TL;DR

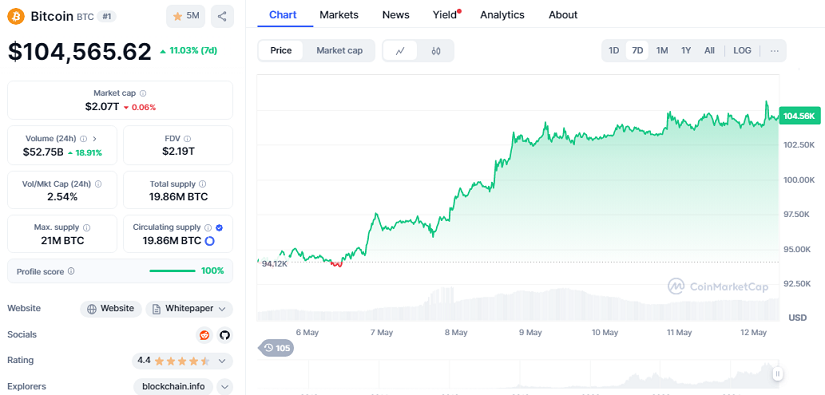

- Bitcoin is currently trading at $104,565.62, just 4% below its all-time high reached in January 2025.

- Optimism surrounding U.S.-China trade talks and continuous ETF inflows are fueling the ongoing rally.

- Analysts argue that if the upcoming U.S. CPI data confirms slowing inflation, Bitcoin could soon break its previous record.

Bitcoin has once again captured global attention by consolidating around the $104,000 level, showing a solid recovery after its April pullback. Over the past 24 hours, the leading cryptocurrency has posted a minimal drop of 0.02%, while delivering an impressive 11% gain over the past week, according to CoinMarketCap. This rise coincides with significant developments in U.S.-China trade negotiations and growing institutional appetite for Bitcoin via ETFs.

ETF Inflows, Institutional Adoption, and Tariff Relief: The Triple Boost

Bitcoin’s continued growth isn’t merely driven by technical factors. BlackRock’s spot Bitcoin ETF has now recorded 20 consecutive days of inflows, accumulating over $5 billion. These figures indicate not just renewed interest, but also long-term confidence from institutions that were once skeptical of the crypto market. Adding to this momentum, the Federal Reserve has paused interest rate hikes, and Fed Chairman Jerome Powell downplayed the inflationary impact of recently lifted tariffs.

Moreover, the recent trade agreement between the U.S. and China has removed a major source of macroeconomic uncertainty. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer confirmed that both economic giants reached an “important consensus” during a summit in Geneva. This development has eased tension in traditional markets and ignited investor appetite for risk assets like Bitcoin.

Inflation in Check and a Potential Rally: Is the Next ATH Around the Corner?

The next major catalyst will be the April CPI report, set to be released on May 13. Economists such as Markus Thielen from “10x Research” argue that a result in line with expectations (2.3% YoY) would likely be seen as bullish by markets. Even if the data comes in slightly hotter, analysts believe it would be perceived as outdated, no longer reflective of the current macro environment free from tariff pressure.

In the meantime, Bitcoin continues to show strong technical momentum, trading above its 50- and 200-day moving averages. Although its RSI signals overbought conditions, analysts are not ruling out further upside in the near term. If BTC manages to break past its current all-time high of $108,786, some optimistic forecasts suggest a path toward $120,000 or beyond could be within reach.