TL;DR

- Bitcoin fell roughly 26% in the fourth quarter to the $86,000 area, but once again showed relative resilience by declining less than the broader crypto market.

- Glassnode data point to persistent weakness across most sectors relative to BTC.

- While BTC remained range-bound between $85,000 and $94,000, Ethereum, Solana, XRP, memecoins, AI tokens, RWAs, and DeFi posted losses ranging from 35% to 56%.

Bitcoin closed the fourth quarter under pressure, yet it again demonstrated relative resilience compared with the rest of the crypto market.

Over the past three months, BTC dropped by around 26% to the $86,000 zone, a deep correction from all-time highs, but still milder than the broader market’s 27.5% drawdown. Amid widespread selling, Bitcoin once again behaved as the least punished asset within the ecosystem.

Glassnode data show persistent weakness in nearly all crypto sectors relative to BTC. Capital rotated back into Bitcoin, a classic defensive signal. Over the last 24 hours, Bitcoin lost more than 4% of its value and slipped below $86,000, while total market capitalization fell 3.8% and dropped back under the $3 trillion mark. The Fear & Greed Index remains in “Fear,” and liquidations exceeded $658 million, pointing to a fragile and highly sensitive market.

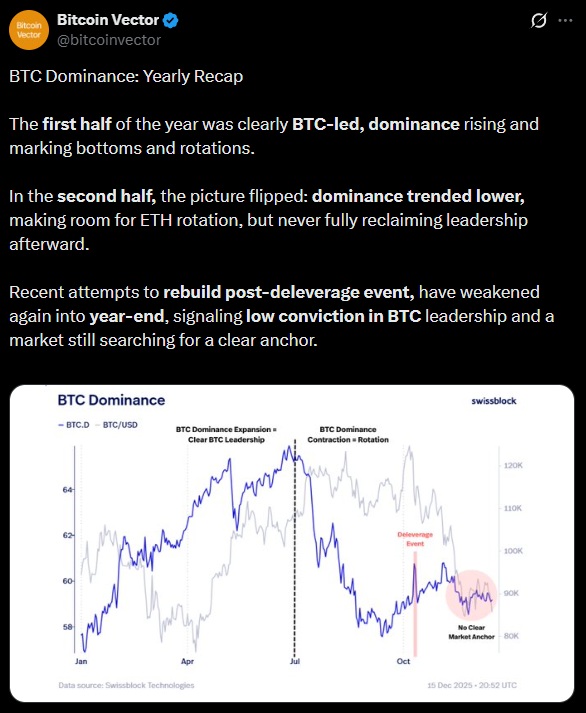

The Loss of Bitcoin Dominance Leaves the Market Without a Clear Anchor and with Low Conviction

The leadership dynamic shifted throughout 2025. In the first half of the year, Bitcoin clearly led the market, increasing its relative weight as prices formed bottoms and rotations took place. In the second half, that dominance faded as flows moved into Ethereum and other large-cap assets. However, attempts to rebuild momentum after deleveraging events lost strength toward year-end, leaving the market without a clear reference point and with low conviction.

From a technical perspective, Bitcoin remains trapped in a narrow range between $85,000 and $94,000. Every rebound meets selling from investors who bought near October’s peak. BTC follows declines in other risk assets but fails to sustain recoveries, weighed down by thinner liquidity and a retreating appetite for risk.

By contrast, Ethereum fell more than 35% over the past 90 days and dropped below $3,000. XRP and Solana declined by 38% and 47%, respectively. Tokens linked to artificial intelligence slid by nearly 50% as the speculative narrative faded. Memecoins lost 56% of their market capitalization, while RWA tokens fell 46% and the DeFi sector dropped 38%.