In this article we will look at unconventional strategies to find hidden opportunities and maximize profits in liquidity pools, show you how to calculate the real profitability obtained, choose the best pairs to add in the pools to get great returns and much more!

A good investment strategy, with detailed analysis, can be the difference between making a lot of money and losing it all.

Beyond the tempting offer of pools with significant returns, token volatility can play a crucial role in the final profitability. In this context, we will explore strategies for choosing cryptocurrency pairs efficiently, as well as selecting which crypto exchange is most convenient to invest in.

How to choose the best cryptocurrency pair to trade?

Choosing which cryptocurrency pair or token to invest in is perhaps the most crucial aspect of a good investment strategy. It would be useless to give liquidity to a pool that offers huge returns if the tokens used suffer large variations in their price, as this could take us out of the range set in the pool and stop obtaining profitability.

Here we will divide into 2 strategies, one for when the markets are stable and one for when they are more volatile:

Strategy In Stable Markets

When markets lateralize and remain stable (within the stability that the crypto market can offer), the right strategy would be to choose a pool that pairs a stablecoin with an already consolidated cryptocurrency. By this we mean coins that are at least within the TOP 50 cryptocurrencies by market capitalization.

Now, we must set a price range, between which we believe that the market will move for that pair, this can be done in the Pools V2. Let’s assume a total range of 20%. What would be a 10% upper range and a 10% lower range, approximately.

With this range we are being efficient as we are boosting the profitability we get in these liquidity pools. The objective with them is to wait for the market to move sideways for a prolonged period of time, which will mean that we are always within the range and that we are getting the highest possible profitability for our positions.

If at any time we get out of range either up or down, we must wait a few days to re-enter within the established area, at that time we will reopen our position.

Strategy In Volatile Markets

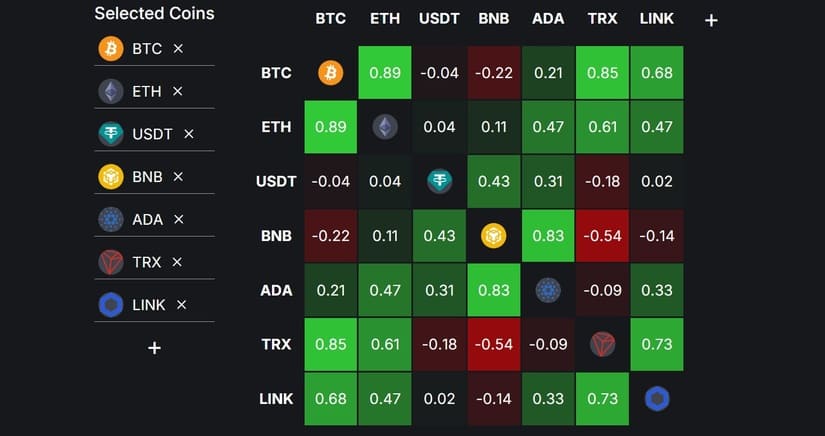

In times where markets are more volatile, it is advisable to enter pools where the price of both currencies are as correlated as possible, i.e. their prices have similar evolutions. To find pairs that have a good correlation, we can use the DeFi Llama tool, where we can access data about this aspect. An example of cryptocurrencies with a high level of correlation would be Bitcoin and Ethereum.

Another possibility is to add liquidity in pools containing two stablecoins, although generally the returns are usually quite low, but with practically zero risk. This type of pools are profitable at any time of the market and avoid having to keep an eye on the market daily to see if we have gone out of range.

Which exchange is convenient to choose?

There are many alternatives when it comes to choosing in which exchange we are going to deposit our liquidity. And although the most frequent thing is to choose the one that offers the best yields, this could be a very big mistake.

The risk of our investment will also be associated to the exchange in which we decide to operate, and this will depend on how established it is. The longer a platform has been operating, the lower the chances of a Rug Pull case. While the newer exchanges have a greater chance of resulting in a scam.

