TL;DR

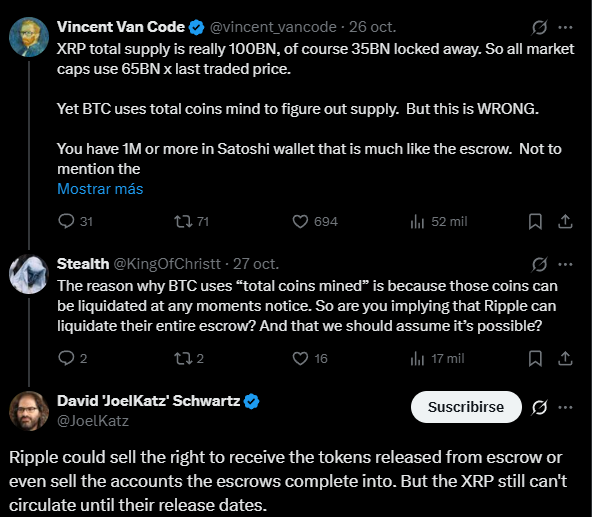

- Ripple’s CTO, David Schwartz, confirmed that the company can pre-sell rights to XRP locked in escrow.

- The company can sell rights to future tokens without releasing them, distinguishing between early liquidity and circulating supply.

- Unlike Bitcoin, whose supply is fixed and decentralized, XRP depends on corporate decisions.

Ripple’s CTO, David Schwartz, confirmed that the company can pre-sell rights to XRP tokens held in escrow, revealing how the company could access liquidity using its future reserves.

The clarification arose during a discussion on X about the market capitalization of Bitcoin and XRP. Several users noted that Bitcoin’s total market value is calculated based on all mined coins, even those lost or inactive, while XRP excludes funds held in escrow. When asked whether Ripple could freely liquidate these reserves, Schwartz explained that the company can sell “the right to receive the tokens once they are released,” but cannot make them circulate prematurely.

This distinction marks a key difference between future liquidity and circulating supply. Ripple cannot release locked tokens before their scheduled release, but it can convert these rights into a funding source. The mechanism is similar to selling futures or forward contracts, where value is realized in advance without altering the market’s current supply.

Bitcoin and Ripple (XRP) Have a Structural Difference

Ripple’s ability to use XRP as collateral reinforces the token’s role within its financial structure. The company holds a significant portion of the total supply in trusts that are gradually released, and how these tokens are managed directly affects perceptions of scarcity and stability. Some analysts suggest this could be a way to dilute the supply over time, potentially broadening distribution but also exerting downward pressure on the price.

The contrast with Bitcoin is structural. BTC’s supply is fixed by immutable code, capped at 21 million coins, while XRP’s supply depends on Ripple’s corporate decisions. Bitcoin has no central entity capable of managing reserves or altering the emission schedule, making it a predictable and fully decentralized monetary system. In contrast, XRP operates under a hybrid model where corporate governance continues to play a central role