Undoubtedly, Ethereum is off to a strong start in 2021. Announcements, once thought far-fetched, are not lighting up the crypto scene.

For 2021 alone, the Ethereum price picked up on Bitcoin’s afterburners, rallying past $1k and printing new 2021 highs.

At over $1.1k, the Ethereum price more than tripled from H1 2020, rising over 5X year-to-date.

In all, the ETH/USD gains capped an impressive year. The year propelled by DeFi.

At the time of writing–and reflecting on the exponential rise of ETH/USD, the number of assets locked and under management in different DeFi protocols rose to above $20 billion, a new high.

The Bullish OCC Announcement

Fanning demand is exciting developments on the fundamental front.

After processing over $835 million of stablecoins in 2020, pushing the cumulative value of stablecoins processed across popular blockchains to above $1 trillion, the Ethereum network could further add to their gains following the announcement by the United States Office of the Comptroller of Currency (OCC).

In their statement, the regulator said banks could issue stablecoin payments.

Their open letter addressed whether regulated banks and savings associations could participate in stablecoins or the blockchain, adding that banks can participate in open networks and store or validate payments.

However, in doing so, these banks must be aware of operational risks associated with those networks, the OCC warned.

More Demand for ETH?

The announcement sparked debate in social networks, with some saying that in the course of the year, and following this directive, more banks will hold ETH to participate in Ethereum. This, they said, would positively affect prices.

Ethereum Price Prediction

The path of least resistance for the ETH/USD pair is northwards.

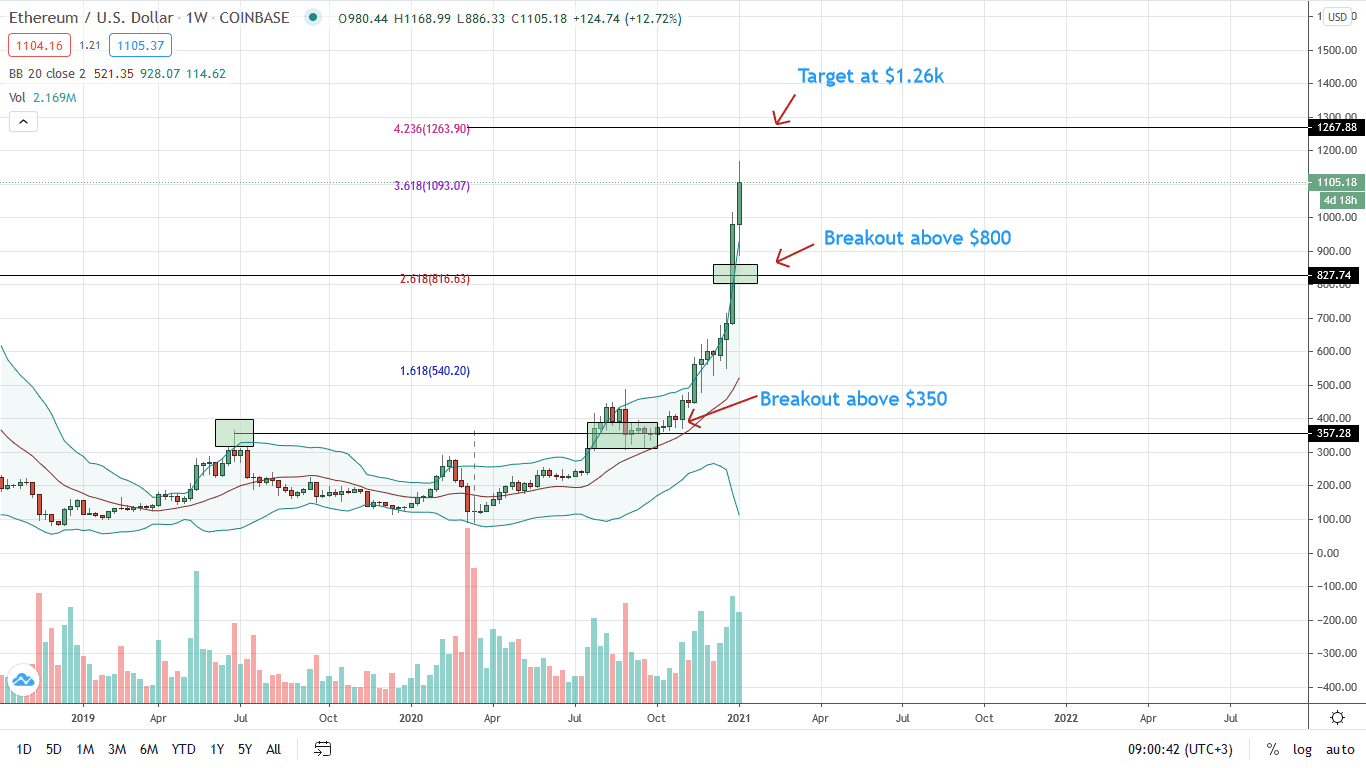

In a bullish breakout pattern with high trading volumes, as the weekly chart shows, every low, in the immediate term, could present an opportunity for aggressive traders to add to their longs.

The first bullish target is $1.26k, the 4.168 percent Fibonacci extension level based on Dec 2018 to June 2019 trade range.

Already, the upward momentum is firm as this week’s bar is banding along the upper BB. The immediate support level is $800, the 2.168 percent Fibonacci extension level.

Sharp losses from spot levels will confirm a double bar bearish reversal pattern, a basis for a dump down to $500, the 61.8 percent retracement level of March 2020 to Jan 2021 trade range.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Ethereum News