On the other hand, there is also the risk of hacking. There have already been many cases that have affected this type of DeFi platforms and have generated huge losses for investors. And, although this does not depend on the age of an exchange, those that are more consolidated tend to invest more resources in security, in addition to the fact that they have had more time to detect potential vulnerabilities.

As an additional recommendation on this aspect, we can say that it is always better to operate with exchanges that have been audited by cybersecurity companies.

Decentralized Exchanges such as Sushiswap, Uniswap, PancakeSwap, MakerDAO, Compound, Balancer, Curve or 1inch are some examples of DEX where at least for the moment we can make investments safely.

How to choose the exchange that offers the best returns?

This point is as variable as market conditions, since returns vary depending on several factors, but if we want to get the best return on our investments in pools we must be attentive to market variations to enter and exit these pools of liquidity when necessary.

To find the pools that offer the best returns we have to investigate 2 points, the blockchains that offer the best returns and the pairs that give the most profit within these blockchains.

To perform this search we can use 3 essential tools, DefiLlama, DexScreener and DappRadar with them we will make an initial investigation and we will define which will be our strategy.

The steps to follow are as follows:

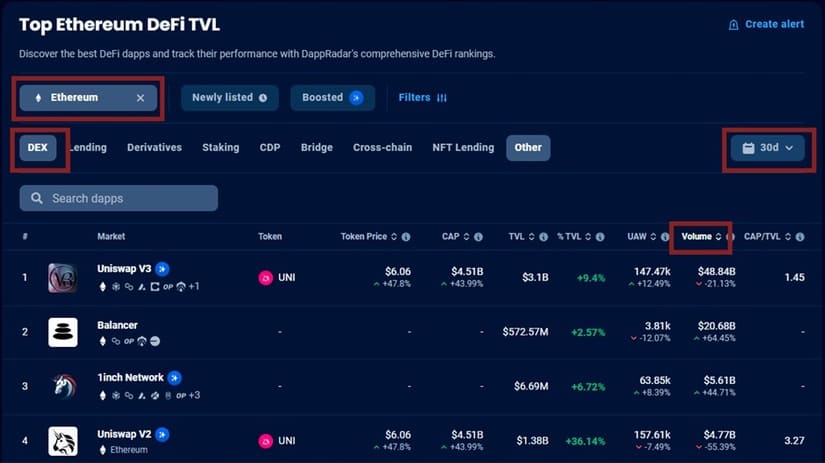

1 – Search in DappRadar the most reliable DEX of each blockchain or blockchains where we want to operate, for example if we want to operate in ETH we will do the following.

- Go to DappRadar section DeFi. https://dappradar.com/rankings/defi

- We choose the blockchain we want to filter, in this example we will do it with Ethereum.

- Select the DEX platform type

- The temporality in 30 days to have a global view.

- Then we sort by volume from highest to lowest to see which DEX are the ones with more volume and therefore the most used by users and more reliable.

In this way we will be filtering for each blockchain the DEX that we should use to have our investment as safe as possible.

2 – Once we have defined the DEX where we can invest safely, we will choose the blockchain and pairs that offer the best returns at the moment.

For this we will perform the following steps:

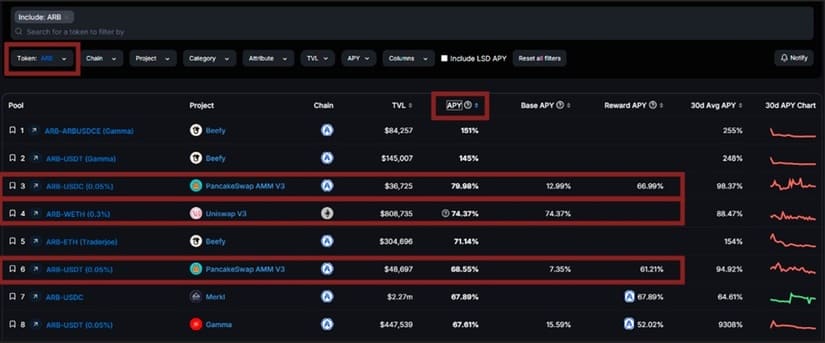

- We go to DeFillama in the Yield (Pools) section https://defillama.com/yields

- Choose a currency with which we want to perform Yield Farming, in this example we will use Arbitrum (ARB).

