TL;DR

- Ripple’s new AMMClawback feature on the XRP Ledger allows token issuers to recover funds even after they have been sent.

- RLUSD can now be used in AMM pools on decentralized platforms, expanding its adoption and increasing its liquidity in the DeFi ecosystem.

- The update strengthens security and facilitates compliance with international financial regulations, ensuring greater stability for RLUSD.

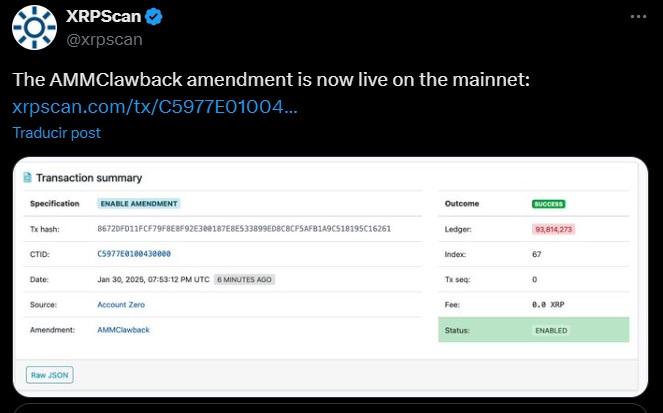

Ripple has implemented a new feature that changes the game on its blockchain. The latest XRP Ledger update introduces the AMMClawback feature, which allows token issuers to recover funds even after they have been sent. The goal is to improve control over transactions. This has a direct impact on RLUSD, the company’s stablecoin, which can now be used in AMM (Automated Market Maker) pools.

The activation of AMMClawback provides more flexibility to token issuers and strengthens security within Ripple’s ecosystem. This feature is especially valuable in cases where tokens are sent to incorrect addresses or are linked to illegal activities. In this way, issuers can quickly recover the funds.

One of the most important implications of the update is the possibility for RLUSD to be used within liquidity pools on decentralized platforms. Before the activation of AMMClawback, RLUSD could only be exchanged through centralized exchanges. Now, its inclusion in AMM pools opens new opportunities for adoption and increases its liquidity in decentralized finance (DeFi) markets. This expansion is crucial for both Ripple and the users of the network.

Ripple Prepares to Dominate the Market Through RLUSD

The XRP community has been very excited about the announcement, and many of its members believe that this update will be key for the XRP Ledger to establish itself as a leading platform in the DeFi sector. With this new token recovery capability, Ripple ensures that RLUSD is not only compatible with a wider variety of platforms but also better prepared to comply with international financial regulations.

In financial terms, RLUSD has recorded a significant trading volume, with a circulating supply close to 72 million tokens. With the addition of new functionalities, Ripple continues to advance its goal of improving accessibility and security in the crypto market, ensuring that its stablecoin remains competitive and meets the highest regulatory standards.