TL;DR

- Circle launched StableFX in November 2025 as an onchain infrastructure for global FX, which processes close to $10 trillion daily.

- StableFX uses RFQ execution and atomic Payment-versus-Payment settlement.

- The launch included the Partner Stablecoins program with issuers from Asia-Pacific and LATAM.

Circle rolled out StableFX in November 2025 as an onchain infrastructure for the global foreign exchange market, which moves close to $10 trillion per day. The system runs on the Arc blockchain and enables 24/7 currency conversion through stablecoin pairs such as USDC/EURC, without prefunding, bilateral agreements, or deferred settlement.

StableFX operates with Request-for-Quote execution from multiple liquidity providers. Settlement follows an atomic Payment-versus-Payment model, achieving sub-second finality compared with the T+1 or T+2 timelines of traditional FX. Its design removes the need to lock capital in pre-funded accounts and reduces operational complexity for treasuries, corporate payments, and international trade.

Circle: The Future of the Financial System

The platform integrates with Circle’s Cross-Chain Transfer Protocol to move liquidity across blockchains and provides institutional access through Gateway APIs and enterprise wallets. The structure allows FX flows to be embedded directly into applications, with programmable currency conversion and continuous settlement.

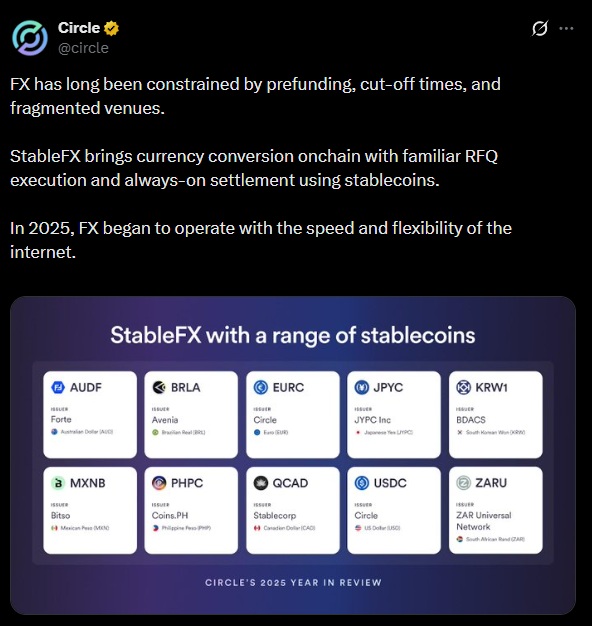

The launch also included the Partner Stablecoins program, aimed at regional issuers. Circle is working with projects in Japan, Brazil, South Korea, the Philippines, Australia, and South Africa to expand local currency pairs and market depth.

Japan enabled USDC in March 2025 through a joint venture with SBI Holdings. The JPYC stablecoin has already been integrated into StableFX for low-cost yen–USDC swaps. Singapore and Malaysia are evaluating the use of stablecoins for trade tokenization and FX hedging, while Brazil and South Korea are showing progress in the institutional market.

StableFX Depends on the Stability of Its Underlying Assets

While the model helps reduce costs and settlement times, it also carries operational and financial risks. USDC lost its peg and fell to $0.87 in 2023 following the collapse of Silicon Valley Bank, setting an important precedent even for widely used stablecoins. StableFX depends on the stability of the underlying assets and the correct execution of smart contracts.

Potential risks include code failures, wallet incompatibilities, and irreversible transactions. In addition, fraud across the industry persists and continues to grow more complex. Crypto scams totaled $12.4 billion in 2024 and more than $4 billion in 2025. The regulatory framework also remains fragmented, with different requirements under MiCA in Europe and U.S. supervisory regimes