TL;DR

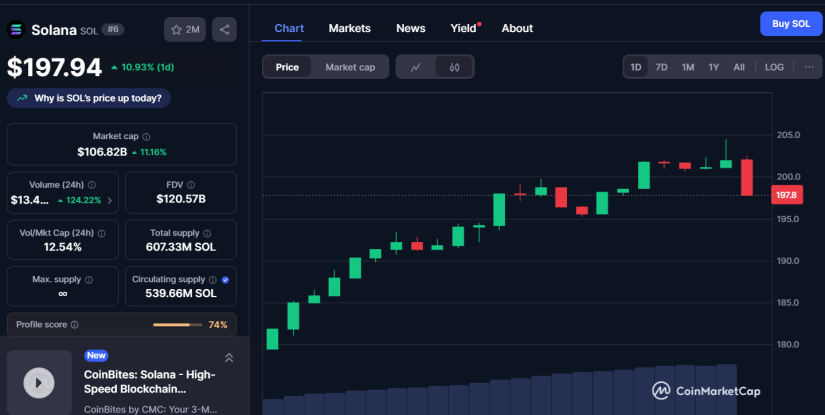

- Solana rises 11% in a single day, approaching $200—a level it hasn’t reached since July 24—driven by higher liquidity and increased buying.

- ETH leads the market rebound, hitting $4,700 and overtaking BTC year-to-date, while XRP, BNB, DOGE, and ADA also post gains that follow the trend.

- Treasury-focused firms like DeFi Development Corp are building large positions in SOL, which now total nearly $675 million in corporate holdings.

Solana is approaching the $200 mark again after an 11% surge over the past day, boosting interest in altcoins amid growing liquidity and stronger buying activity.

SOL had not surpassed this level since July 24 and had only reached it once before in February. Industry analysts consider that nearing this mark reflects a return of investor appetite and could sustain momentum if demand continues to rise.

For much of the current bull cycle, Solana stood out as one of the few cryptocurrencies outside Bitcoin to reach a new all-time high before the second half of the year, hitting that milestone in January. However, in recent weeks it lost ground to Ethereum. Since mid-July, ETH’s performance has reversed the annual lead Solana had maintained since September 2024, gaining 20% against SOL over the past twelve months and 25% year-to-date.

Solana’s latest jump coincides with a broader market recovery led by Ethereum, which reached $4,700—its highest level since November 2021. This rally also allowed ETH to surpass BTC in year-to-date gains. The effect extended to other large-cap assets: XRP rose 5.2%, BNB gained 6.4%, DOGE jumped 12.5%, and ADA climbed 13%. Bitcoin advanced 1.6% over the same period.

Major Companies Accumulate Fortunes in Solana (SOL)

Part of the surge in Solana comes from firms managing large cryptocurrency reserves. These companies have invested billions of dollars in recent weeks, boosting demand for assets like SOL. One example is DeFi Development Corp, which manages 1.3 million SOL worth over $260 million and reports estimated daily revenue of $63,000, calculated in SOL. Recent data shows that SOL holdings by publicly listed companies are approaching $675 million.

The current environment combines technical momentum with corporate capital inflows, strengthening Solana’s position against potential short-term corrections. While its price sits slightly below $200, recent performance and steady institutional buying reinforce expectations that it could maintain or surpass this level in the near term.