TL;DR

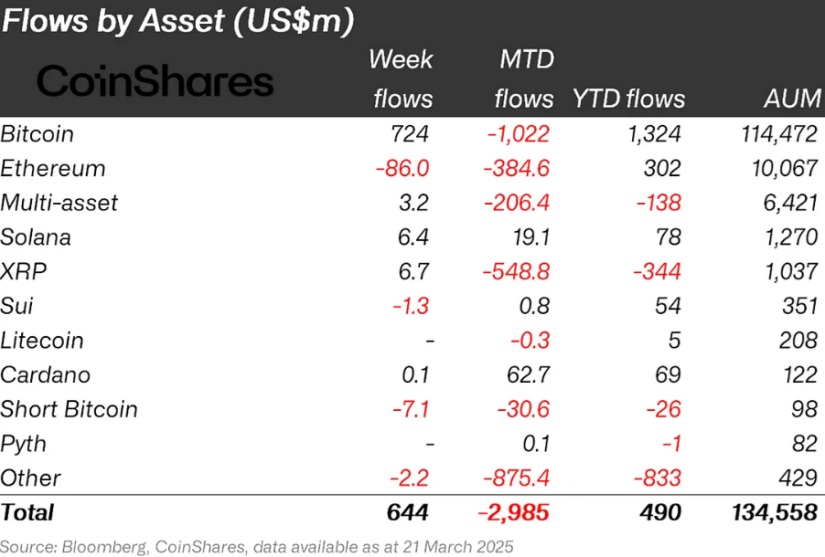

- The digital asset market broke a five-week streak of consecutive capital outflows, recording $644 million in inflows.

- The United States led investments with $632 million, while Switzerland, Germany, and Hong Kong saw smaller positive flows.

- Bitcoin attracted $724 million, compensating for previous losses, while Ethereum experienced outflows of $86 million, and Solana stood out with $6.4 million in inflows.

Last week marked a significant shift in investment flows for digital asset products. After five consecutive weeks of losses, capital inflows totaled $644 million.

This coincides with a 6.3% increase in assets under management from the low reached on March 10th, signaling a positive change in investor sentiment toward the crypto market. Throughout the analyzed week, no capital outflows were recorded, contrasting with the 17 consecutive days of constant withdrawals that preceded it.

The United States captured the majority of the inflows, adding $632 million. Positive flows were also registered in Switzerland, Germany, and Hong Kong, although to a lesser extent, suggesting that the mild optimism toward the market has spread globally.

Digital Assets Did Not Recover Uniformly

Bitcoin was the main recipient of capital, accumulating $724 million. This volume not only compensated for the outflows of the previous weeks, which totaled $5.4 billion, but also reaffirmed its position as the most attractive digital asset for institutional investors. On the other hand, products designed to bet against Bitcoin’s price experienced their third consecutive week of outflows, amounting to $7.1 million, indicating that bearish expectations are slowly fading.

The performance of altcoins showed mixed results. Ethereum suffered the largest capital outflows, reaching $86 million, while other projects like Sui, Polkadot, Tron, and Algorand also ended in the red, albeit to a lesser extent. In contrast, Solana managed to attract $6.4 million, positioning itself as the best-performing altcoin during the period. Polygon and Chainlink also recorded small inflows.

A revaluation of the crypto market is taking place after weeks of uncertainty. The return of capital to investment products demonstrates renewed confidence in digital assets, especially Bitcoin. However, the continued outflows from Ethereum and other altcoins suggest that optimism does not extend uniformly across the entire market.