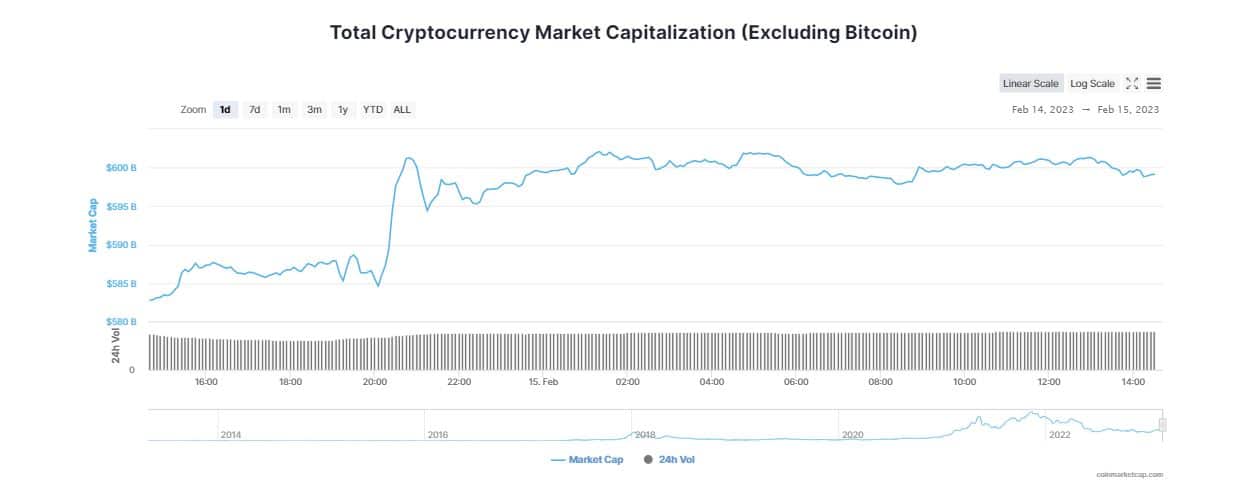

After a brief decline, Bitcoin (BTC) retested the $22K mark as concerns about a widening crackdown by regulators eased. The global crypto market cap climbed back above $1 trillion following the release of US Consumer Price Index (CPI) data for January, which showed a “lower-than-expected decline in inflation”.

According to CoinMarketCap, the global crypto market cap is up 2.41% in the last 24 hours to $1.03 trillion.

The total crypto market volume over the last 24 hours soared more than 5% to $59 billion. The digital assets sector posted a modest rise as the January inflation report suggested the Fed could keep rates higher for longer. In a statement, Edward Moya, senior market analyst at OANDA claimed,

“The market might be pricing in a little more Fed tightening but that isn’t weighing that much on cryptos today. Regulation and contagion risks have pressured digital assets this month, so the downward move was potentially exhausted.”

Bitcoin Rebounds

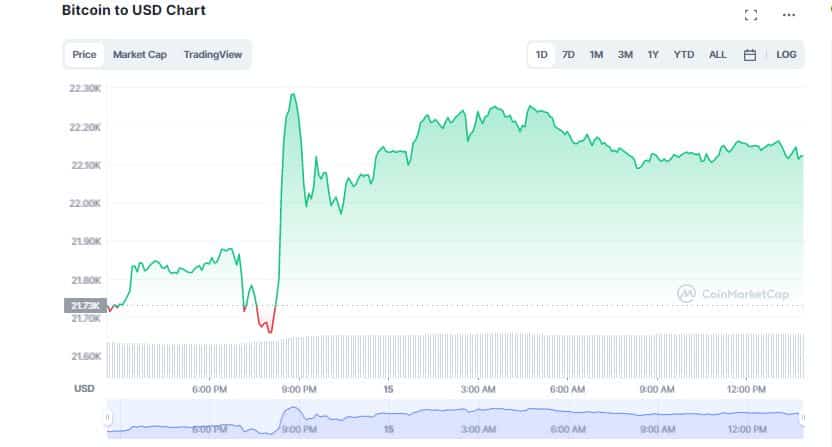

Despite plunging over the past seven days, Bitcoin (BTC) is up 1.61% in the last 24 hours to hover at $22,133. The flagship token has traded below that level since a string of regulatory actions pumelled the crypto market. It seems BTC’s next resistance now lies at the $22,260 level, while the support lies at the $22,000 level. If Bitcoin (BTC) manages to close above the critical resistance level of $22,375, it could indicate the next key resistance level at $24,260.

This surge in activity is due to the popularity of the Ordinals protocol, which allows storage of non-fungible tokens (NFTs) on the Bitcoin blockchain.

The 7-day moving average of Bitcoin blockchain transactions has reached 345,000, a figure not seen since the second… pic.twitter.com/8LcIwfLkP2

— Coinvert (@coinvert) February 9, 2023

Meanwhile, experts believe the growing popularity of the Ordinals NFTs protocol, which enables the integration of non-fungible tokens with Bitcoin, has triggered an increase in activity on the network boosting its prices. As per analysts, long-term Bitcoin investors are also increasingly holding onto their coins with whales gaining control over the market as the on-chain transaction size reached a five-year high.

Pseudonymous analyst Kaleo took to Twitter to explain that every single time Bitcoin (BTC) has broken out of a major long-term bearish resistance against the Nasdaq, it has resulted in a powerful rally. Given this track record, it is highly likely that this time won’t be any different. On the other hand, Jason Pizzino, a crypto analyst, said the bellwhether is still in a bullish market, but cautioned it may experience short-term dips. Edul Patel, CEO at Mudrex chimed in noting,

“Most cryptocurrencies rose following the US Consumer Price Index (CPI) data for January, where inflation fell less than expected. Bitcoin rebounded from the recent lows and is currently trading above the US$22,000 level. “

This is your last reminder that every single time BTC has broken out of a major HTF bearish resistance vs. NDX it's had a face melting rally follow.

I have a hard time believing this time is going to be any different. pic.twitter.com/0FSFmMngAI

— K A L E O (@CryptoKaleo) February 14, 2023

Will Crypto Soar to New Highs?

At the same time, Ethereum (ETH) jumped nearly 3% over the past day to trade at $1,547. Decentralized finance (DeFi) activity on Ethereum has witnessed an upswing over the past few months. The highly anticipated, “Shainghai Upgrade” is also playing a vital role in keeping ETH prices at a formidable position. Patel added,

“Ethereum also saw an increase in value, trading above $1,500, in sync with Bitcoin’s performance. Despite the modest gains, the overall trend in the market is slightly bearish.”

Meanwhile, major coins traded in the green over the past 24 hours with XRP, Solana (SOL) and Polkadot (DOT) rising in the range between 1.68% and 3.66%. Cardano (ADA) experienced a sharp uptick zooming more than 7% in the last 24 hours to $0.38. Popular memecoins such as Dogecoin (DOGE) and Shiba Inu (SHIB) shoot up after Twitter boss, Elon Musk jokingly introduced a dog as Twitter’s new CEO.

Markets bouncing upwards.

Just a matter of time until we’ll see high number targets again.

Buy the dips, we’ll probably have fun coming months.

— Michaël van de Poppe (@CryptoMichNL) February 14, 2023

Recently, prominent crypto analyst Michael van de Poppe tweeted an optimistic message stating that markets are bouncing upwards and believes that it’s only a matter of time before the market hit high number targets again. He tweeted,

“Markets bouncing upwards. Just a matter of time until we’ll see high number targets again. Buy the dips, we’ll probably have fun coming months.”