Bitcoin is undoubtedly robust. Supporting computing power is at a record high a few weeks after halving.

Although it was expected that hash rate will dip—and it did, the rebound has been spectacular, a marvel in the eyes of supporters. In the midst of all these, prices continue to stabilize above $9,000 as network fees fall.

Transaction Fees Dropping

An observation by Messari Crypto found that Ethereum’s transaction fees have eclipsed Bitcoin’s.

The development came as no surprise. Ethereum extends on Bitcoin’s functionalities and aside from allowing smart contracting, the platform is a playing ground for financial dApps. DeFi as an emerging sub-sector locks over $900 million worth of ETH.

Meanwhile, Bitcoin’s halving mean miners who are heavily reliant on periodic rewards might earn more in this third epoch if projected trends are anything to go by.

Going forward, miners are expected to draw most of their revenue from transaction fees. Therefore, while Ethereum dominates, BTC fees may rise as the demand for the network increases.

President Trump wanted to “go-after” Bitcoin in 2018

President Trump dislike for Bitcoin and cryptocurrencies has been once again highlighted by a John Bolton book.

Titled, The Room Where It Happened, the author who worked briefly in the Trump Administration alleges that POTUS instructed Treasury Secretary Steven Mnuchin to go after Bitcoin for fraud.

In 2019, President Trump said Bitcoin is not money and is backed by thin air.

The FED to buy Individual Corporate Bonds

Meanwhile, the U.S. Federal Reserve is stepping up their purchases of debt, and has extended it to the purchase of individual corporate bonds.

Although not all qualified, the approved bonds of rated corporations will receive funding from the central banks as a way of mitigating and preventing a systemic collapse of the financial system due to Coronavirus.

Bitcoin Price Analysis

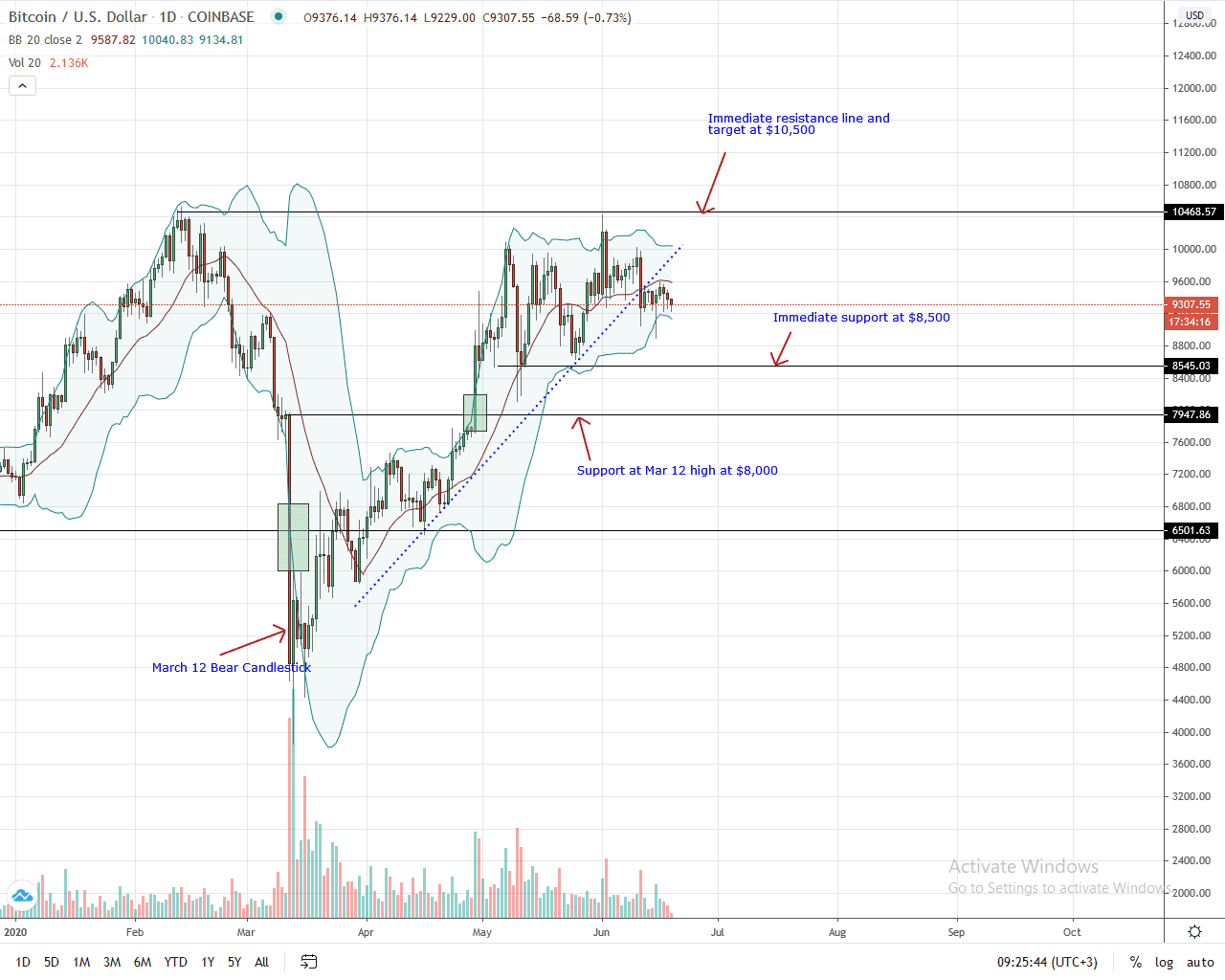

Week-to-date, Bitcoin price is stable against the greenback. Changing hands at $9,305, prices are ranging against the USD. Specifically, BTC is held within a tight $400 trading range with caps at $9,620.

While bulls will be firmly in control once there is a break above June 11, 2020, and even $10,500, at the back of high trading volumes, risk averse traders can stay on the sidelines until a clear buy or sell signal prints. A rally, driving prices above these two resistance zone will build the case for $14,000 as mentioned in previous analyses.

On the reverse side, a close below $9,000 confirms bears of June 11, 2020, and the double bar bear reversal pattern of June 01-02, 2020. This will print a clear bear breakout below the three-month support trend line as the risk of BTC falling back to $8,500 spikes.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you found this article interesting, here you can find more Bitcoin news