Bitcoin (BTC) has managed to hold on to $23K level despite a slight fall in the cryptocurrency market on Monday. After weeks of accumulation, major altcoins also slipped amid the ongoing market volatility.

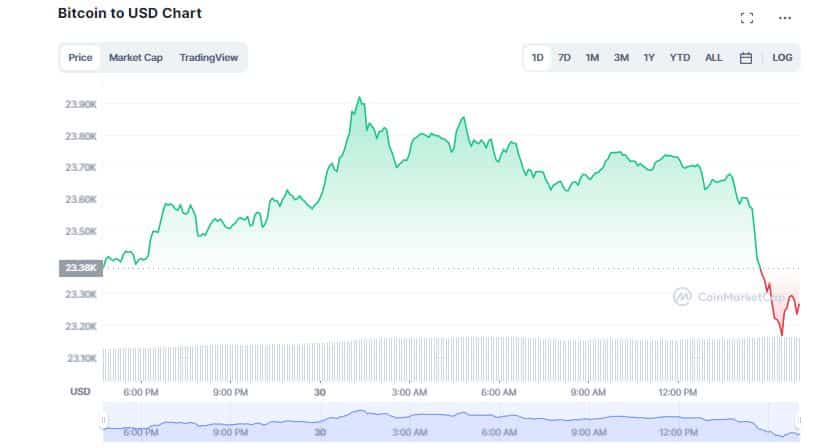

According to CoinMarketCap, following a minor bull run, Bitcoin (BTC) prices dropped 0.49% in the last 24 hours to trade at $23,197. In the early hours of January 30, the flagship token soared to reach $23.9K before retreating slightly amid ongoing investor optimism. BTC kicked off the New Year on a strong note along with macroeconomic headwinds started cooling down after a brutal previous year.

As per reports, the U.S. Commerce Department announced that personal consumption expenditures (PCE) excluding food and energy in December had registered its most moderate annual rate increase since October 2021. It indicated a positive uptick in the economy although considerable downside risks continue to threaten the economy.

Bitcoin Holds Above $23K

Over the past seven days, Bitcoin (BTC) gained more than 1.80% as the entire market responded to optimistic US consumption data. In addition, recently, data from the crypto analytics platform Glassnode showed that the flow of BTC from miner wallets to exchanges is at a three-year low suggesting that miners are holding on to their Bitcoin tokens rather than selling it.

Experts follow the market behavior of miners minutely, as a decrease in selling pressure from this group is generally seen as a positive sign for the price of Bitcoin (BTC). Several experts have chimed in to discuss the current health of the digital asset sector.

Edul Patel, CEO at Mudrex exclaimed that Bitcoin briefly reached $23,946 over the weekend as the market responded to US consumption data, although it couldn’t sustain that level. He hoped if the bullish trend continues, BTC may soon reach $24,000 and $25,000. In a statement, Shivam Thakral, CEO at BuyUCoin said,

“Bitcoin had an exciting weekend as it touched $23,900 on Sunday. Bitcoin is up by 42 percent this month and is expected to test the $25,000 level very soon. If the macroeconomic factors continue to be stable, we can expect a bullish momentum to continue in the coming weeks.”

