TL;DR

- Privacy coins moved against the broader market: the sector gained 4% on the day and 13.1% on the week, while Bitcoin fell 2.3% and altcoins dropped by as much as 10%.

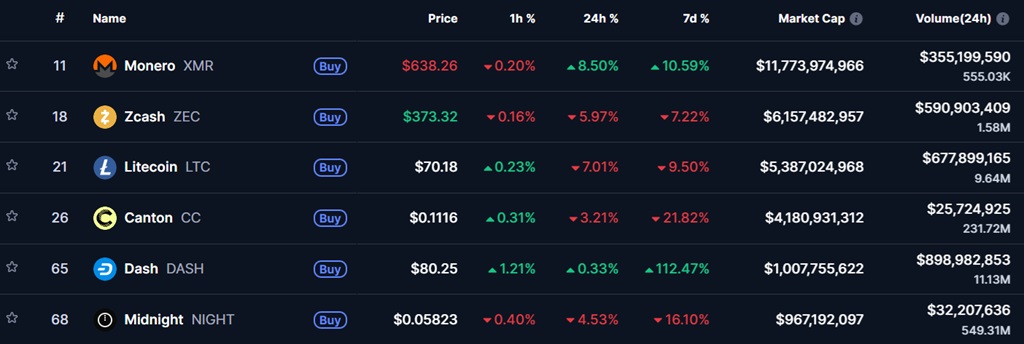

- Monero climbed 8.5% and is trading around $638 after setting a new high, Dash moved above $80 with a weekly gain of more than 100%, and Dusk jumped 292% over the week.

- Demand was driven by flows into Monero from stolen BTC and LTC, alongside tighter regulations, increased on-chain surveillance, and a search for assets with lower correlation to Bitcoin.

Privacy coins broke away from the broader crypto market trend during a session marked by widespread selling and liquidations close to $1,000 million. While Bitcoin fell 2.3% and most altcoins declined between 3% and 10%, Monero, Dash, and Dusk moved in the opposite direction and attracted significant capital inflows.

The privacy-focused niche rose 4% on the day and 13.1% on the week, according to CoinGecko. Monero gained 8.5% over 24 hours and is trading near $638 after hitting a new all-time high the previous week. Dash began to rebound in the last hour and now posts a weekly increase of more than 100%, pushing above $80.

Dusk posted the most aggressive move, with a daily gain above 59%5 and a weekly surge of 292%, reaching $0.2540, signaling a concentrated rotation into low-liquidity assets with specific narratives. Zcash, by contrast, failed to keep pace and fell 6%, trading at $373 due to internal issues at the Electric Coin Company.

Why Are Privacy Coins Rising?

This trend was driven by specific catalysts. On-chain investigators identified conversions of stolen Bitcoin and Litecoin into Monero. Those flows increased volume in a thin market and amplified the price impact across different tokens. While this cannot be considered the main driver, it accelerated a process that was already underway.

Analysts point to a re-rating of the privacy sector driven by stricter regulations, greater on-chain surveillance, and increasingly intrusive compliance requirements. In that environment, privacy coins act as instruments with low correlation to Bitcoin and as a hedge in stress scenarios.

Geopolitical uncertainty, including the possibility of renewed trade tensions between the United States and the European Union, is pushing investors toward assets that tend to behave counter-cyclically. The flows currently being observed do not reflect euphoria; they function as a protection mechanism against uncertainty.

The institutionalization of the crypto market also plays a key role. Public blockchains have become more traceable, not less. That transparency has increased demand for opt-in privacy as an operational and risk-management tool, beyond any ideological stance.

The expansion of capital controls, financial regulations, and data oversight has also been critical. Privacy has moved away from a marginal niche and now holds a functional role within some portfolios. Recent statements by Vitalik Buterin in support of privacy reinforced that view and added legitimacy to the argument