In the age of autonomy and trustless operations, Ethereum is emerging as a preferred platform. It may have a slow throughput but the fact that it was the first that pioneered smart contracting and dApp development means most developers find security in the platform.

At the moment, the talk is its domination of decentralized or open finance.

DeFi is the current buzz, and is where billions of dollars of ETH is locked as collateral for several operations including lending and borrowing. Attracted by above rate yields and paperless loans, investors continue to flock to Ethereum-based financial applications further fuelling the demand for ETH.

As the demand increase, the path of least resistance is only but up. However, as it is, there is an obvious disconnection between the price and the demand for DeFi dApps.

While the amount of ETH locked is at record highs, prices continue consolidate below $250. With ETH 2.0 launch delaying—with no details from Vitalik Buterin or the Ethereum Foundation, it only fuels needless speculations. Chief amongst them being the unlikely possibility of the Beacon Chain mainnet launching in Q1 2021.

Though nothing can be discounted given the nature of public chains and the high level of consensus required not to fracture the network, the success of ETH 2.0 Beacon Chain will set the foundation for subsequent phases.

A smooth and timely launch this month or at a tentative time in H2 2020 is a net positive for ETH, and may further pump price above $250.

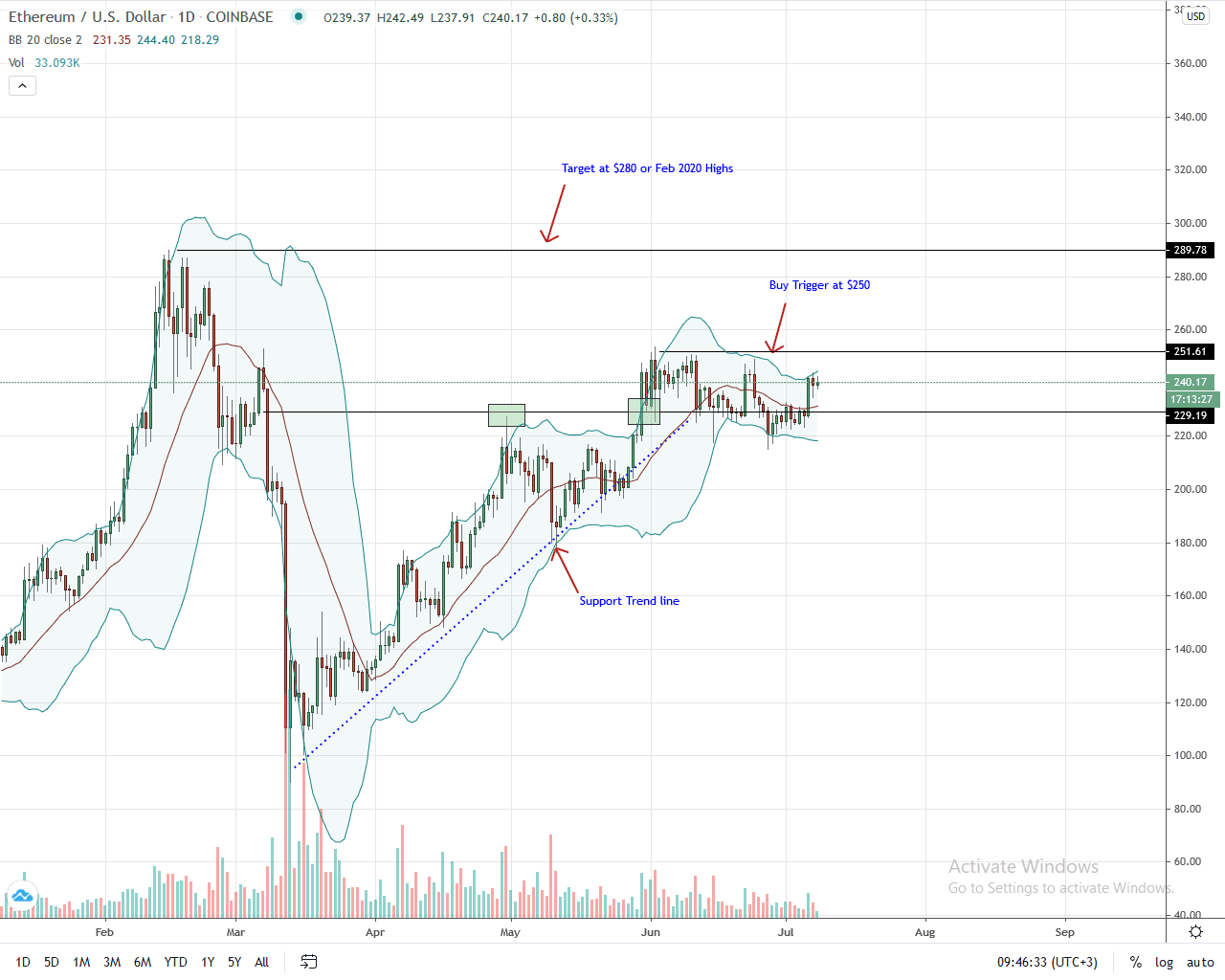

Ethereum Price Analysis

At the time of writing, the ETH price is up roughly six percent versus the greenback, and up five percent against BTC.

After sinking below $230 last week confirming bears of early June 2020, bulls are now back. Interestingly, losses of June 27 have been reversed and prices are in sync with bulls of June 22, 2020 as ETH/USD price action is yanked back to within a tight $30 trade range.

Given the consolidation and increased volatility of the last few days, the best course of action as prices range is to wait for a sharp break above $250 (if bulls take over) or a decline below $225-$230 zone (if bears emerge on top) before traders enter the market.

As reiterated before, a close above $250 at the back of high trading volumes could pump ETH to $280 or Feb 2020 highs. On the flip side, losses below $230 may see ETH sinking to $200, or worse.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you found this article interesting, here you can find more Ethereum News