TL;DR

- BlackRock plans to launch a Bitcoin ETP in Europe, expanding its presence in the crypto market after the success of its Bitcoin ETF in the U.S.

- The fund, based in Switzerland, could debut this month and faces regulatory issues, needing to be an independent ETP due to the regulations.

- Despite competition in Europe, the firm seeks to replicate the success of its iShares Bitcoin Trust (IBIT), which has reached $58 billion in assets under management.

BlackRock has announced its intention to launch a Bitcoin exchange-traded product (ETP) in Europe, expanding its presence in the crypto market following the success of its Bitcoin ETF in the United States.

The new fund, which would be based in Switzerland, will be BlackRock’s first crypto ETP outside of North America and could debut this month. The launch coincides with a period of increasing regulatory clarity and the expansion of the crypto market in Europe, especially after the implementation of new regulations in the European Union at the end of 2024.

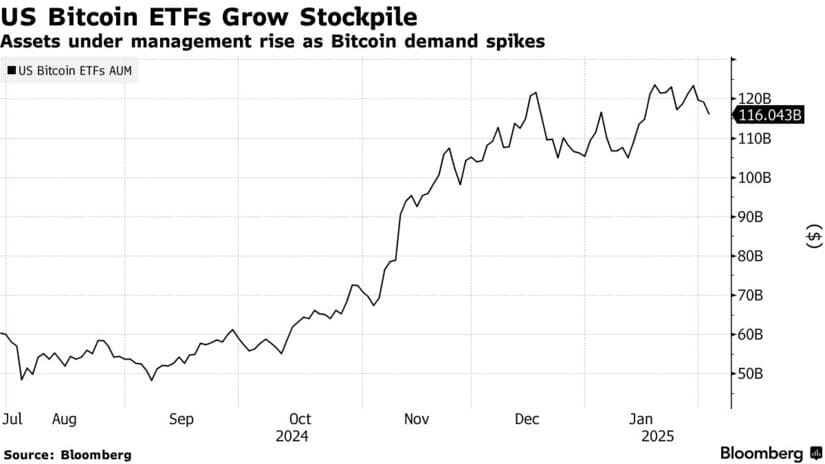

The iShares Bitcoin Trust (IBIT), launched in the U.S. in January 2024, has been a resounding success, reaching $58 billion in assets under management by early 2025. This fund has dominated the Bitcoin ETF market, attracting enormous amounts of capital and setting performance records.

BlackRock Seeks to Replicate the Success of Its Bitcoin ETF

Given its popularity, BlackRock seeks to replicate this success in Europe, where the crypto ETP market is very competitive but still smaller compared to the U.S. Currently, there are over 160 products tracking the price of Bitcoin and other cryptocurrencies on European exchanges, but their total volume does not exceed $17.3 billion.

The European market faces some specific regulatory challenges. While some analysts suggested that BlackRock could use a strategy similar to its Canadian ETF, European authorities are expected to reject this option. Instead, BlackRock would need to launch an independent ETP, which could influence the fee structure of the product. In Europe, crypto products already have low fees, with some even offering a 0% expense ratio.

Optimistic Outlook for the Crypto Market

Demand for crypto products continues to grow, partly driven by the Bitcoin rally, which reached a historic high in January 2025. The involvement of figures like Donald Trump, who has expressed support for the sector, and expectations for clearer regulations, have favored the investment climate.

As one of the world’s largest asset managers, BlackRock aims to capitalize on this trend in Europe, where investor sophistication is high, but their appetite for crypto products has historically been more cautious compared to the U.S. market