TL;DR

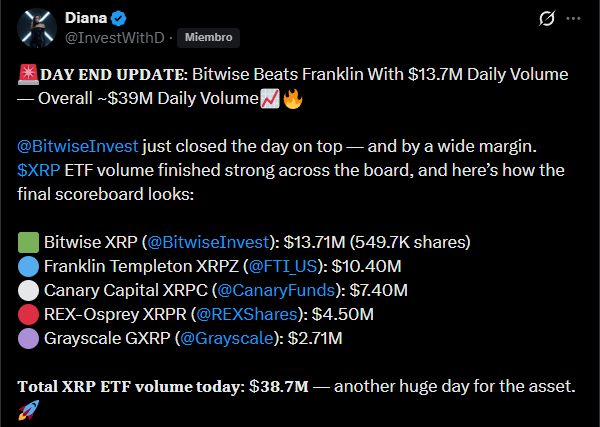

- Bitwise strengthens its dominance in XRP ETFs, attracting demand that boosts institutional exposure to Ripple’s token.

- The market closed the day with $38.7M in volume, reflecting momentum that combines growing liquidity with stable adoption.

- The XRP Ledger saw over 100M RLUSD minted by regulated entities, signaling that corporate activity is advancing outside the retail radar.

Bitwise expands its presence in the XRP ETF market as institutional activity on the XRP Ledger accelerates a structural shift still largely unseen by retail investors.

The firm ended the day with $13.71M in volume and 549,700 shares traded, placing it ahead of Franklin Templeton and confirming a shift in demand for regulated exposure to Ripple’s token. The ETF market totaled $38.7M daily, showing an expansion process that combines liquidity, regulatory clarity, and strong interest in instruments integrating tokenized assets within traditional structures.

Franklin Templeton recorded $10.40M in volume, supporting ongoing institutional demand, while Canary Capital, REX-Osprey, and Grayscale posted moderate but consistent levels. The overall activity increase indicates that ETFs have moved beyond a marginal channel and now operate as a stable conduit for investors seeking exposure without managing crypto infrastructure.

Institutions Are Unlocking XRPL’s Potential

The XRP Ledger registered activity with a deeper impact than daily ETF performance. Over 100 million RLUSD, Ripple’s institutional-grade stablecoin, were minted in a single month by regulated entities. RLUSD is designed for treasury operations, payments, and cross-border flows, not retail use or speculation. Each minted unit represents real corporate activity, with no arbitrage or market incentives distorting demand. The volume demonstrates that financial institutions are already operating on XRPL with low-latency processes and immediate settlement capabilities.

RLUSD’s growth highlights a dynamic invisible to retail users. Its adoption relies on direct network use as infrastructure rather than narratives. XRPL enables operations in an open environment, with predictable costs and no bottlenecks, allowing traditional firms to migrate back-office functions into programmable environments.