TL;DR

- The crypto market faces the expiry of nearly $15 billion in Bitcoin and Ethereum options today, exceeding the monthly volume seen in recent weeks.

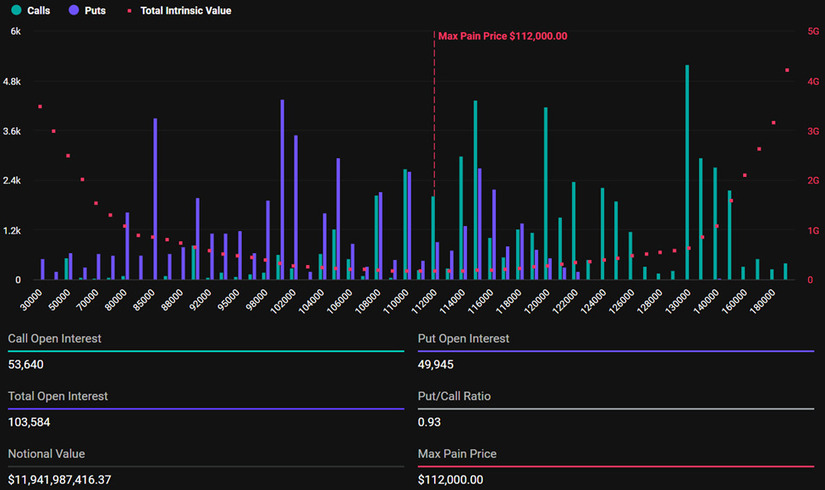

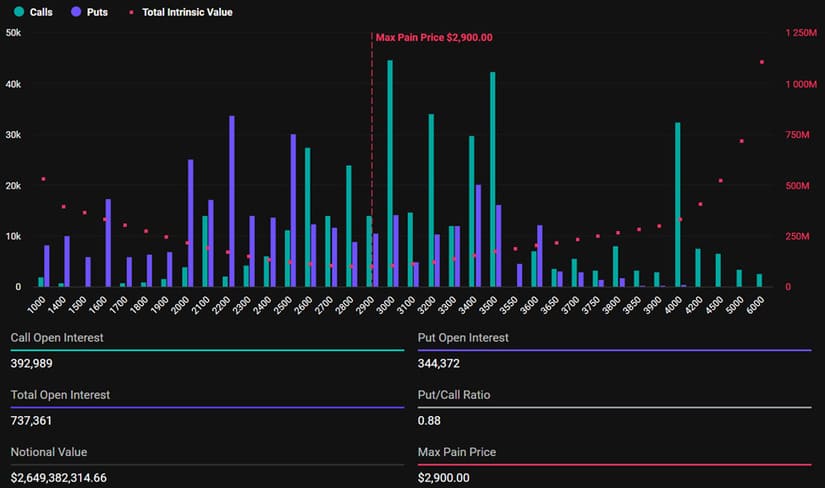

- According to Deribit data, there are $11.94 B in BTC contracts with 103,584 positions and $2.649 B in ETH, where calls outnumber puts.

- With a put/call ratio of 0.93 for BTC and 0.88 for ETH, the max pain levels at $112,000 and $2,900 could pull prices toward those points.

The crypto market is heading into an options expiry worth nearly $15 billion in Bitcoin and Ethereum—monthly volume that surpasses the past few weeks and comes close to the $17 billion seen at the end of H1.

Options Market

Deribit reports that Bitcoin contracts total $11.94 billion, with open interest sitting at 103,584 positions split between puts and calls. Meanwhile, Ethereum options add up to $2.649 billion, led by 737,361 calls, reflecting a mild bias toward bullish scenarios.

The max pain levels are set at $112,000 for Bitcoin and $2,900 for Ethereum. At those prices, most options holders would face the largest losses, and asset prices often tend to gravitate toward those points as expiry approaches. The put/call ratio stands at 0.93 for BTC and 0.88 for ETH—figures that show a moderately optimistic outlook, although some investors are hedging against potential pullbacks.

Will Volatility Spike? Key Factors to Watch

Analysts at Greeks.live note that volatility is hovering around 30%, and many traders are holding onto short positions despite accumulated losses. That behavior stems from concerns about sharp corrections, even as prices trend upward. Watching volatility levels is crucial to anticipating potential market swings in the hours ahead.

SpaceX Moves $153 Million in Bitcoin

Interest in today’s expiry intensified after SpaceX moved $153 million in Bitcoin following three years of inactivity. While the transfer triggered a wave of speculation, analysts believe it won’t affect the overall structure of options positioning. In contrast, call bets on Tesla ahead of its Q2 earnings reflected optimism, but a disappointing earnings report showed how overextended positions can lead to sharp reversals.

All Deribit options expire at 8:00 UTC, and the market typically stabilizes after this reset. July’s expiry will serve as a stress test for Bitcoin and Ethereum prices. The immediate reaction after expiry will set the tone for the days ahead, as traders recalibrate based on where prices land and how incoming liquidity reshapes positioning.