TL;DR

- Spot XRP ETFs in the United States recorded net inflows for 29 consecutive days in December, while Bitcoin and Ethereum ETFs posted heavy outflows.

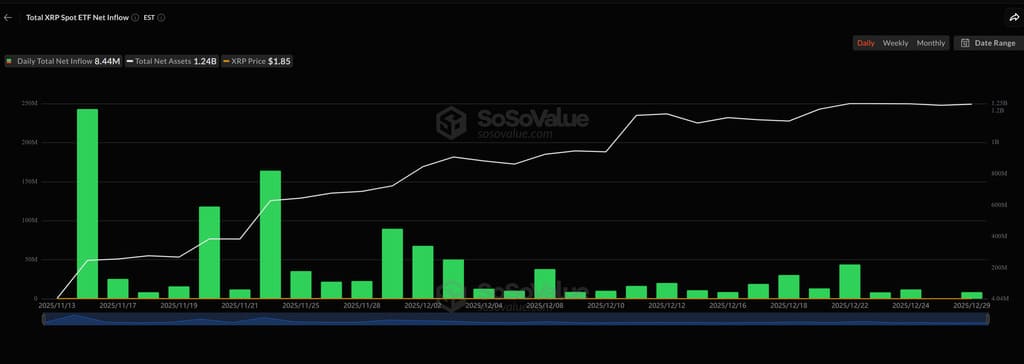

- XRP ETFs added $8.44 million in the latest session and now total $1.15 billion in cumulative inflows, with $1.24 billion in assets under management.

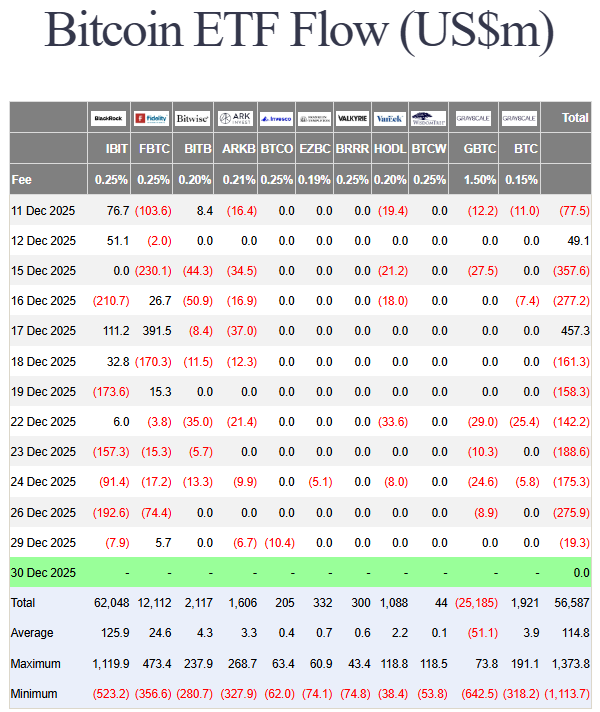

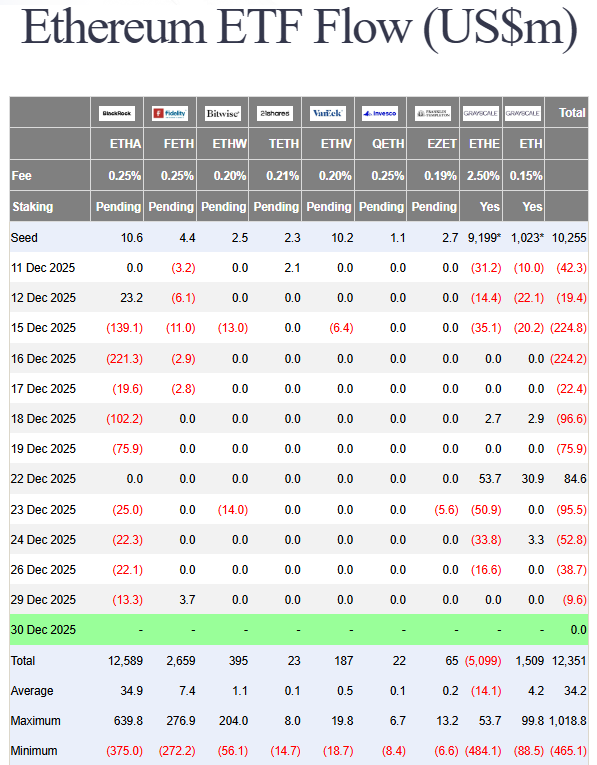

- Spot Bitcoin ETFs lost more than $1.1 billion, while Ethereum ETFs shed roughly $612 million.

Spot XRP ETFs in the United States logged net inflows for 29 straight days in December. The positive flow held steady while Bitcoin and Ethereum ETFs absorbed strong and persistent outflows throughout the month.

According to SoSoValue, spot XRP ETFs added $8.44 million in the latest trading session and have accumulated $1.15 billion since launch. Assets under management stand at around $1.24 billion. Ripple’s token managed to withstand the broader selling pressure across the crypto market, although this resilience has not translated into price performance.

Institutional Capital Reallocation

During December, XRP-linked funds attracted $478 million. The pace was stronger in the first half of the month, when daily inflows exceeded $30 million and in some sessions approached $40 million. In the second half, inflows slowed but did not reverse. There were no days with net outflows.

XRP’s behavior stands in sharp contrast to Bitcoin. Spot BTC ETFs recorded more than $1.1 billion in net outflows in December. The worst reading came on December 15, when withdrawals surpassed $357.7 million in a single day. From that point on, selling pressure remained elevated, and sporadic inflow days failed to change the overall trend.

Ethereum followed a similar pattern. Spot ETH ETFs posted roughly $612 million in net outflows over the month. December 15 and 16 marked the peak outflow days, with $224.8 million leaving the funds. Institutional capital cut exposure aggressively in both assets.

Why XRP ETFs Keep Growing

The divergence between the tokens is not tied to short-term performance or monthly returns, but to the type of exposure they offer. XRP provides a less crowded profile within institutional portfolios, with a more clearly defined regulatory framework in the United States and a use case focused on cross-border payments and settlements. For longer-horizon capital, those factors carry more weight than short-term volatility.

The month-end picture sends a clear signal. Capital did not exit the crypto market evenly. It reallocated. Bitcoin and Ethereum absorbed heavy selling, while XRP attracted steady inflows. This is not a tactical rotation. It is a selective allocation