- Sort by APY from highest to lowest

In this way we will see which projects offer the best profitability and with which pair we should pair ARB to obtain it, at the time of writing this tutorial we can see how with this cryptocurrency we could obtain annual returns of between 60 and 80% in exchanges that we have previously qualified as reliable, remember that this type of investment requires attention from the markets and these returns can vary at any time, so depending on the evolution of the market we must decide whether to exit or continue in these pools.

How to calculate the profitability of a dex in a liquidity pool?

To find the most profitable pools, we will compare the daily trading volume with the deposited liquidity and we will look for the pool that has more volume compared to the liquidity. Whenever the volume is higher than the liquidity, it means that they are paying us a good profitability. The higher it is proportionally, the better.

But as this can change at any time, given the great volatility of market operations, we are going to see an analysis process so that regardless of the moment in which you plan to invest, you know how to detect which are the most profitable. However, we must also take into account the commissions.

If, for example, we find one that meets the levels of liquidity and volume that we have seen before, but offers commissions of 0.01%, even if it generates a lot of volume it will not generate so many commissions and this is when we have to make additional checks.

We enter it, and we will be able to see how many commissions it generates on a daily basis. But as there can be important variations from one day to another, we must make an average. This number, then we must divide it by the liquidity and then multiply it by 365 (the days of the year).

In short, the formula would be:

Average daily commissions / pool liquidity x 365 x 100 = Percentage of profitability

Let’s look at a quick example: Let’s assume commissions of $160. We divide it by the liquidity, assuming $120,000 and multiply it by 365 (the days of the year). It is giving us an average annual return of 48%.

Applying strategies to maximize returns in liquidity pools

Everyone knows that during periods of higher market volatility the best returns can be obtained. However, the truth is that if we want to be much more profitable than the rest of the investors we cannot do what everyone else is doing, but we have to try to find the most unknown investments.

One little-used strategy is to look for pools that have low liquidity. Take for example a pool that only has $1,400. This is a tiny amount compared to most pools where there are usually hundreds of thousands of dollars or millions of dollars deposited.

Why would we want to do this? Well, the less liquid a pool is, the more commissions we will get if we are in it. But of course, we have to choose the pools that generate commissions. It is useless to go to a pool that has little liquidity but does not generate commissions. This is when we have to make our calculations.

For this technique, although others could work, it is best to use the PancakeSwap and Uniswap exchanges. Because, apart from being among the most reliable, they are available in practically all blockchains and are among the exchanges that have more pairs of coins with which we can add liquidity.

The good thing is that because the liquidity is so fragmented between different blockchains and different exchanges, we can find those unknown pool opportunities where there is very little liquidity.

To find good pool opportunities with these characteristics we can use tools like Dex Screener, a blockchain analysis platform that will show us the different pools on the exchanges in the blockchain we want.

Then, we must filter by liquidity level, looking for some that have low liquidity, and making sure that they maintain relatively high trading volume. Remember to look for cryptocurrency pairs as we have already seen above.

Some necessary clarifications: if from now on the volume of the entire crypto market drops and less is traded with these coins, the profitability of the pool will also drop, because it will be generating less commissions. And on the other hand, as we have to use concentrated liquidity, i.e. we have to select a price range, depending on the one we select our profitability will be higher or lower.

Conclusion

The world of Decentralized Finance (DeFi) offers us an immense range of opportunities to make our cryptocurrency investments perform. However, we have witnessed ample evidence that we are in a market with a very high volatility that can change variables from one moment to another.

So, to ensure the best possible profitability, it is essential to perform analyses such as the ones we have seen throughout the article. If you have read all our recommendations, you will be able to identify new opportunities that are not so common among investors, achieving even better returns.

Disclaimer: this article was prepared for educational purposes only. Therefore, it should not be considered under any point as an investment advice. Do your own research.