TL;DR

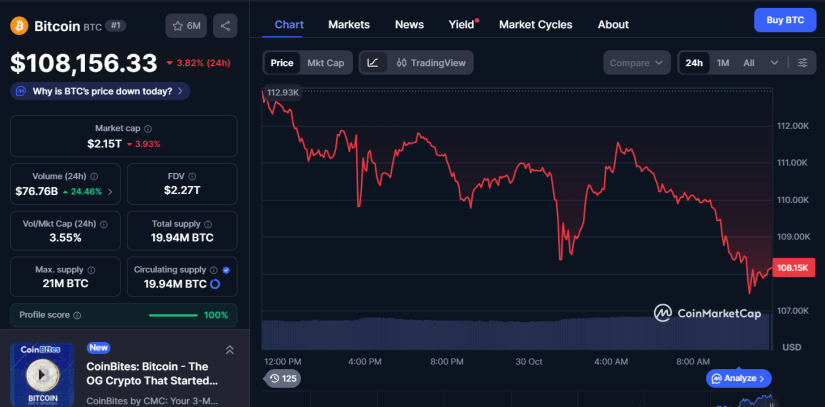

- Bitcoin fell 4% and dropped below $108,000 following the Fed’s rate cut, while Powell’s comments cooled market optimism.

- Santiment detected increased flows to exchanges, long position liquidations, and mild whale accumulation after the FOMC meeting.

- ETH declined to $3,780 and XRP to $2.47, but ZEC rose 9% above $350, and TRUMP and M gained 6%-7% despite the overall market drop.

Bitcoin tumbled sharply after the Federal Reserve cut its benchmark rate by 0.25%, in line with market expectations.

However, Jerome Powell’s statements cooled trader optimism and triggered an abrupt correction. BTC fell below $108,000 after a 4% drop in a typical “buy the rumor, sell the news” reaction, as short positions increased and leveraged positions unwound.

The market had priced in a more dovish Fed tone, with the possibility of another rate cut before year-end, but Powell warned that it was not guaranteed. His caution immediately reversed sentiment and sparked a wave of liquidations. Santiment data showed rising inflows to exchanges and declining funding rates, signaling long position closures. At the same time, social sentiment shifted toward caution, with terms like “Powell,” “Fed,” and “rate cut” dominating forums and social media discussions.

Divergent Market Reactions

According to Santiment, these spikes in negative attention often coincide with capitulation zones, suggesting potential rebounds once the market absorbs the shock. They also detected slight whale accumulation after the FOMC meeting. This reflects a temporary defensive turn driven by uncertainty over U.S. monetary policy.

Bitcoin’s adjustment and drop also impacted the broader market. ETH fell below $3,780, and XRP declined to $2.47. BNB traded under $1,090, SOL dropped to $186, DOGE traded at $0.1822, ADA fell to $0.61, and TRX dropped to $0.29, all in red with losses between 2% and 6%.

In contrast, some altcoins resisted the shock: ZEC rose 9% to over $350, while TRUMP and M gained between 6% and 7%. The total crypto market capitalization decreased 4% to $3.64 trillion, though funding rates normalized, indicating a reduction in excessive leverage.