TL;DR

- Marinade Finance drives the increase in Solana staking; over 425.7M SOL are currently delegated, pushing the network’s stake rate to 68.9%.

- Marinade Select increased its SOL-denominated TVL by 87% in six months, rising from 863k to 1.6M SOL, fueled by ETFs and large delegators.

- The protocol’s DAO redirected revenue from MNDE buybacks to mSOL, raising the supply by 22,300 tokens; total mSOL now reaches 2.54M.

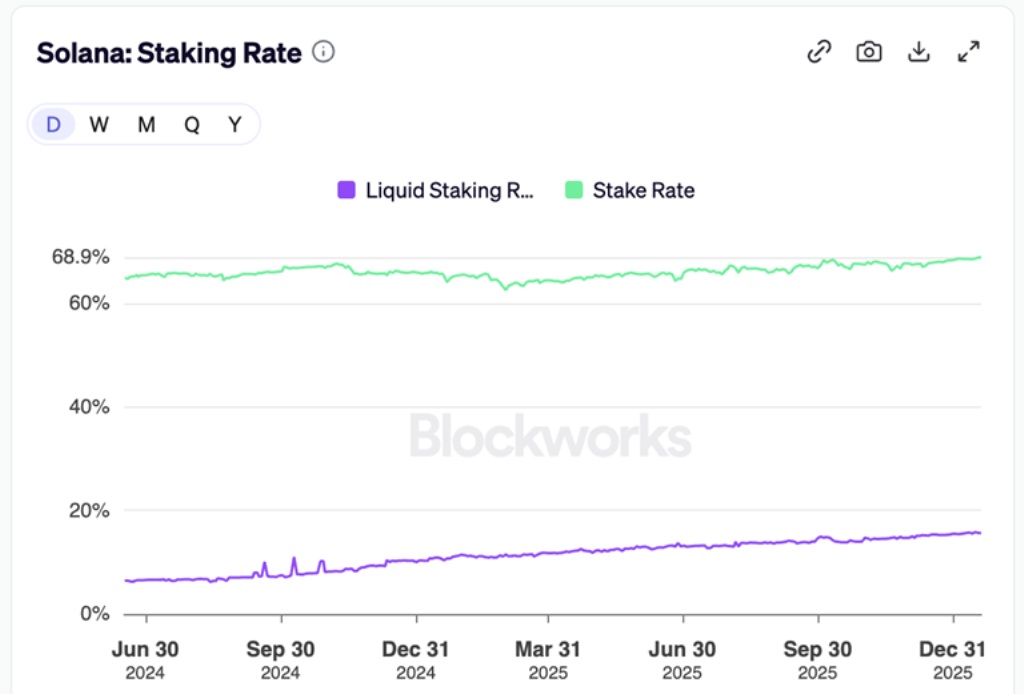

Marinade Finance pushes Solana staking to a two-year high. According to Blockworks, over 425.7 million SOL are currently staked, the highest absolute level recorded. This amount pushed the network’s staking rate above 68.9%, the highest since January 2024.

The increase occurred even as SOL lost nearly 47% of its value over the past three months. Delegated token volumes continued growing in both native and liquid staking. LST adoption reached an all-time high, with a liquid staking rate of 15.64%.

Solana Leads in Absolute Staking

Marinade Finance expanded the scale of its staking products during this period. The protocol offers native and liquid staking services through its Stake Auction Marketplace, used by validators and large delegators. Marinade Select captured the most significant growth within this offering.

Marinade Select is targeted at institutional clients and is based on a curated pool of verified validators, with KYC and SOC-2 standards. Over six months, its SOL-denominated TVL increased 87.13%, from 863,000 SOL in July 2025 to over 1.6 million in January 2026. Part of this growth was linked to Solana ETFs, with issuers like Canary Capital delegating their holdings through the protocol.

Marinade DAO Changes Revenue Allocation

Solana’s staking rate far exceeds other Layer-1 networks. Ethereum maintains around 30%, while BNB Chain sits at 18.4%. Solana leads staking adoption both in absolute and relative terms.

Marinade DAO adjusted the protocol’s revenue allocation. Since August 2025, it directed 50% of revenue to MNDE buybacks, accumulating over $1.17 million in tokens in the treasury. In December, following the approval of MIP-17, the DAO paused buybacks and redirected funds to increase mSOL liquidity.

Since this change, the mSOL supply grew by 22,300 tokens, reaching 2.54 million, valued at $434 million, capturing 5.18% of Solana’s LST market