TL;DR

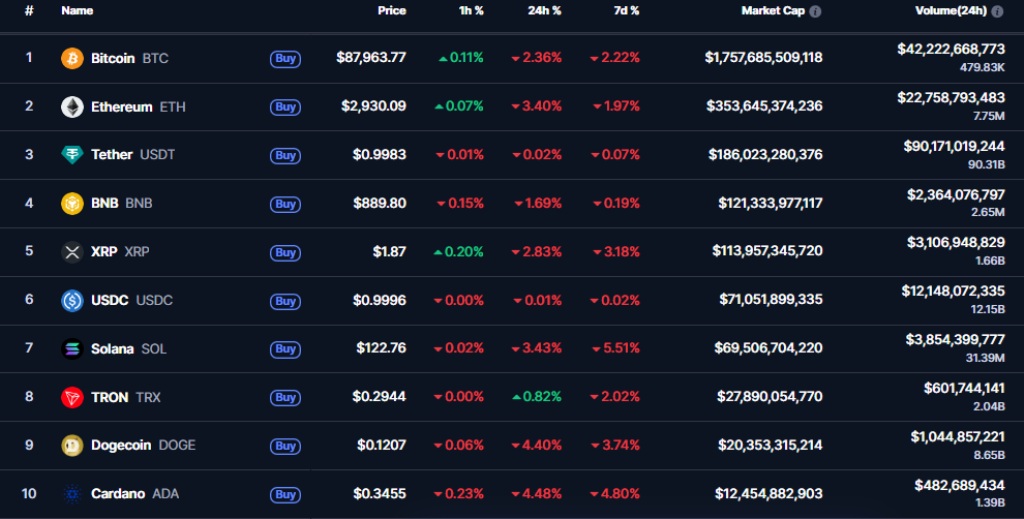

- Bitcoin fell 2.1% and is trading at $88,000. Trading volume rose 4.2% to $42.9 billion. The broader market followed the same trend.

- The crypto market cut its total capitalization by 2.1% to $2.98 trillion, with broad declines across the top 10.

- The Fed’s decision to keep rates at 3.50%–3.75% increased volatility, triggering liquidations of more than $300 million.

Bitcoin declined 2.1% over the past 24 hours, trading at $88,000. Its trading volume rose 4.2%, exceeding $42.9 billion, according to CoinMarketCap data.

The crypto market shows a broadly negative trend. Total market capitalization fell by about 2.1% in just 24 hours, reaching $2.98 trillion. Tron (TRX) is currently the only top 10 token that posted gains during the session, although limited to 0.8%.

Bitcoin and the Market Fall After the Fed Statement

The market downturn coincided with the Federal Reserve’s decision to keep interest rates in the 3.50%–3.75% range during its first monetary policy meeting of 2026. Fed officials stated that future changes will be decided “meeting by meeting.” The release of the statement increased volatility across risk assets, including the crypto market.

Bitcoin is holding a tight range around $88,000, following a rally that pushed it close to $98,000 earlier this year. Traders are closely monitoring key support and resistance levels: a drop to $75,000 could trigger significant liquidations in long positions, while a move up to $105,000 would impact short positions. Currently, approximately $13.5 billion in long positions and $13.29 billion in short positions are exposed to liquidation, according to Coinglass.

The Market Records Spikes Driven by Rapid Liquidations

Ethereum is hovering around $2,930, down 3.4%, in line with the broader market trend. Solana is trading near $123 after a 3.4% decline. BNB fell 1.7% to $890 per token. XRP is priced at $1.87, down 2.8%. Dogecoin and Cardano each dropped 4.4%, trading at $0.12 and $0.345 respectively. Finally, Pi Network fell 5.5% and is trading at $0.163 per unit.

The pullback followed a week marked by volatile intraday moves. Bitcoin and other tokens posted price spikes that were quickly unwound by trader selling, generating cumulative losses of more than $300 million in 24 hours.

Market attention remains focused on Fed policy and the performance of safe-haven assets such as gold and silver. Traders are adjusting positions amid uncertainty. The crypto market continues to show high volatility, narrow trading ranges, and elevated liquidation risk