TL;DR

- A whale withdrew 800 BTC ($71M) from Bitfinex and accumulated 1,000 BTC over six days, showing preparation to hold ahead of market shifts.

- Two newly created wallets pulled 1,600 BTC from Binance ($144M), indicating coordinated accumulation rather than random transfers.

- These withdrawals reduce liquid supply, reinforce institutional confidence, and could position Bitcoin for a potential rally.

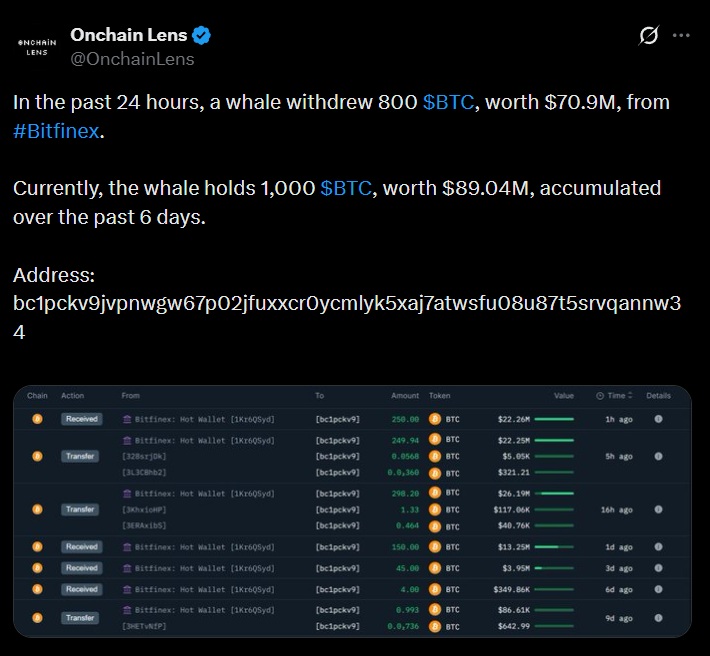

A whale moved 800 BTC, worth around $71 million, from Bitfinex within 24 hours, adding to a purchase accumulation that totals about 1,000 BTC over the past six days, valued at more than $89 million.

OnchainLens data shows these transactions are not isolated: two new wallets withdrew an additional 1,600 BTC from Binance, roughly $144 million, suggesting a coordinated accumulation process rather than random transfers.

Whales Act in a Nearly Coordinated Way

Moving Bitcoin from centralized exchanges to private wallets signals a long-term holding mindset and reduces immediate selling pressure. Large investors often behave this way near market inflection points, positioning themselves ahead of abrupt shifts. While this does not guarantee an immediate price increase, it tightens liquid supply, a factor historically favorable for scarce assets like Bitcoin.

Is Bitcoin Preparing to Rally?

Bitcoin is holding around $89,500, up roughly 2% in the past 24 hours. The combination of price stability and whale withdrawals reinforces the perception of confidence at current levels. This suggests that major holders find these prices attractive and are willing to accumulate, preparing for a possible upward move.

Continued accumulation could translate into a rally if macroeconomic conditions and liquidity support it. The key will be the interaction between demand and the shrinking supply of Bitcoin available on exchanges.

Coordinated and consistent accumulation signals institutional interest and confidence in market structure. For other investors, this implies that current levels may serve as entry points if they want to align with traders capable of influencing liquidity.

Bitcoin enters 2026 showing signs of confidence. The current dynamics point to a scenario where scarcity and institutional strategy could set the pace in the coming months