TL;DR

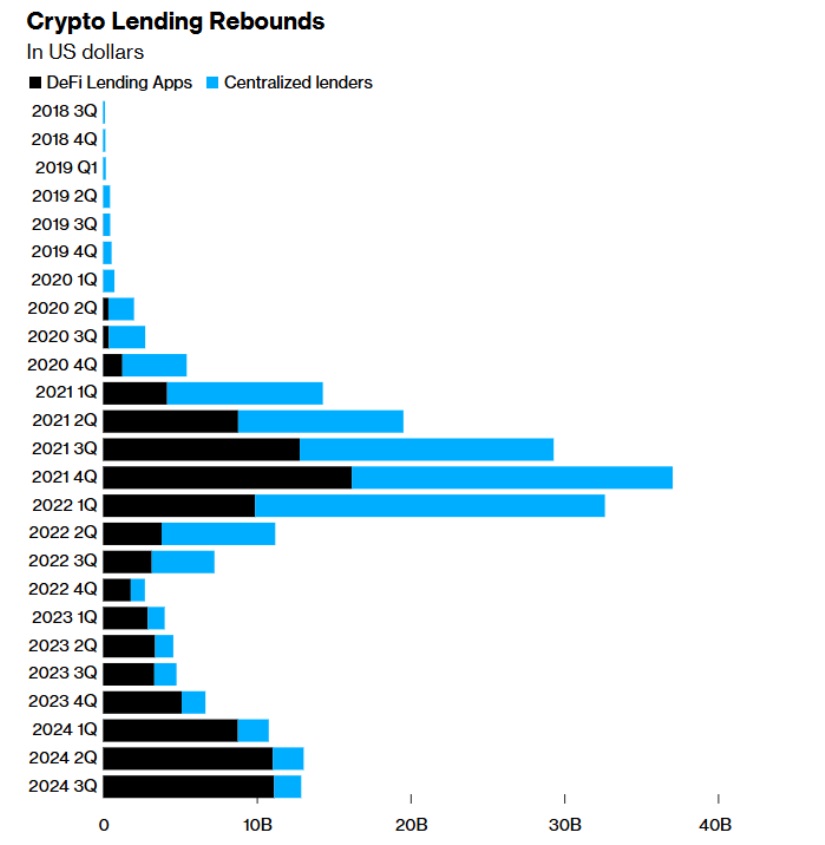

- The crypto lending market is revitalizing thanks to the demand for leverage and the rise of DeFi applications.

- Bitcoin’s price exceeds $100,000 in December 2024, increasing funding rates and demand for cryptocurrency-backed loans.

- DeFi platforms such as Aave and Compound lead the growth, while centralized providers still handle smaller volumes.

The crypto lending market is experiencing a resurgence driven by the growing demand for leverage and the rise of decentralized finance (DeFi) applications.

After a long period of difficulties, which included the bankruptcy of several renowned platforms, the lending market has begun to rebound strongly as Bitcoin and other cryptocurrency prices rise, marking a stage of optimism in the ecosystem.

In early December 2024, Bitcoin’s price reached new all-time highs, surpassing $100,000, which has led to a substantial increase in funding rates for opening long positions in perpetual futures markets. This phenomenon reflects a growing thirst for leverage among market operators, who seek to capitalize on bullish moves by using assets as collateral for loans.

The surge in demand for Bitcoin-backed loans has been driven by two factors: those who have held their assets since previous cycles are using their cryptocurrencies as collateral to make investments in real estate, vehicles, and other assets, while new participants are looking to take advantage of the benefits of using their cryptocurrencies as collateral to make other types of investments.

The Lending Market Still Appears Cautious

On the other hand, DeFi platforms have taken the lead. Applications such as Aave, JustLend, and Compound have seen a sharp increase in the volume of funds lent. According to research data, the total amount locked in these DeFi protocols has surpassed its 2021 highs, demonstrating tremendous confidence in these decentralized systems. In contrast, centralized lending providers still handle much smaller volumes, reflecting the preference for DeFi models, which are considered safer due to their transparent structure and the requirement for over-collateralization.

However, the sector remains cautious due to the collapses of major players in recent years, such as Celsius and FTX. Many institutional lenders, who were previously willing to fund crypto lending platforms, have opted to stay on the sidelines due to the risks associated with the lack of regulation and financial scandals that have shaken the industry. Although the demand for lending services remains strong, uncertainty persists