ETH Sees Explosive Growth in Network Activity

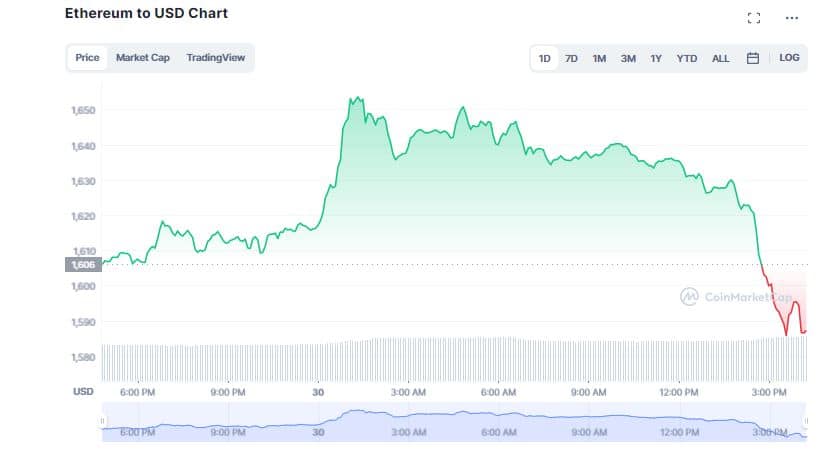

Meanwhile, Ethereum (ETH) dropped 0.80% in the past 24 hours to hover at $1,550. After hitting a 12-week high of $1,660, Ether retracted marginally below the psychological level of $1600. The second largest cryptocurrency plummeted 2.84% over the past one week after a long-awaited rally. Despite the downturn, Ethereum fundamentals continue to remain strong as Ethereum on-chain activity continues to increase.

As per Etherscan, the daily token transfer number topped 1 million again last week doubling over the past six months. Furthermore, experts anticipate ETH price surge as the “Shanghai Upgrade” inches closer. The Ethereum unique address count is also at an all-time high of 221 million.

🚀 #Ethereum's price may be on the rise, but the real story is in the network's usage!

❄️ With a record high of 92.5 million addresses and growing active usage. It's clear the @ethereum ecosystem is thriving despite the crypto winter. pic.twitter.com/BorPy2LTKe

— PrimeXBT (@PrimeXBT) January 27, 2023

Will the Crypto Market Rise Soon?

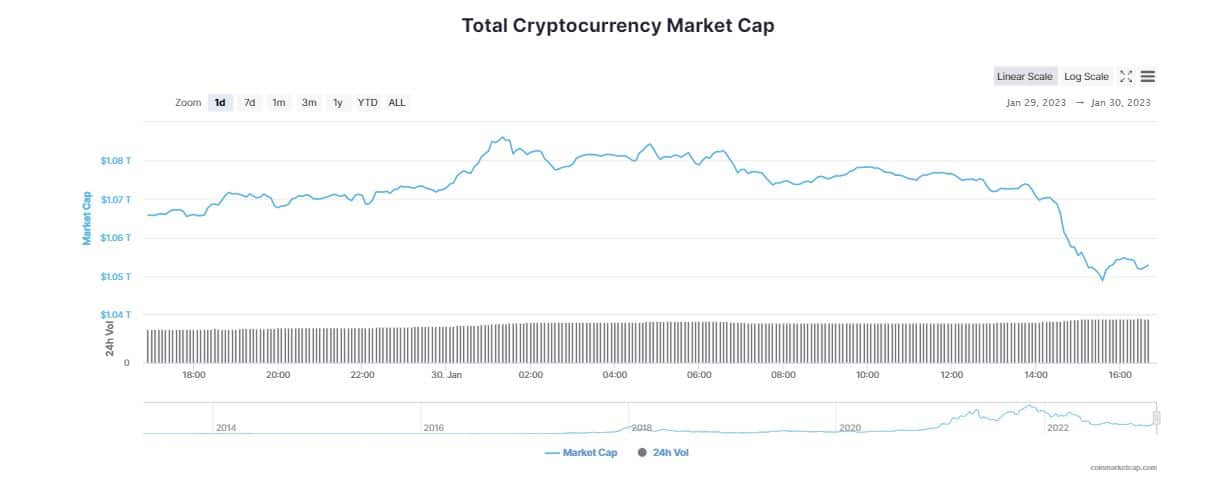

On the other hand, major altcoins also declined along with the global crypto market cap which fell 0.88% in the last 24 hours to $1.05 trillion. Both, XRP and Cardano (ADA) tanked nearly 3% to trade at $0.39 and $0.37, respectively. Polygon (MATIC), Polkadot (DOT), Solana (SOL) and Litecoin (LTC) took a dive, plunging in the range between 1.13% and 4.67%, in the past 24 hours. In the same time, Dogecoin (DOGE) and Shiba Inu (SHIB) prices spiralled downwards, falling 3.37% and 2.85%.

It is likely that a potential interest rate hike by the US Federal Reserve is a major concern, as shifts in market expectations surrounding this event can have a significant impact on the crypto market. If the interest rate hike aligns with or marks below market expectations that is, lesser hike than expected, it could create a more supportive environment for cryptocurrencies.