TL;DR

- Bitcoin remains in a bearish tone despite a partial rebound, and the excess of short positions could trigger a short squeeze.

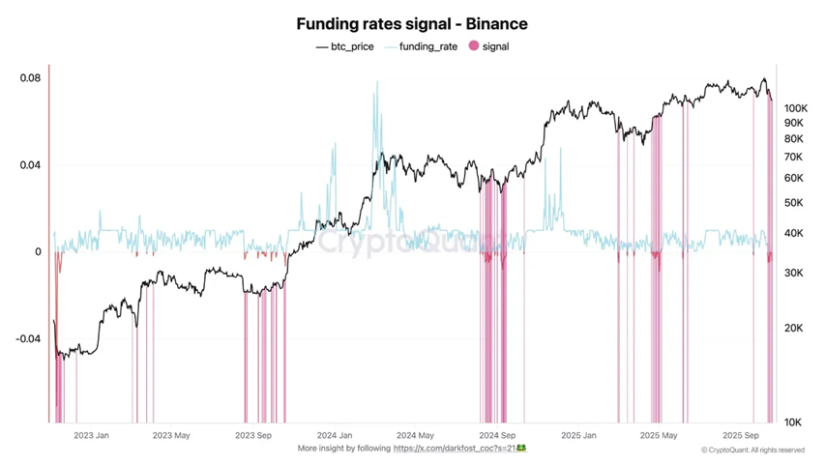

- Funding rates on Binance stayed negative six out of seven days, reflecting a clear dominance of bearish positions following the mid-October mass liquidation.

- The $12 billion drop in BTC futures open interest signals reduced exposure and confidence, suggesting that distrust could fuel an accelerated price recovery.

Bitcoin shows signs of entering a phase that raises doubts among investors, who remain skeptical about the continuation of its rebound.

CryptoQuant analysis warns of a potential bullish breakout driven by the excess of short positions. Despite the partial recovery of the price following the drop on October 10, the market remains pessimistic and uncertain about the trend’s sustainability.

Funding rates on Binance, the largest Bitcoin futures market, stayed negative six of the past seven days, around -0.004%. This behavior reflects a clear preference for bearish positions, reinforced after the mid-month mass liquidation.

Short Squeeze for Bitcoin?

Analysts suggest that this skepticism could turn into fuel for the next rally: if the price continues consolidating upward, the liquidation of shorts could trigger a short squeeze capable of pushing Bitcoin toward liquidity zones between $113,000 and $126,000.

The report notes that the current market structure mirrors patterns seen before major rebounds, such as in September 2024 and April 2025. In both cases, negative sentiment preceded a sharp price jump that doubled its value within weeks.

In this context, CryptoQuant also highlighted a $12 billion decline in BTC futures open interest over the past week, indicating reduced exposure and confidence among traders. Historically, such contractions often precede expansion phases.

Near a Decisive Turn

The analysis describes the current phase as a period in which investors, still affected by recent declines, doubt that the market can regain strength. This lack of conviction delays entries and creates imbalances in derivatives, amplifying volatility when the price moves contrary to expectations.

Although overall sentiment remains cautious, CryptoQuant believes the market could be closer to a decisive move than it appears. Derivative metrics, the drop in open interest, and predominantly bearish positioning create a scenario where distrust could become the main driver of a rapid recovery. Bitcoin trades around $111,000, and analysts warn that a massive short liquidation could mark the turning point that reignites the bullish trend.