TL;DR

- Michaël van de Poppe points out that altcoins could begin a rebound after nearly four years of the longest bear market in history.

- The analyst emphasizes that this cycle is different from previous ones, and only 0.1% of investors are likely to achieve exceptional returns.

- The MACD and the monthly bullish divergence indicate a potential trend reversal, favoring blue-chip altcoins.

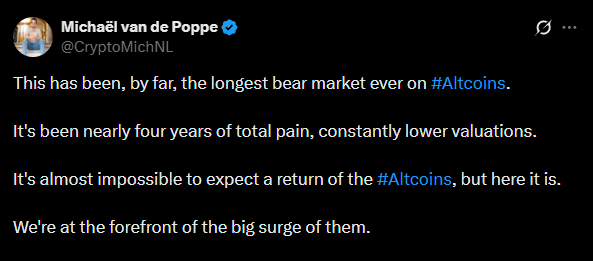

Altcoins are going through a historic bear market that has lasted nearly four years, but according to Michaël van de Poppe, the renowned crypto analyst, the situation is about to change.

A Market Only for the Bold

Van de Poppe described this period as “the longest bear market ever” and noted that, despite widespread skepticism, the altcoin market is on the verge of a significant rebound.

He stressed that the current cycle is “completely different” from previous ones and warned that comparing it solely in terms of time is misleading.

To achieve extraordinary returns, such as a 1,000% increase in portfolios, investors must make bold decisions and take high risks, a feat accomplished by only a tiny fraction of participants, roughly 0.1% of the market. Van de Poppe describes the situation as “the last easy cycle” for the crypto market, as adoption continues to accelerate, many assets remain undervalued, and new investors are still entering the ecosystem.

A Cycle Change for Altcoins

From a technical perspective, his analysis focuses on the MACD and monthly price divergence. The MACD has shown continuous red bars since late 2021 but is approaching a crossover into positive territory, signaling a potential trend reversal. Additionally, a monthly bullish divergence has persisted for two years, and the red bars are about to turn green, suggesting that the altcoin upswing could consolidate in the coming weeks.

Van de Poppe recommends focusing on high-quality or blue-chip altcoins, holding them for extended periods to capture returns as market confidence recovers. The key warning is that the current market demands smart decisions and selective strategies, as not all investors will benefit from this potential rebound.

The technical scenario aligns with signals from other platforms, which show widespread capitulation and prices below fair value—historically indicators of significant rebounds. Although altcoins face a prolonged cycle of declines, the combination of adoption, undervaluation, and favorable technical signals could mark the start of a new bullish cycle.