TL;DR

- The memecoin market has entered a correction phase, seeing a 22% drop in market capitalization and a 27% decline in trading volume over the past 30 days.

- Activity on the Pump.fun platform has returned to initial levels, and the OFFICIAL TRUMP token lost 92% of its value, with its market cap falling below $1.2 billion.

- The sector shows signs of saturation after over 13 million memecoins were issued this year, and users are beginning to seek assets with more stable demand.

The memecoin market has entered a correction phase that marks the end of the 2025 frenzy. The pullback accelerated in recent weeks, directly impacting prices, trading volume, and the activity of the platforms that drove this speculative wave.

Bitcoin fell back below $90,000, putting pressure on assets most sensitive to shifts in market sentiment. The total crypto market capitalization dropped nearly 3% in 24 hours, standing at $3.07 trillion, while the Fear and Greed Index flashed “Fear,” signaling that the market remains unstable.

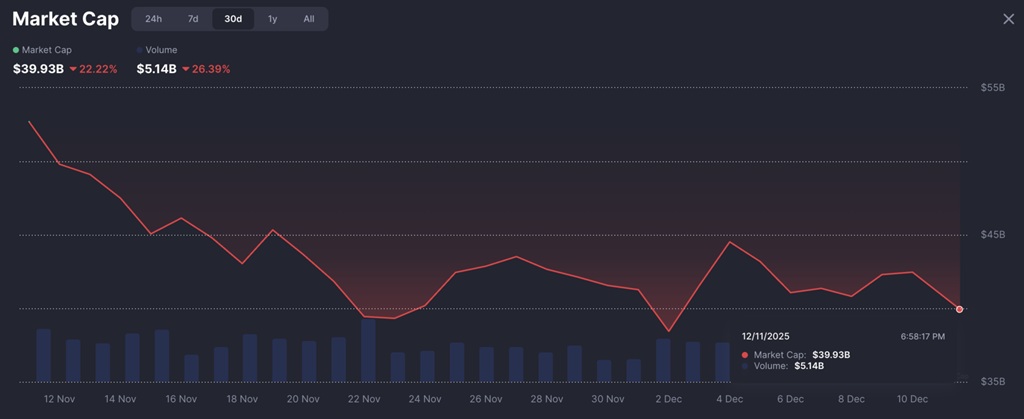

The sharpest contraction is visible in the memecoin segment. Combined market capitalization fell 22% over the past 30 days, hovering around $40 billion. Trading volume followed the same trend, declining 27% to $5.15 billion over the same period.

Activity on Pump.fun, the platform that launched millions of tokens, returned to levels seen shortly after its debut, highlighting that the initial momentum could not be sustained. The most extreme case is OFFICIAL TRUMP: the token once reached a valuation of $8.8 billion and now trades 92% below that peak. Its market cap fell below $1.2 billion, and it currently trades around $5.66.

Dogecoin and Shiba Inu also reflect market fatigue. Dogecoin marked its 12th anniversary in a lateral trading phase, down 57% year-to-date at around $0.137. Shiba Inu dropped 61% YTD and trades 90% below its all-time high, at $0.0000006262. The market can no longer sustain the speculative volume that defined the first half of the year.

Almost All Memecoins Dropped More Than 6% This Week

Only MemeCore (M) managed to stand out. Over the past week, it rose more than 12%, with a current price of $1.5, although it fell slightly by 0.4% today amid the broader market pullback.

Analysts point to saturation as the main issue. a16z’s 2025 State of Crypto report recorded over 13 million memecoins issued this year, a number that exceeds the market’s available attention even in highly speculative cycles. Most projects lacked fundamentals or a differentiating proposition. Traders bought expecting someone else to buy higher, a cycle that worked until the influx of new participants dried up.

The memecoin market is not disappearing, but it has lost much of its vitality. Users are starting to seek assets with clearer regulatory frameworks and projects that can sustain real demand in an environment less tolerant of massive speculation