TL;DR

- Before diving into cryptocurrency investments, it’s essential to grasp some basic concepts about how its market operates.

- Choose an exchange that holds proper licenses, employs robust security protocols, and offers hack insurance; pick a wallet that strikes the right balance between accessibility and safety.

- Define your investor profile and strategy (time horizon, risk tolerance, diversification), dedicate time to ongoing research, and keep your FOMO in check.

Entering the crypto market can be as rewarding as it is challenging. The potential for profit coexists with operational and security risks. Before committing your first dollars to Bitcoin, Ethereum, or other altcoins, it pays to follow a set of best practices that will help you navigate this space with greater ease and confidence, reducing the chance of unpleasant surprises.

1. Understand the Basics of the Crypto Market

Crypto markets never sleep, and prices swing dramatically. Every transaction is validated on the blockchain through mining or consensus mechanisms, ensuring an immutable record. Still, this adds technical complexity.

Before buying, educate yourself on key concepts like wallets, private keys, exchanges, and token vesting. A solid foundation will prevent confusion and keep you from making impulsive decisions born of ignorance.

2. Choose a Reliable Exchange

Not all exchanges offer the same level of security or meet the same regulatory standards. Opt for well‑known platforms that provide:

-

Licenses or registrations with financial authorities

-

Anti‑money‑laundering (AML) protocols

-

Insurance coverage against hacks

Take the time to read user reviews and check trading‑volume metrics. This due diligence will spare you the headache of dealing with an insecure exchange.

3. Match Your Wallet to Your Needs

How you store your crypto is a personal decision. For frequent trades, a hot wallet (online) makes quick buys and sells easy but exposes your keys to remote threats. For larger holdings or long‑term storage, choose a cold wallet (hardware), which keeps keys offline.

Finding the sweet spot between convenience and security is critical: don’t keep large sums in just one type of wallet.

4. Define Your Profile and Strategy

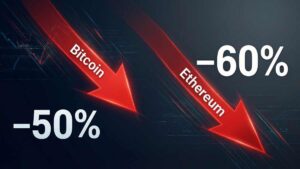

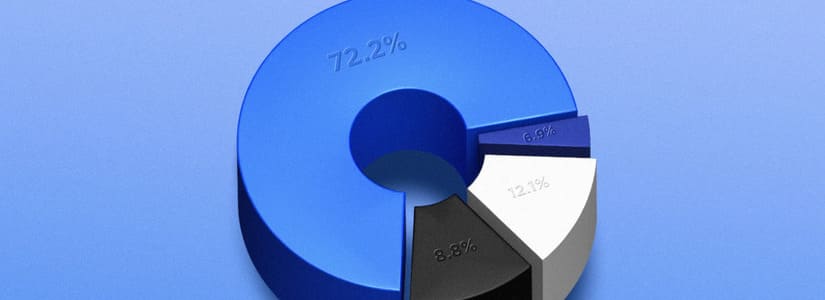

Before you risk any capital, clarify your investment horizon and risk tolerance. Are you aiming to ride short‑term rallies, or do you plan to hold crypto as a store of value? Your answers will guide how much you allocate to Bitcoin versus altcoins and emerging projects. Consider a diversification rule—say, 60% in blue‑chip assets and 40% in higher‑risk tokens—and adjust it as you gain experience.

5. Invest Time in Continuous Learning

The crypto world evolves at breakneck speed. New blockchains, DeFi protocols, and NFT projects emerge daily. One article won’t cut it: follow specialized forums, listen to reputable analysts’ podcasts, and examine on‑chain data about token distribution and key wallet activity. Always cross‑check influencer tips against official sources and technical whitepapers.

6. Curb the FOMO Impulse

Fear of missing out drives many to buy at price peaks. To avoid reckless choices, set limit orders for both buys and sells at predetermined levels.

Lean on simple indicators like historical support and resistance, and stick to your plan even during wild swings. A hasty purchase can quickly turn into a painful loss.

7. Be Rigorous About Security Everywhere

Protect your devices and network: install up‑to‑date antivirus software, use password managers, and enable two‑factor authentication (2FA) on all accounts. Be wary of shortened links in emails or social posts, and always verify a site’s domain before logging in. Store your seed phrase in a physical, offline, damage‑proof location.

8. Plan for Taxes

Every country treats crypto differently. Check local regulations before reporting your first trades. In many jurisdictions, buying and selling triggers taxable events, so keep meticulous records of prices, dates, and amounts. Preparing for these obligations will help you avoid penalties and optimize your net gains.

9. Maintain a Long‑Term Perspective

While day trading may seem enticing, incorporate “buy and hold” positions into your strategy. Identifying projects with solid fundamentals—active communities, real‑world use cases, and transparent teams—increases the odds of lasting returns. Allocating part of your capital to these long‑term bets can help weather the market’s volatility.

Conclusion

Starting out in crypto requires discipline, knowledge, and attention to detail. Understanding the technology, choosing trustworthy platforms, securing your keys, and mapping out a clear strategy will keep emotion from clouding your judgment. Follow these tips, and you’ll lay a strong foundation for informed decision‑making and safer navigation in the crypto world