TL;DR

- Centrifuge and S&P Dow Jones Indices launched the first tokenized S&P 500 fund on blockchain, using official data and institutional management.

- Anemoy Capital will be the first licensed manager authorized to operate on this infrastructure, combining smart contracts with fiduciary oversight.

- The project will enable investors to trade, exchange, and automate S&P 500 strategies programmatically and around the clock in an onchain environment.

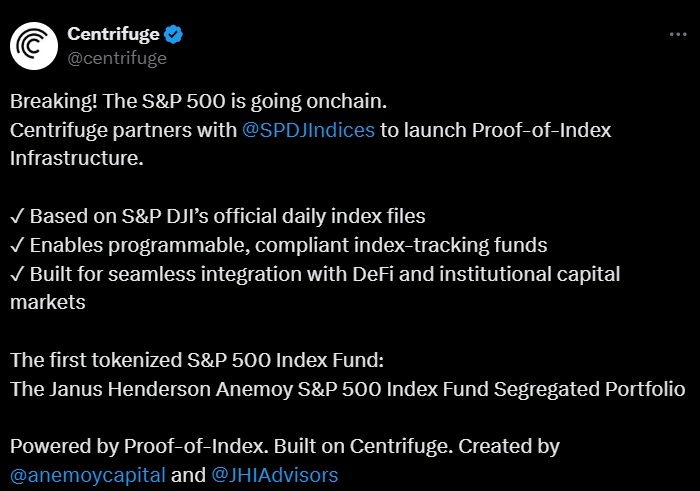

Centrifuge and S&P Dow Jones Indices announced the launch of the first tokenized fund replicating the S&P 500 on a public blockchain.

The project introduces an onchain infrastructure that allows the use of official index data to create programmable financial products, following the same methodology used in traditional markets.

This initiative enables S&P DJI-licensed asset managers to develop tokenized funds that meet institutional standards while leveraging the transparency and flexibility of decentralized finance. Anemoy Capital received the first license to operate on this infrastructure and will launch the Janus Henderson Anemoy S&P 500 Index Fund Segregated Portfolio, combining institutional fiduciary management with smart contract technology.

The goal is to bring the full functionality of the S&P 500 into the onchain ecosystem, allowing investors to trade, exchange, use as collateral, and automate strategies based on the index at any time, without relying on traditional market hours. Today, the S&P 500 handles over $1 trillion in daily trades through ETFs, derivatives, and structured products.

Centrifuge Aims to Lay the Foundation for a New Financial Infrastructure

Nick Cherney, Head of Innovation at Janus Henderson, confirmed that their two tokenized funds, JTRSY and JAAA, surpassed $500 million and $1 billion in assets under management in record time. According to Centrifuge, this new proposal will enable the creation of automated strategies and products with native liquidity and composability.

During the announcement, executives from both companies pointed out that the breakthrough lies not only in digitizing a well-known asset but in giving it programmable functionality, allowing it to be managed, operated, and redistributed without the usual geographic or time-based restrictions.

The fund was unveiled at the Centrifuge RWA Summit in Cannes, alongside its new proof-of-index infrastructure, designed to standardize and validate tokenized products backed by traditional indexes. Market forecasts anticipate the onchain economy could reach $16 trillion by 2030, and this type of integration seeks to establish the groundwork for an open, programmable financial infrastructure built to meet the highest institutional standards.