The cryptocurrency market witnessed a bloodbath yet again as the global crypto market cap slipped below the $1 trillion mark. Bitcoin (BTC), Ethereum (ETH) along with other major digital assets plunged following the hawkish comments from Federal Reserve Chair Jerome Powell, latest budget from United States President Joe Biden and the collapse of crypto-bank, Silvergate Capital.

Why is Crypto Experiencing A Drawdown?

Crypto woes continue as macroeconomic headwinds along with the collapse of Silvergate continue to batter the industry. In a March 8 announcement, Silvergate revealed its plan to “wind down operations” and liquidate the bank. On Thursday, President Biden released his budget vowing to cut $3 trillion from the federal deficit over the next decade. He proposed several monetory measures to increase corporate budget and raise more revenue by increasing taxes on oil and gas companies.

It is likely that the steep rate hikes have triggerred a sense of fear among investors and traders all across the world. Additionally, as per the budget it seems, United States crypto miners could eventually be subject to a 30% tax on electricity costs that aims to “reduce mining activity.”

To add fuel to the fire, the US central bank had also recently, sent strong signals about tackling inflation through strict monetary policies and larger rate hikes.

Higher Rate Hikes Drags Market Further Down

Adding to crypto investors’ concerns, New York State Attorney General Letitia James filed a lawsuit against crypto exchange Kucoin on Thursday, alleging that Ethereum (ETH) and some other crypto assets are securities and should be registered as such. The market downturn can also be attributed to crypto exchange Blockchain.com after it disclosed that the company was shutting down its London based crypto asset management arm.

On top of such negative developments, BlackRock, the world’s largest asset manager said it anticipates the Federal Reserve could hike interest rates to a peak of 6%. This comes after Powell’s testimony before the Senate Banking Committee of a higer than expected interest rate hike this year. Black Rock noted,

“We think there’s a reasonable chance that the Fed will have to bring the Fed Funds rate to 6%, and then keep it there for an extended period to slow the economy and get inflation down to near 2%.”

Bitcoin Hits 3 Week Low

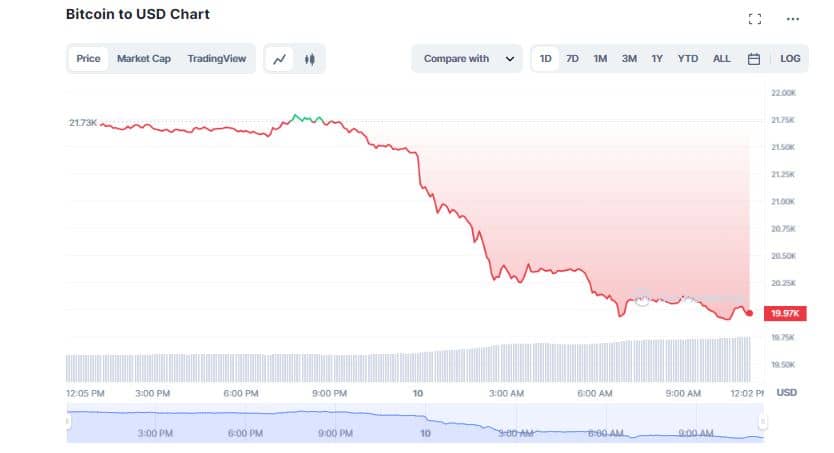

These development caused both the crypto market and the traditional market to bleed over the past 24 hours. According to CoinMarketCap, the global crypto market cap slipped below $1 trillion mark, once again. as investors digested the grim financial predicament. At the time of writing, the global market cap fell 6.74% in the last 24 hours to $930 billion.

The digital assets sector mirrored the US stock market as Wall Street’s three major stock indexes closed lower on Thursday, with bank stocks creating the biggest drag. The S&P 500’s bank index finished down 6.6% after hitting its lowest level since mid-October. The Nasadaq ended down more than 2% while the benchmark S&P 500 and the Dow lost close to 2%.

Meanwhile, Bitcoin (BTC) shed more than 8% to drop below the psychological $20K level. Over the past seven days, the flagship crypto declined nearly 11% to currently trade at $19,928. Bitcoin’s dominance also took a hit falling 0.77% over the day to 41.35%. In a statement, Edul Patel, CEO at Mudrex explained,

“Bitcoin slipped below the $20,000 level in the past 24 hours as investors continued to react to the US Fed Chair Jerome Powell about the interest rate hikes. This suggests that there is currently a lack of aggressive buying at these levels, which could cause the price to drop to the crucial support level of $19,000.”

Altcoins Reel Under Massive Sell-off Pressure

In tandem with Bitcoin (BTC), the second most valuable cryptocurrency, Ethereum (ETH) tanked 7.95% in the past 24 hours to hover at $1,416. Ether shrank almost 10% over the last one week as hawkish monetary policies may decrease the liquidity in the market in the coming weeks. At the same time, major altcoins traded with substantial cuts.

Cardano (ADA), XRP and Polygon (MATIC) tumbled in the range between 3% and 5%. Solana (SOL) nosedived more than 8% to trade at $17.03. Meanwhile, popular memecoins such as Dogecoin (DOGE) and Shiba Inu (SHIB) cascaded 8.55% and 9.74%, in tha last 24 hours, respectively. Despite the meltdown, Shival Thakral, CEO at BuyUcoin said,

“Hawkish monetary policies may decrease the liquidity in the market in the coming weeks which may result in further price falls. The dip in the prices will offer a buying opportunity to seasoned investors based on their risk appetite.”