Bitcoin (BTC) is lower, denting hopes that the coin is in the early stages of recovery, reading from the candlestick arrangement in the daily chart.

As it is, the coin is printing lower lows despite the downtrend momentum slowing down.

Because of yesterday’s dump, Bitcoin is back in a bear breakout formation, aligning with the general trend of last week, which is also influenced by the sharp sell-off in the last week of April.

Then, BTC fell from its peak of $31,000, the highest level registered this year.

Blame Sentiment for Sell-off

The dump in Bitcoin prices could be due to sentimental factors.

Yesterday, a bulk transfer of 1,750 BTC was moved to Binance, the world’s largest cryptocurrency exchange by trading volumes.

A whale deposited 1,750 $BTC ($48M) to #Binance ~30 mins ago.

The whale deposited 5,791 $BTC ($163M) on April 21, after that the price of $BTC dropped nearly 3% in 5 hours.

Maybe 1,750 $BTC won't be sold, maybe it will.

In any case, keep an eye out for $BTC price changes. pic.twitter.com/sydPNmIX72

— Lookonchain (@lookonchain) May 18, 2023

Shortly afterward, prices dipped before recovering. However, the slump in the late trading hours of the New York sessions forced the coin lower.

By yesterday’s close, the coin was trading at the lowest level recorded this week. Considering the pace of the dump, there could be more sell-off in the days ahead.

While prices struggle, the number of whole-coiners, that is, individuals with 1 BTC, could increase. This is because as prices reduce, it becomes more affordable for the coin’s supporters.

Most believers maintain that Bitcoin will anchor the future of money as a medium of exchange and a store of value.

According to Glassnode, a blockchain analytics platform, over 1 million addresses currently hold at least 1BTC.

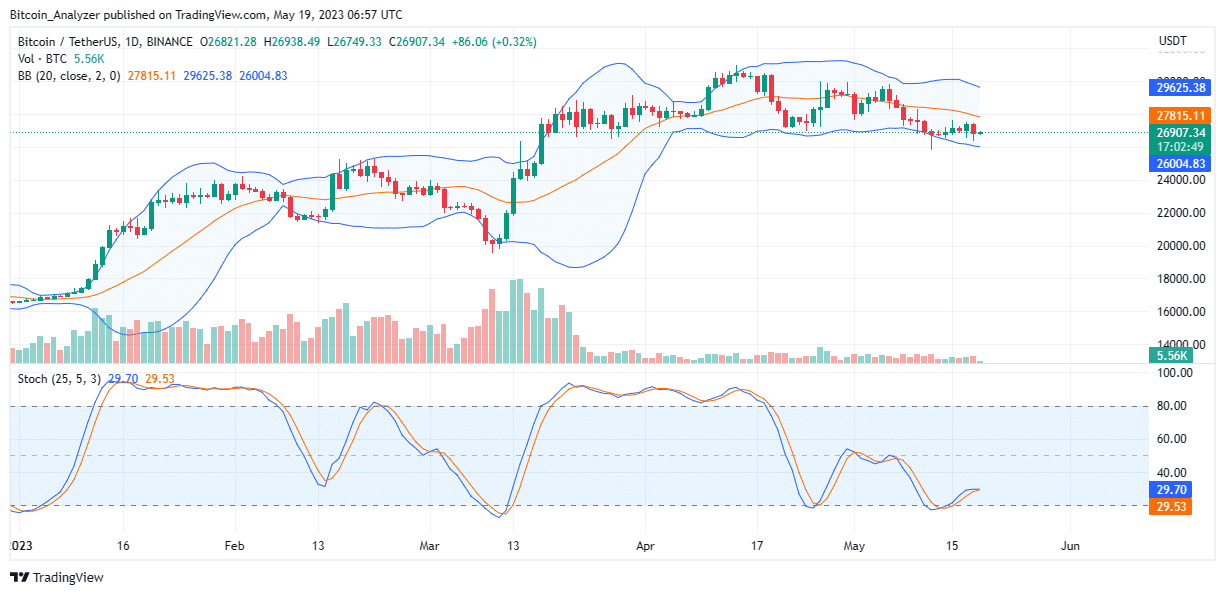

Bitcoin (BTC) Price Analysis

Coin trackers show that BTC is down 5% on the last trading day and 12% from April peaks.

At spot rates, price action favors sellers. Specifically, the existing BTCUSDT candlestick arrangement swings to support last week’s bearish breakout formation that forced the coin below $27k.

As such, in continuation of that formation, the BTC dump will likely continue, especially if today’s close is below $27k.

Should trading volumes also expand, the odds of BTC fast-crashing below $25.8k and $25k will be elevated. This could allow conservative traders to align with the trend and ride the emerging leg down.

This will only change if there is a sharp expansion above $28.3k with equally high participation levels. In that case, BTC could be on the path toward recovery toward $31k.

Technical charts courtesy of Trading View.

Disclaimer: The opinions expressed do not constitute investment advice. If you wish to make a purchase or investment we recommend that you always conduct your research.

If you found this article interesting, here you can find more Bitcoin News.