TL;DR

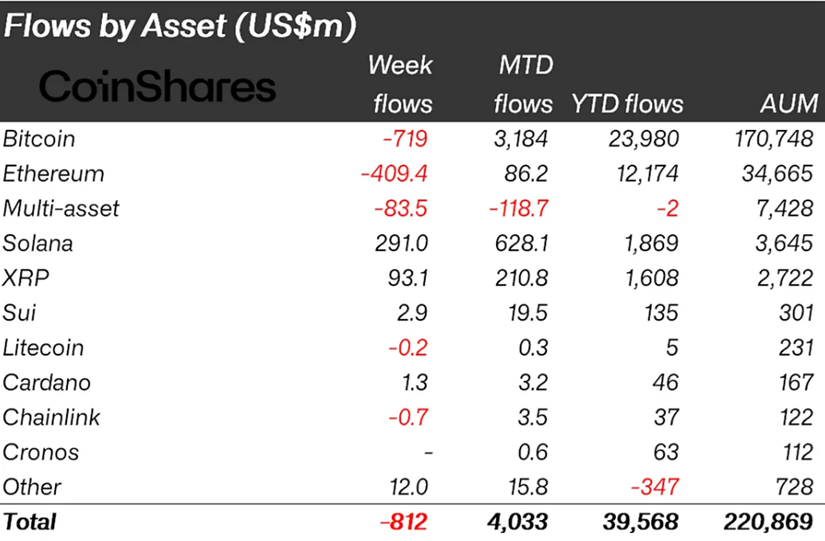

- Crypto funds saw $812M in outflows last week, halting their positive streak and cutting AUM from $241B to $221B.

- Bitcoin and Ethereum lost $719M and $409M, while Solana and XRP attracted $291M and $93.1M on U.S. ETF expectations.

- The U.S. accounted for $1B in outflows; Switzerland, Canada, and Germany posted inflows, keeping YTD at $39.6B with the chance to surpass last year’s record.

Crypto investment funds recorded net outflows of $812 million last week, ending a streak of steady inflows.

According to CoinShares, total assets under management dropped from $241B to $221B, reflecting investor concerns after stronger-than-expected U.S. macro data lowered the odds of interest rate cuts.

Bitcoin and Ethereum were the hardest hit. Bitcoin ETPs saw $719M in outflows, while Ethereum products lost $409M, halting the positive trend both assets had shown earlier this year. The report highlighted that there was no significant increase in short-Bitcoin products, suggesting the negative sentiment is weakly held and likely temporary.

Key Weeks Ahead for the Market

In contrast, Solana stood out with $291M in inflows, driven by expectations of upcoming U.S. ETF launches. XRP also posted $93.1M in positive flows. Analysts project that the coming weeks will be decisive for crypto ETFs in the U.S., with the SEC expected to rule on several applications, including the much-anticipated Litecoin ETF from Canary Capital, followed by potential approvals for Solana, XRP, Dogecoin, Cardano, and Hedera ETFs.

Regional Crypto Flows

Regionally, flows showed a clear geographic split: the U.S. led outflows with $1B, while other crypto hubs showed resilience, with inflows in Switzerland ($126.8M), Canada ($58.6M), and Germany ($35.5M). Despite the weekly setback, funds maintain strong momentum, with $4B in inflows so far this month and $39.6B YTD, close to the 2024 record of $48.6B.

The expectation of imminent regulatory decisions, combined with strong inflows into Solana and XRP, suggests crypto investment funds could quickly return to growth and move closer to last year’s record highs