” levels — the strike prices where option holders lose the most money. For Bitcoin, that level stands at $102,000, while BTC trades above $107,500. Ethereum is priced near $2,450, above its $2,200 maximum pain mark. This mismatch typically triggers selling pressure in the hours leading up to expiry, as market makers rebalance positions to limit losses.

This Options Market Event Could Be Decisive for Bitcoin

Ahead of the event, Bitcoin’s open interest quadrupled compared to last week, driven by the quarterly nature of this expiry, which consolidates positions built throughout the second quarter. Large-scale trade volume also increased sharply. In the last 48 hours alone, $1.4 billion in calls moved, signaling that institutional investors actively repositioned their portfolios in anticipation of heightened market swings.

On the technical side, Bitcoin is attempting for the fourth time to establish $108,000 as a support level. Analysts suggest that holding weekly closes above $104,400 could signal a bullish continuation. If that level breaks, BTC may enter a lateral phase typical of the third quarter.

Institutional activity remains mixed. Some long-term investors increased their Bitcoin reserves, while others trimmed short-term positions. Meanwhile, Ethereum faces a more fragmented scenario. Although certain funds increased their holdings, institutional outflows persist. Analysts identify $2,400 as a critical level for ETH, warning that a breakdown could trigger a deeper correction.