TL;DR

- Crypto lending is showing a clear divergence: DeFi is cutting back on borrowing as risk appetite fades, while the CeFi market is starting to capture renewed liquidity demand.

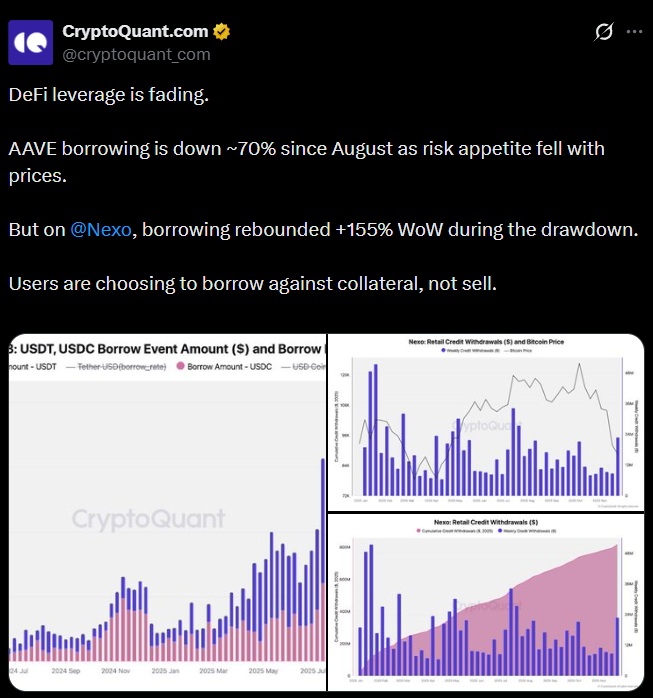

- Aave recorded a 69% drop in weekly USDT and USDC borrowing, falling from $6.2 billion to $1.9 billion.

- Nexo posted a 155% week-on-week rebound in credit withdrawals, signaling that users prefer borrowing against crypto collateral rather than selling assets at depressed prices.

Crypto lending activity is undergoing a shift driven mainly by the contrasting behavior of DeFi and CeFi during the current market correction, according to CryptoQuant data. Falling prices, lower risk appetite, and new liquidity needs are reshaping how and where users access credit.

Borrowing in the DeFi market has contracted sharply as traders reduce leverage and exposure. Since August, loan volumes across major protocols have declined in step with the broader market pullback. On Aave, one of the largest decentralized lending protocols, weekly borrowing of USDT and USDC dropped by 69%, from a peak of $6.2 billion to $1.9 billion by the end of November. This pattern points to an active deleveraging process rather than an inflow of fresh capital. Even so, Aave still holds $16.3 billion in outstanding loans.

Aave Borrowing Fell 69%

The decline in incremental DeFi borrowing signals a clear reduction in speculative risk-taking across decentralized markets, as users react quickly to volatility by adjusting their positions.

By contrast, CeFi activity is beginning to show early signs of recovery in credit demand. Although centralized platforms also experienced an initial contraction, the latest data points to a divergence. At Nexo, weekly retail credit withdrawals fell from $34 million to $8.8 million between July and November, but rebounded the following week to $23 million, a 155% week-on-week increase.

This behavior suggests that users prefer to borrow against their crypto assets as collateral rather than sell them at depressed prices. CeFi platforms act as a liquidity backstop during downturns, allowing investors to access cash without giving up long-term exposure.

The Structural Role of CeFi

CryptoQuant highlights the structural role of centralized lenders during market downturns. While the DeFi market adjusts quickly through deleveraging, the CeFi sector absorbs liquidity demand when investors seek flexibility and capital preservation. In 2025, Nexo accumulated $817 million in credit withdrawals, positioning itself as one of the leading crypto-backed lending firms.

The data shows that both models, CeFi and DeFi, play complementary roles within the ecosystem, with clearly differentiated risk profiles and user behavior