TL;DR

- AlloyX introduced the Real Yield Token on Polygon, a tokenized money market fund with assets custodied by Standard Chartered.

- RYT invests in Treasuries and commercial paper, and as a tokenized asset it can be used in DeFi as collateral or for looping strategies.

- The tokenized Treasuries market has reached $8B with an average yield of 3.93%.

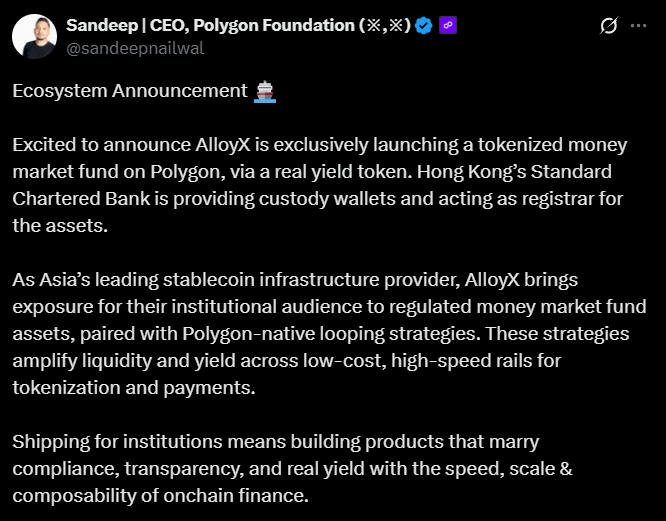

AlloyX has launched a tokenized money market fund on Polygon, designed to merge bank-custodied assets with native DeFi strategies.

The fund, named the Real Yield Token (RYT), represents shares in a traditional money market fund whose underlying assets are custodied by Standard Chartered Bank in Hong Kong. This structure ensures full regulatory compliance and regular audits. The initiative responds to growing demand for real-world assets (RWAs) on the blockchain, bringing together traditional financial instruments with the digital economy.

RYT invests in short-term, low-risk instruments such as U.S. Treasuries and commercial paper, but tokenization makes these shares tradable onchain. This enables their integration into DeFi protocols, where they can be used as collateral for loans and reinvested strategically—a process known as looping that allows investors to maximize yields within DeFi markets.

Why AlloyX Chose Polygon

Polygon was selected for its Ethereum-scaling infrastructure, offering low fees, fast transactions, and a robust DeFi ecosystem. These features are essential for tokenized funds seeking both liquidity and cost efficiency.

The fund launched by AlloyX targets the rising demand and institutional interest in tokenized money market funds. Products such as BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) show that large capital players are exploring blockchain to provide dollar-yield exposure through Treasuries and repurchase agreements. However, most of these lack the DeFi-native functionality that sets RYT apart, such as looping capabilities and seamless integration across decentralized protocols.

The tokenized Treasuries market has reached $8 billion, with an average yield to maturity of 3.93%. Moody’s describes it as “a small but rapidly growing product,” noting sharp growth since 2021. In the United States, adoption has accelerated due to the passage of the GENIUS Act and the rising use of stablecoins, which have allowed both institutional and retail investors to access greater liquidity and consistent returns.

The tokenization of money market funds combines the security of traditional instruments with the versatility of the DeFi economy. It allows users to earn yield, use assets as collateral, and reinvest them efficiently—merging conventional cash management with the opportunities of decentralized finance. Through this strategy, AlloyX positions RYT as a bridge between traditional financial markets and the digital economy