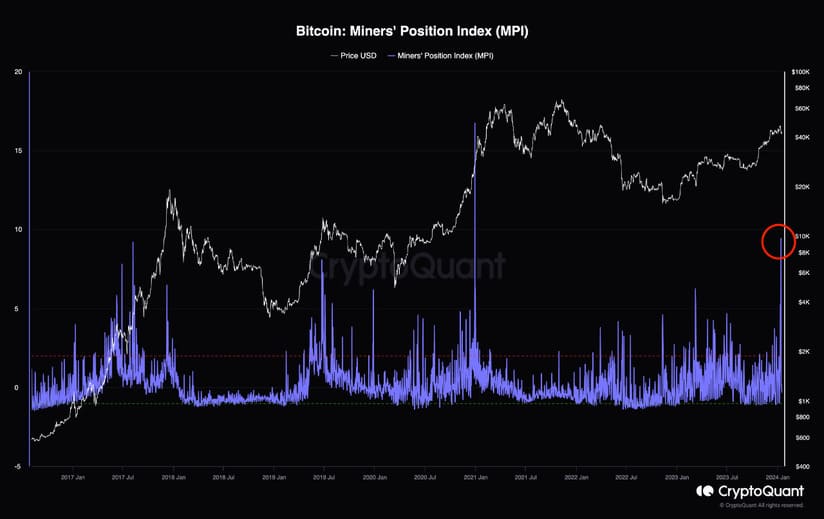

Recently, an increase in selling pressure by Bitcoin miners has been observed, according to on-chain data. This phenomenon raises concerns regarding its potential impact on the price of the leading cryptocurrency. The index, known as the Miners’ Position Index (MPI), experienced a sharp rise, reaching levels not seen since January 2021.

The MPI is a significant metric that tracks the relationship between Bitcoin miners’ outflows, expressed in U.S. dollars, and the 365-day moving average. This relationship provides insight into the selling pressure that miners exert on the market compared to their average annual behavior.

When the MPI value surpasses 1, it indicates that miners are potentially selling at a faster rate than the annual average, which may have bearish implications for the asset. Conversely, if the indicator is below that threshold, it implies that miners are engaging in a relatively low amount of selling, which can be considered neutral or even bullish for Bitcoin.

The term “miners’ outflows” refers to the total amount of cryptocurrency being withdrawn from the combined wallets of all chain validators, known as the “miners’ reserve.” This regular movement of coins out of their addresses is primarily done for selling purposes, providing clues about the current selling pressure applied to the market.

Uncertainty Surrounding Miners’ Outflows and Their Long-Term Impact on Bitcoin’s Valuation

It is essential to note that miners consistently need to sell some of their Bitcoin to cover operating costs, primarily electricity bills associated with mining. While regular miners’ outflows are part of their standard operation, the MPI serves as a tool to assess whether the magnitude of these sales is significant compared to their historical behavior.

In the current landscape, the increase in the MPI raises questions about its potential influence on the market. While the price of Bitcoin has been maintaining a consolidation around $43,100 in recent days, the market’s response to similar events in the past has varied. Uncertainty persists regarding whether the recent uptick in miners’ sales will have a long-term impact on the price of BTC or if the market will efficiently absorb this selling pressure.